The truth is cryptocurrency and NFTs are becoming more and more prevalent in business use. For our business, we have been receiving payments in crypto for a while, and this year have started to dive into NFTs (right now just buying a few, but possibly to sell in the future).

With those truths in mind, it's important to figure out how to account for gains and losses on taxes.

This guide is specific to how to keep records and account for cryptocurrency and NFT transactions for a business. And we're foused on the bookkeeping part - we'll leave some notes on the taxability of these things, as it can vary based on your business type and how you're personally recognizing income and expenses.

Note: I'm not a CPA, but have consulted with several experts in this space. Sadly, there are a very slim few tax and accounting experts in the crypto and NFT space, and their time and availability is limited due to high demand. As always, though, you need to get your own tax advice!

The Basics - What Do We Need To Track?

Just like with everything related to your business, you need to track income and expenses. However, with cryptocurrency, this gets a little trickier because of an added wrinkle - price fluctuations.

With crypto being so volatile, you might receive 0.25 ETH - which when you received it as payment was worth $1,000. But today, when you convert it to US Dollars, it's only worth $985. You have to account for that $15 loss (and it does benefit you to track the losses). But on the flip side, you also need to track the gains.

The same is true with NFTs - you have price fluctuations, but you also have convoluted transactions. You're using ETH (or another crypto), and that could have a gain or loss when you buy the NFT. All of that needs to be tracked and accounted for.

Sounds overwhelming? It is. But if you start keeping good records from the start, it's much easier than trying to piece things together in the future.

Just remember, at the end of the day, you need to report the following:

- Income

- Expenses

- Gains/Losses From Price Fluctuations

Tools To Use

Alright, to make this all happen, you need to have the right tools. You're going to need to have both accounting tools AND crypto-tracking tools.

I'm a fan of Quickbooks Online for accounting software, but you can also use any software that supports journal entries and custom account types. The downside to Quickbooks is that it is a bit pricey. Even their cheapest plan will cost you over $100 a year. However, you're not going to find a more robust accounting tool for small business. Check out Quickbooks here >>

When it comes to tracking cryptocurrency transactions, our favorite pick is CoinTracker. What makes CoinTracker awesome is that it will sync with your wallet and keep track of all transactions on your account. You can then categorize them with the app - but where it becomes especially handy is when you start buying and selling crypto, or using crypto as a tool. Then it will help you keep track of the gains and losses from price fluctuations. Check out CoinTracker here >>

I use both of these, and so our demo's below will also use them.

Finally, we always recommend using a hardware wallet for your crypto - especially if you're doing things through your business. We recommend Ledger, and it this case, it makes it really easy to setup multiple crypto accounts.

How To Setup Your Accounts In Accounting Software

Once you have your accounting software, you need to setup the accounts you're going to need to use. These are the bookkeeping accounts to keep track of both your balances, and your gains and losses.

Balance Sheet

First, you're going to need your Balance Sheet accounts. These your wallets. You're going to need an account for each type of crypto you're dealing with, as well as an NFT account if you're owning NFTs.

These should be categorized as "Other Current Assets".

For example, since we deal with both Bitcoin and Ethereum, we have:

- Cult of Money BTC

- Cult of Money ETH

- Cult of Money NFT

P&L Statement

Next, you're going to need to setup the accounts that will flow through to your profit and loss statement. These should be categorized under "Other Income" as you'd report it in a similar way to interest income on a business bank account.

Since we deal with both cryptocurrency and NFTs, we have:

- Cryptocurrency Gains (Losses) - Long Term

- Cyrptocurrency Gains (Losses) - Short Term

- NFT Collectible Gains (Losses)

Common Crypto And NFT Income and Expense Categories

Now that you have the basic account types setup, you can start thinking about income and expenses just like a regular business. And honestly, a lot of this accounting isn't too different. You still report your income and you still track your expenses. There are only some random nuances below which we will show examples of.

This list below is NOT meant to be all-inclusive, but just to highlight some of the common examples we're seeing, and may give you some insights into how to keep track.

Income

When dealing with cryptocurrency for sales, you track this just like normal income. So, sales would still be considered sales. Doesn't matter if someone paid you in dollars or Bitcoin. A sale is a sale.

- Sales: If you sell something and are paid in crypto, it still falls under sales just like any other USD sale would.

- Mining Income: If you are mining crypto, I'd create an income category specifically for mining income. Then you'd report expenses like we mention below.

- Sale of Crypto: If you sell a cryptocurrency or crypto-asset, you'd need to report the gain or loss on it using the new categories you created. This also applies when you convert crypto to USD.

- Airdrops: These would fall under crypto gains.

Expenses

Again, just because you're dealing with cryptocurrency, not much changes. Expenses are still expenses. However, there are some nuances when it comes to NFTs, which we will cover below.

So, when tracking expenses, just because you pay something with crypto doesn't mean you don't track it. In fact, this is also the part where you're going to have to start tracking gains and losses - because if you send BTC as a payment, there may be a difference in value from when you received it.

For example, on November 15 you receive 0.01 BTC as payment and it's worth $650. BTC was trading at $65,000 that day. However, on December 15, you send that 0.01 BTC to buy some office supplies for $480. BTC was only worth $48,000 that day. At the same time you'd book the normal office supply expense for $480, you'd also book a crypto loss for $170.

Remember: Everything is reported in USD!

Here's some common examples I'm seeing:

- Gas Fees: These gas fees or transaction fees would fall under Merchant Account Fees just like normal credit card processing fees.

- Crypto Gains Or Losses: You need to keep track of the gains and losses associated with using currency.

- Contractor Payments: Just because you use crypto to pay a contractor doesn't mean you don't expense it as a contractor payment. However, you also need to keep track of this for 1099 reporting purposes. Again, just because crypto was used doesn't exempt you from that.

Special NFT Considerations

Not all NFTs are collectibles. In fact, many have utility and should probably be classified as an expense. So, you definitely need to keep track of all NFTs individually - you can't simply "blanket" all NFTs into one category.

For example:

- ENS Domain Name: An ENS name is what allows you to have the .eth web address. While an ENS name is a smart contract (thus an NFT), I'd classify this as website expenses - just like you would if you bought a .com domain at GoDaddy.

- Discord Membership: Many professional communities are selling access via NFT tokens. I would classify these NFTs as professional fees (but only if it relates to your profession).

- Books and Guides: Again, some professionals are selling eBooks and other tools as NFTs. Just check out the NFT Tax Guide. This would likely be a professional fee.

But at the end of the day, if you're like Visa and bought a CryptoPunk, these NFTs would simply be considered collectibles.

Crypto and NFT Journal Entry Examples

Alright, now let's talk about the practical aspects of bookkeeping your crypto and NFT transactions. Some of this might start basic, but I hope it helps solve some of the frustrations I went through when I started keeping track.

Receiving Crypto For A Sale

Let's start with the basics - receiving cryptocurrency for a sale. The trick with this is that you process the sale normally - invoice or whatever. Then, when it comes to receiving payment, you want to select the correct cryptocurrency account to receive it. And remember - you always use USD!

Here's what that looks like in Quickbooks:

This is where tools like CoinTracker come in handy! Since you need the USD value at the time of the transaction, CoinTracker takes care of that for you. For example, you can see this transaction where we received 0.018017 ETH, but for accounting purposes, we want to track the USD value - $80.15.

So, for accounting purposes, you actually received $80.15 as a sale. If you really want to, you could add the ETH amount in the description, and also the purpose (or NFT name).

Paying A Contractor Via Crypto

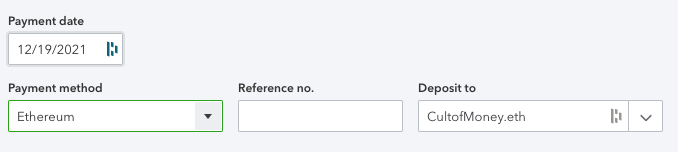

Let's dive into making a payment with crypto from your business crypto account. In this case, we are paying a contractor via crypto from our Ethereum wallet. Side note - this is a great use case for crypto and for paying people abroad.

In this situation, we are going to need to make a couple of journal entries. I'm going to assume you've already agreed on an amount. For our example, we're sending 0.46 ETH (roughly $2,000 USD) to a contractor.

Here, we start with CoinTracker and look at the transaction:

There's a few important pieces of information you need to accurately book this entry in your accounting software. You need:

- Cost Basis (remember, it was originally entered into your wallet on this cost)

- The Gain or Loss

- The Net Amount To The Contractor

We can take this information, and do the following journal entry to account for everything:

You can see we are taking the $2,178.60 out of our Ethereum Account, paying our contractor, and then also adding the loss into the crypto gain/loss account.

The end result of this is that you will see $2,178.60 less on your balance sheet for your Ethereum account, and you'll see the contractor payment and crypto gain/loss post to your P&L statement.

Buying An NFT

I'm going to show you two examples of buying an NFT just to highlight the differences of NFT types and why you may want to account for them differently.

In my first example, I purchased a membership to a professional community so I could learn more about crypto and NFTs. Honestly, using an NFT for this purpose is just membership communities or professional conferences in a web3.0 world. As such, I view this very much as a professional fee.

Again, let's start with the CoinTracker record:

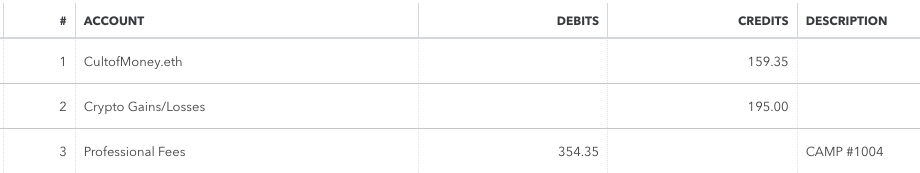

So, with that record of transactions in mind, we can then make the journal entries to represent this transaction. Here's what that looks like in Quickbooks:

As you can see, we are taking out $159.35 out of our Ethereum account, but in this case we actually have an gain of $195 to account for - so that's added in. In this case, since this is a utility NFT, we debit our Professional Fees account to reflect the expense.

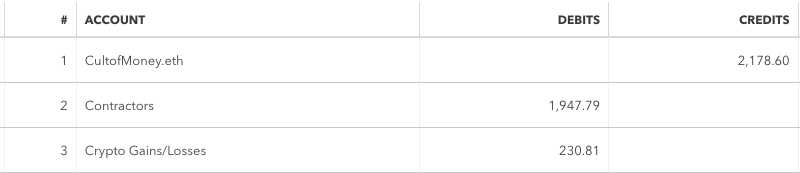

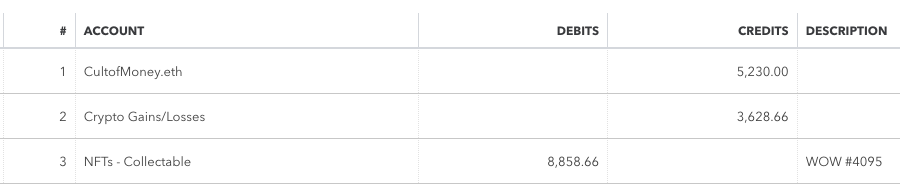

Let's take a look at a collectible NFT and see how it's slightly different. In this case, we bought a World of Women NFT (P.S. this is a really cool project). You can see this transaction below:

Now, in this case, instead of expensing the NFT, we're going to add it to our NFT Collectible account as an asset. Here's what that looks like in Quickbooks:

So a few things are happening here. First, we're pulling the value out of our Ethereum account, but we also have a large gain that we have to credit to the Crypto Gain/Loss account. After that, we can debit the NFT Collectible account (yes, we realize it's spelled wrong too).

Anyway, this transaction will make the balance sheet reflect that we both have less Ethereum, and now we have an asset. Also, the gain will flow through to our P&L statement.

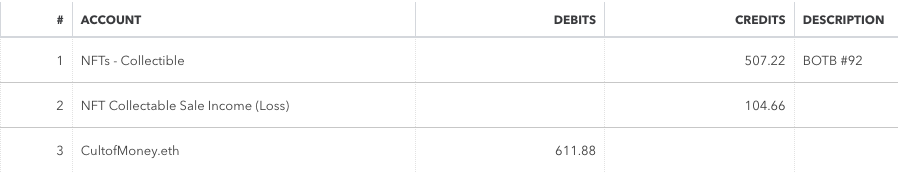

Selling An NFT

Finally, let's talk about what happens when you sell an NFT that is a collectible. It's very similar to the reverse above, so let's start with the transaction.

So, you can see we sold this NFT and have a gain on the transaction. Unlike crypto gains, we want to report that gain as a collectible gain. Here's what this looks like in Quickbooks:

As you can see, this time we pull the value out of the Collectible account, and we also add the gain in. The total amount is then added to our Ethereum account balance.

Final Thoughts On Crypto and NFT Taxes

Over the last several years, the IRS has made clear that reporting your cryptocurrency income, gains, and losses is required. The problem is, it's not that easy and even the "best" software out there isn't totally helpful. And some situations, like NFTs, you can't generalize. You need to track each transaction and report it by what you're actually doing with it.

And when you add in a business, the reporting and bookkeeping becomes even more complex. Hopefully this guide will at least help you accurately keep track of your transactions, so it becomes a little easier to report during tax time.

As always, we're looking for ways to make things easier. If you have any tips or tricks, please share them below in the comments!

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page, or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications including the New York Times, Washington Post, Fox, ABC, NBC, and more. He is also a regular contributor to Forbes.

I have a question as a new business owner launching a charitable NFT project. Say I have an account that has been receiving a sum of eth. So say I have .15 eth and I receive another .01 eth making it a total of .16 eth in the account. Now I make a purchase that costs .01 eth as a business expense. How do I determine the cost basis of that spent eth? Is it from the first .01 I ever received or from the most previous .01 eth I received? Also, what about if the purchase was larger like .05 eth but the cost basis for when I received that eth is at two different price points?

I appreciate this article, I was completely lost before reading this. Thank you!

Everything is in USD. That’s what sucks about crypto accounting. So, you need to find the cost basis of all the ETH on the date you received it. While most of us in crypto only think in ETH, the US Government only thinks in dollars.

So, let’s keep it simple and say the cost basis on the 0.15 ETh was $225 – each 0.01 ETH is worth $15. Then you go the 0.01 ETH at $20.

The business expense of 0.01 ETH would be a $20 expense.

A 0.06 ETH business expense would be $95. (That’s 5×15 + 20).

I recommend using a tool like Cointracker to keep track of your cost basis for you. Makes it much easier.