FTX is a global cryptocurrency exchange with a range of products, including cryptocurrency options, swaps, and futures. The main FTX exchange is open to most international users, while FTX US is available to residents of the United States.

The international version has slightly different offerings due to regulations. This review is primarily focused on FTX US.

FTX is best for active traders or those with experience using active trading platforms. Fees are competitive with other large centralized exchanges.

The big draw to FTX over others is its suite of advanced trading products you can’t find elsewhere. Here’s a closer look at how FTX works so you can decide if it makes sense for your cryptocurrency trading needs.

Important Update: FTX was forced to declare bankruptcy in November 2022 due to lack of liquidity. This impact both FTX.us and FTX international. As a result, customers may lose money. This is a big red flag and issue, and customers should avoid FTX.

FTX Details | |

|---|---|

Product Name | FTX, FTX US, and the |

Product Type | Crypto Exchange, Derivatives Platform, & NFT Marketplace |

Supported Currencies | International: 275+ US: 23 |

Trade Fees | FTX App: $0 |

Promotions | None |

Pros & Cons

Pros

Cons

What Is FTX?

FTX is a global cryptocurrency exchange and derivates platform. Users in the United States can use the FTX US platform to trade US dollars for 23 different cryptocurrencies and five other national fiat currencies.

FTX US supports spot trading, options, swaps, and futures. These active trading products are best for expert and experienced investors.

FTX is based in Hong Kong. FTX US is a regulated exchange in the United States. It's licensed by FinCEN, the CFTC, and many state regulatory agencies. This means U.S. users should feel as safe using FTX as any other large cryptocurrency exchange.

According to CoinMarketCap, FTX is the third-largest cryptocurrency exchange globally by trading volume, with over $1 billion in volume per day. FTX US is the 11th largest global exchange.

What It Offers

These are the most important features to know about at FTX:

Spot Trading

Spot trading is an industry term for trades at the current market rate. FTX US includes support for about two dozen currencies from US dollars, plus markets based in Australian dollars, Brazilian Digital Token (a stablecoin), Canadian dollars, euros, British pounds, and USD Tether.

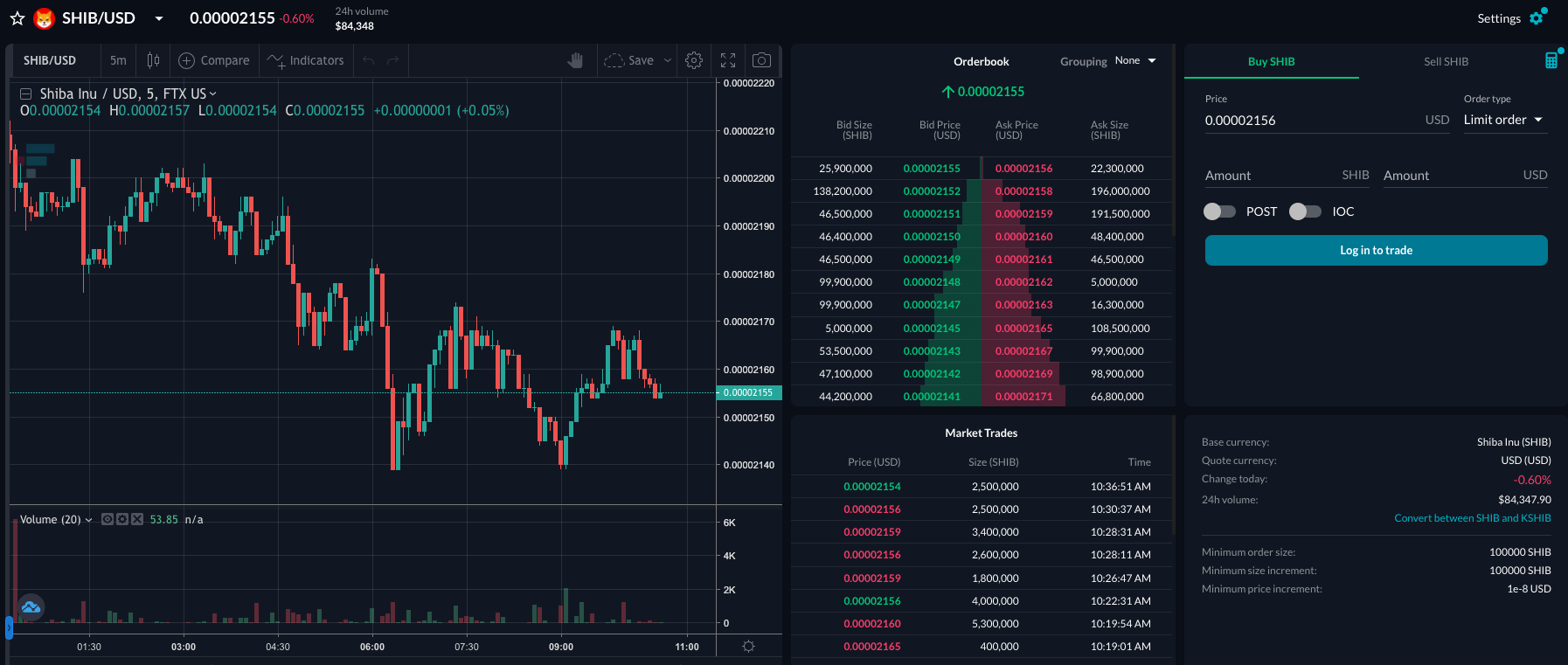

The FTX US exchange trading screen

The most popular currencies on the FTX US spot trading platforms are Bitcoin, Ethereum, Solana, Bitcoin Cash, and Litecoin.

The web and mobile apps for FTX US are intuitive and easy to use. The web version has customizable layouts, charts with dozens of overlays, a view of the current open order book, recent trades, and a quick entry trading form. In addition to market and limit orders, FTX US supports advanced stop market, stop limit, trailing stop, take profit, and take profit limit order types.

Derivatives

Derivatives is a finance term for financial trading instruments that derive their value from other underlying assets. FTX US Derivatives supports options, swaps, and futures based on cryptocurrency market prices.

- Options: Options contracts allow you to buy or sell a cryptocurrency at a specific price on a particular future date. If the currency is worth more than the contract’s price, you are “in the money” and can exercise the contract for a profit. FTX US has options markets for Bitcoin and Ethereum.

- Futures: Futures are similar to options, but the contract holder is required to exercise the contract on its maturity date rather than having an option to do so. FTX US offers Bitcoin futures where you can buy contracts to buy Bitcoin at a specific price on a future date.

- Swaps: A swap is a complex derivatives contract suitable for expert traders and investors. FTX US supports Bitcoin and Ethereum swaps.

Note that each of these derivatives make use use leverage, which amplifies profits as well as losses. This makes it riskier to trade them than non-leveraged products and should only be considered by experienced traders who fully understand these risks.

NFTs

FTX US has a program for non-fungible tokens (NFTs). Users can mint new NFTs or trade on the "FTX US NFT" marketplace (that's a lot of acronyms!). FTX supports NFTs on the Ethereum, Solana, and FTX blockchains.

Supported Crypto And Fiat Currencies

- BTC

- ETH

- SOL

- LTC

- LINK

- MATIC

- SUSHI

- BCH

- DOGE

- WBTC

- YFI

- UNI

- GRT

- KSHIB

- USDT

- AAVE

- BAT

- SHIB

- TRX

- MKR

- PAXG

- DAI

- AUD

- CUSDT

- BRZ

- CAD

- EUR

- GBP

FTX Fees & Pricing

On the FTX US spot exchange, trade fees start at 0.40% and go down with higher trade volumes. You can qualify for lower trading fees with trading volumes over $100,000 per month. FTX.com's fees are much lower. They start at 0.070% and go down from there.

For FTX US, ACH deposits cost $0.50 each, but that fee is waived in many cases. Wire transfer fees are 1% up to $35 of the deposit or withdrawal amount, but that’s currently waived for all users. There are no fees to deposit cryptocurrency, but you have to pay the withdrawal blockchain fees for some tokens.

Currently, FTX isn't charging any transaction fees on the FTX App. That means if you're comfortable with using your phone, you can buy many of the top currencies completely commission-free. The FTX App also doesn't charge any ACH deposit or withdrawal fees.

How FTX Compares

Compared to other large cryptocurrency exchanges in the United States, FTX does a reasonable job balancing fees and features. It isn’t the cheapest around and doesn’t have the biggest list of digital currencies. But the average cryptocurrency user will find their needs met at FTX.

FTX US stands out as an excellent choice for advanced traders looking for derivative products. However, if low fees or a huge number of currencies are your main priorities, consider looking elsewhere.

FTX also isn't the best option if you're looking for simplicity. Following their Blockfolio acquisition, the company now has three different platforms: FTX, FTX US, and the FTX App (formerly Blockfolio). And unfortunately, you can’t use the same login credentials across them.

Here's a closer look at how FTX compares to some of its top competitors:

Header | |||

|---|---|---|---|

Star Rating | |||

Trade Fees | FTX App: $0 | Starts at 0.50% | Starts at 0.26% |

Supported Currencies | International: 275+ US: 23 | 100+ | 100+ |

Derivatives | Yes, options, swaps, and futures | Coming soon | Yes, futures |

Mobile App | |||

Cell |

How To Open An FTX Account

You can create a new account at the FTX website or mobile app. After entering your email and a password, you have to go through two levels of identity verification to use all account features.

- Level 1 verification: Enables deposits and up to $10,000 in daily withdrawals. This requires your basic contact information and verifying your phone number.

- Level 2 verification: Unlocks unlimited deposits and withdrawals and requires verifying your Social Security number through a connection with Stripe.

Registering for a new FTX US account is very easy. If you have your information handy, you could be up and running with an active account in less than 10 minutes. If you’re fast, you can sign up in less than five minutes.

FTX Security

FTX uses standard financial security features, but it’s also essential to follow online security best practices, such as using a unique password for every website and two-factor authentication with trusted multi-factor authentication apps like Authy or Google Authenticator.

However, it came to light in November 2022 that FTX had used customer account to facilitate loans and other obligations. As a result, FTX was forced to suspend withdrawals due to an inability to pay. This liquidity issue sent the company into bankruptcy. As a result, customers should avoid FTX.

Customer Service At FTX

FTX US offers support by email through a support ticket system. However, in most cases, you should consider FTX a self-service product where you handle account updates and needs yourself. It should also be noted that FTX US is not widely reviewed by past users on major customer service rating sites.

Is FTX Right For You?

FTX is currently in bankruptcy and customer should avoid FTX.

Customers who have assets at FTX may lose some or all of their cryptocurrency.

FTX Features

Product Type | Crypto Exchange, Derivatives Platform, & NFT Marketplace |

Min Deposit | $0 |

Min Balance Requirement | $0 |

Trade Fees | FTX App: $0 |

Supported Currencies | International: 275+ US: 23 |

Derivatives | Options Swaps Futures |

ACH Deposit Fee | FTX US: $0.50 FTX App: $0 |

Withdrawal Fees | FTX and FTX: Only charges fees on ERC20/ETH & OMNI token withdrawals. FTX App: $0 |

Supported Payment Types | Debit or credit card |

Security | 2FA Trading passwords |

Mobile App Availability | Android and iOS |

Desktop Availability | Yes |

Customer Support Options | Email support ticket system |

Promotions | Use the referral code "cultofmoney" to get 5% off fees at FTX US |

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment. His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, HuffPo, Investor Junkie, and other fine financial blogs and publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.