When you’re looking to lend your crypto for interest or use cryptocurrency as collateral for a loan, you should know about CoinLoan.

CoinLoan is a decentralized finance (DeFi) company focused on facilitating cryptocurrency loans, as well as a crypto exchange and institutional cryptocurrency products.

Here’s a closer look at CoinLoan to help you decide if it makes sense for your cryptocurrency trading, investing, and borrowing needs.

Quick Summary

CoinLoan Details | |

|---|---|

Product Name | CoinLoan |

Product Type | DeFi Lending |

Supported Coins | 20+ |

Interest Rates | Up To 12% APY |

Promotions | None |

Pros

Cons

Who Is CoinLoan?

CoinLoan is a cryptocurrency platform founded in 2017 and based in Estonia. It earned licenses from European regulators in early 2018 and launched its lending platform and exchange later that year.

In addition to the main CoinLoan platforms, the company launched its own Ethereum ERC-20 token about four years ago, which can be used to save on fees when borrowing with the platform (lending and interest accounts are fee-free).

The CoinLoan Token (CLT) is available on limited exchanges, namely Bittrex, HitBTC, and Hotbit. As of this writing, about 9% of the total possible supply is minted and in circulation with a market cap of $33 million, putting it near the bottom of the top 500 cryptocurrencies list by market capitalization.

CoinLoan offers a web version and mobile apps for Android and iOS.

CoinLoan Features

The main features at CoinLoan are as follows:

Earn

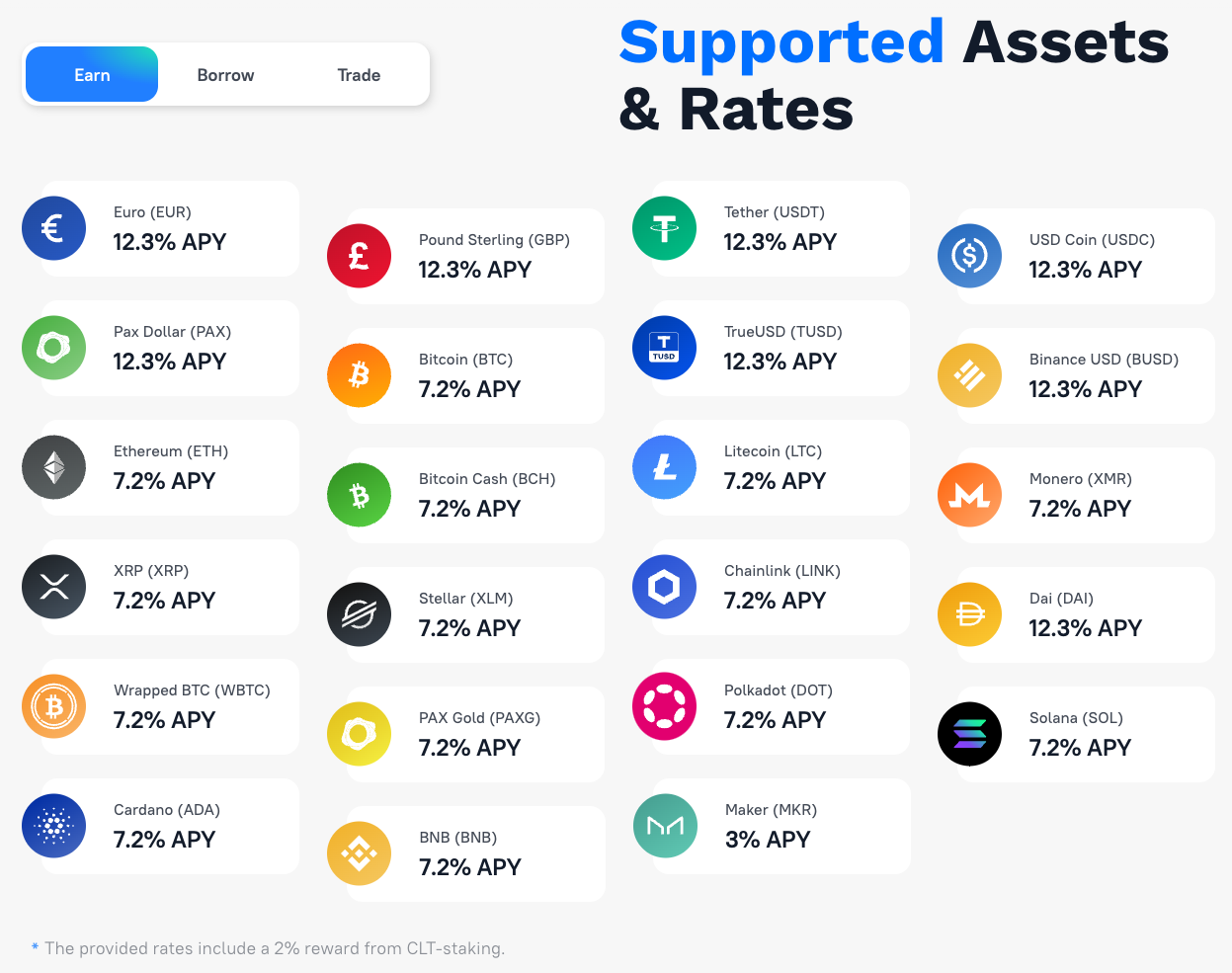

The earn program at CoinLoan offers rates up to 12.3% APY on cryptocurrency balances when you take advantage of the 2% bonus from the CLT currency reward program. Without CLT, rates range from 1% to 10.3% for its list of nearly two dozen supported currencies.

While the list of currencies isn’t huge, it covers most popular cryptos, stablecoins, and a few fiat currencies. Supported currencies include USD Coin, Bitcoin, Binance USD, Ethereum, Bitcoin Cash, Litecoin, XRP, Stellar Lumens, Polkadot, Solana, Cardana, Binance Coin, and Maker.

After signing up and funding an account, interest is paid daily. There are no fees for depositors who invest on the platform.

Borrow

The Borrow program enables users to borrow in cryptocurrency or fiat (EUR or GBP) using cryptocurrency as collateral. Costs vary based on the loan size, collateral percentage, and loan period.

Borrowers must put down 20% to 70% of the loan amount as collateral, labeled as LTV for Loan to Value on the application. Loans require a 1% origination fee. As of this writing, interest rates range from 4.5% to 7.5%, depending on the LTV percentage. Terms range from one month to 36 months.

You may qualify for discounts on your borrowing fees and rates with the CTL currency.

Cryptocurrency Trading

The Trade side of CoinLoan enables users to buy, sell, and swap fiat currencies with cryptocurrencies. Rates are not available until you log in. When trading, it’s a good idea to compare rates with major exchanges like Coinbase and Binance to ensure you’re getting a fair price.

Are There Any Fees?

There are no fees or charges for depositing into an account and lending through the Earn program. You can earn more with the CLT rewards program.

Borrowing requires an origination fee of 1% and interest rates ranging from 4.5% to 7.5%, again with more favorable pricing when holding CLT in your account and participating in the rewards program. Paying with CLT gets you a 50% discount on origination fees.

Cryptocurrency withdrawals require a fee. Users can make one Ethereum or ERC-20 token withdrawal per month for free.

If you’re a borrower and fall under a margin call, liquidation fees are 7% of the liquidated collateral value.

How Does CoinLoan Compare?

Note that this industry is evolving rapidly, so look for recent news and announcements before putting your funds under any crypto company’s care. For example, companies like Celsius have suffered severe capital constraints that may lead to customer losses.

CoinLoan isn’t the only collateralized cryptocurrency lending and borrowing program. Here are some others to know about:

Aave: Aave is an open-source lending and borrowing program tied to the AAVE currency. It supports markets including Ethereum, Avalanche, and Polygon, among others. Aave requires using of a Web3 wallet.

Gemini Earn: Gemini Earn is the staking and earning program from the large U.S.-based exchange Gemini. It’s considered one of the safer platforms, but rates may not be the best.

Nexo: Nexo is an easy-to-use cryptocurrency exchange and lending platform with many competing features with CoinLoan.

Hodlnaut: Hodlnaut is another simple lending and borrowing platform. It pays up to 7.25% interest on deposits. Hodlnaut works with seven different currencies and has $350 million in assets on deposit.

CoinRabbit: CoinRabbit is a quick borrowing and lending platform for cryptocurrency that supports more than 70 currencies. Deposit rates for savers reach up to 10% APY.

How Do I Open An Account?

Like most reputable cryptocurrency services, CoinLoan requires know your customer (KYC) verification to unlock all features. CoinLoan is a licensed financial services company in the EU that is legally required to verify customers.

KYC is completed through a 3rd party partner and requires submitting your address and contact information, a government photo ID, and a selfie to show that you’re that face on the passport, driver’s license, or other acceptable identification.

Aside from these KYC steps common to cryptocurrency companies, the signup process is simple and easy to follow.

Is CoinLoan Safe?

We’re in a tumultuous time for cryptocurrency, which makes safety and security a top concern. While we have not done an in-depth analysis of CoinLoan’s assets and liabilities, it has operated with a high degree of trust to date. It doesn’t show any serious signs of security risk for users who follow online best practices, like using a VPN on public wifi networks and a unique password on every website.

The only big red flag was a recent change to withdrawal rules. The company claims the change is temporary, but all users are limited to $5,000 in total withdrawals over 24 hours. After a few other services cut off withdrawals, this could have you worried enough to avoid depositing any new funds.

Customer Serivce

Reviews on Trustpilot from past customers are generally positive, with a 4.2 average rating from nearly 300 reviews. Positive reviews focus on a good customer experience and customer service. Negative reviews point to recent changes to withdrawal policies and worries about being unable to withdraw in the future.

Is It Worth It?

If you’re looking for an upstanding site to deposit cryptocurrency for interest or borrow using your crypto as collateral, CoinLoan could be a good choice. While the recent lower daily withdrawal limit is a red flag, the company otherwise appears to be resilient against the recent crypto winter so far. But as with all crypto services, invest and deposit funds with extreme caution.

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment. His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, HuffPo, Investor Junkie, and other fine financial blogs and publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.