So many things are based on your credit rating today. The difference between having a high credit rating (lets presume that we’re talking about a FICO score for example) can cost or save you thousands of dollars.

Your credit score can also play a factor in how much you pay for insurance, whether a landlord would rent you an apartment, or even if you can maintain a security clearance at your job.

The bottom line is your credit rating matters.

Why Your Credit Rating Matters

- Credit Cards – This is the most obvious, the rate you’ll be charged on your credit card. However, you really shouldn’t be carrying a balance, so with credit cards, your score will affect whether or not you can get those great reward credit cards and their sign-up bonuses. This could cost you hundreds of dollars in benefits.

- Any possibility of getting personal loans – Banks won’t give you a personal loan without great credit. You could always hit up a payday loan place (or better yet Prosper), but you’ll still pay hundreds or thousands of dollars more in interest than someone with great credit.

- Whether you get that sweet deal on a great rental – Many landlords and rental services will pull your credit. Depending on your credit, you may be asked to put up additional deposits, charged a higher rent, or not offered a rental at all. This can cost you thousands of dollars more than someone with great credit scores.

- Student Loans – With the cost of education being so high, a small change in rates can have huge effects. The average student loan debt was greater than $39,000 for graduates in 2021. For private schools, this amount is likely even higher. Over a 10 year repayment, a bad credit score could cost you thousands of dollars in extra interest, for something that you already received. Check out this student loan refinancing comparison and see why your credit score can make a big difference.

- Your mortgage rate – The difference between prime and subprime credit could be worth several percentage points on your mortgage, or recently whether or not you can even qualify to get a mortgage. The difference 4% and 6% on a $250,000 loan over 30 years is almost $110,000. Here is where your credit score could cost you hundreds of thousands of dollars.

- Your job, the hiring process and any required security clearance – More and more employers are pulling credit reports to see how responsible you are. Why would they trust someone with company resources when they don’t even take care of their own responsibilities? Missing out on a great job could make your life miserable, plus you could potentially cost yourself hundreds of thousands of dollars over the course of your career.

Intelligent use of leverage is a great way to increase your wealth and standard of living. However the key to leverage is to make sure that it works for you and not against you. Credit provided in all the above examples can be either beneficial or detrimental to your life.

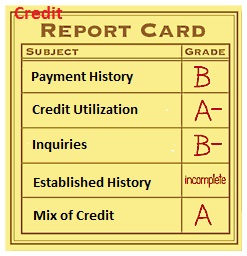

What Goes Into Your Credit Score?

- 35% affects Payment History

- 30% affects Utilization

- 15% affects Established History

- 10% affects Inquiries

- 10% affects Mix of Credit

So looking at the components of your credit score, the most important things to remember are that you don’t want any late payments, bankruptcies, liens, or collections, and you ideally won’t be using most of your available balance (credit limit on credit cards) and you’ll have a number of different lines of credit open for as long as you can.

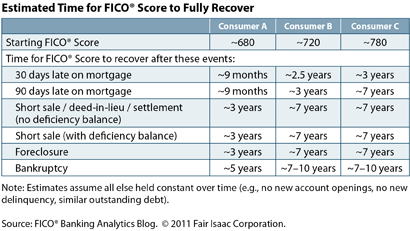

FICO released data indicating how different credit events on a mortgage affected the credit score.

As you can see, the credit points lost is greater for the higher credit rated consumer. Another way to look at this is that you wind up at the same credit score for a given event, regardless of where you started.

Like climbing a mountain one step at a time, it takes much longer to get back to a high credit score after one of these events than it takes to get to a lower level credit score. Looking back at the impact table, you can see little difference between the 30 days late and 90 days late. Check to learn how I save money for an emergency fund.

How To Track Your Credit Rating

If you’re looking for a free way to track your credit rating, we recommend using Credit Karma. This free tool allows you to pull up your credit reports, and gives you a great estimate of your credit score. It also gives you tools and resources to help boost your credit score. Check out Credit Karma here.

The moral the story is don’t be even a little late paying your bills, the impact is huge. Readers, have you had credit score impacts due to a single missed payment or error? What were the effects?

Karl Nygard is the original founder of Cult of Money and created the website to share his ideas on investing, personal finance, and more.