There's a common misconception that you need thousands of dollars to begin investing.

But the reality is that you don’t even need hundreds of dollars. In fact, many brokers and cryptocurrency exchanges let you start investing with just a few dollars.

Here’s a look at some of the most popular, low-cost ways to start investing with $100 in 2022. If you're ready to start your investing journey and building your nest egg, these ideas are the perfect place to start.

The Best Ways To Invest $100 In 2022

Between digital assets and more traditional asset classes, there are plenty of ways to start investing with $100.

Crypto-based investments are some of our favorites. But there are numerous ways to put your money to work, even if it's a small amount.

Invest In Cryptocurrency

One of the simplest ways to begin investing with $100 is to invest in crypto.

And starting with this asset class is very simple. If you use a popular crypto exchange like Coinbase or Gemini, you can begin trading with just $2.

These exchanges also support dozens of cryptocurrencies alongside popular coins like Bitcoin and Ethereum:

Every cryptocurrency has unique risks and benefits, so make sure you know what you’re investing in when you click the buy button.

Stake Cryptocurrency For Passive Income

Once you invest in crypto, a lot more income opportunities start opening up.

One of these opportunities is crypto staking. With staking, you lock-up your crypto to help validate blockchain transactions or to provide liquidity for exchanges. In return, you earn interest on your crypto for easy, passive income.

Some staking pools and crypto savings accounts also lend out your crypto, much like a regular bank. But either way, you can leverage your digital assets to create a new passive income stream for yourself without much work.

Two popular crypto savings accounts you can invest $100 in are BlockFi and Celsius.

Celsius' weekly APY.

Both companies let you deposit popular cryptocurrencies like Bitcoin, Cardano, and Ethereum to earn interest. And options like Celsius pay 17% APY or more on certain cryptos and stablecoins.

These types of interest rates are much higher than you find with a traditional savings account. And you also get paid in-kind, meaning your crypto portfolio can slowly grow as you earn interest.

Invest In A Crypto IRA

A Bitcoin IRA or Crypto IRA is a cryptocurrency-focused investment account for retirement.

A Traditional IRA is funded with pre-tax dollars, meaning you don’t pay any taxes on the income the year of your contribution. In the future, qualified withdrawals in retirement are taxable at your regular tax rate, which will hopefully be lower in retirement when you’re busy being retired instead of working.

With a crypto Roth IRA, contributions don’t get any tax benefits, but qualified withdrawals in the future are tax-free, meaning you don’t pay any capital gains tax.

Investing in crypto for your retirement used to be difficult. But these days, companies like Alto and RocketDollar let you invest in crypto and other alternative assets with your IRA.

Both companies have a $0 funding requirement, so investing $100 is also possible with either crypto IRA.

Dabble In Crypto Yield Farming

If you have the technical skills to use a software crypto wallet, you can get involved in the Web 3.0 economy through yield farming.

Yield farming is an advanced type of staking where you can earn much higher returns. This is where you find crazy high crypto APY deals in the hundreds or thousands of percent range.

However, this investing strategy involves more risk than using crypto savings accounts. In fact, yield farming isn't suitable for most investors because you really have to do your due diligence to find the right liquidity pools.

But if you're passionate about crypto and passive income, this is still a lucrative way to invest $100 or even less.

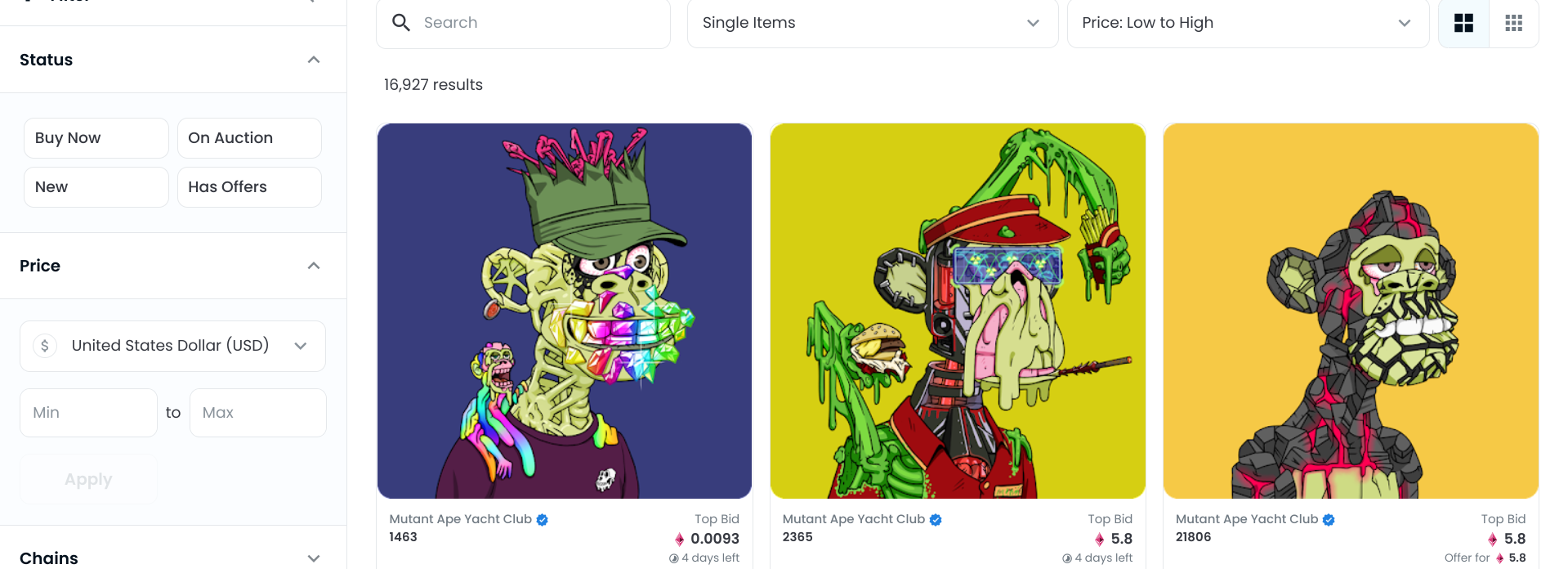

Invest In NFTs

If you believe in the NFT craze, you can jump in and buy digital artwork with hopes it appreciates in value.

NFTs, or non-fungible tokens, are digital assets tracked using the same blockchain technology as cryptocurrencies. That means every NFT has one unique owner, and the NFT is tied to that owner’s digital wallet.

Most NFTs are based on the Ethereum blockchain, although there's a growing number of Solana NFT marketplaces as well.

Some Mutant Bored Ape NFTs.

In either case, you can buy NFTs on marketplaces like OpenSea or with various Solana wallets. If you pick an NFT that's part of a trendy project or get lucky, its price can potentially skyrocket, leading to a handsome return.

Again, this comes with a very high level of risk of losses. You also have to set aside funds for gas fees, which are network payments for buying or selling digital assets. Be careful not to spend too much of your $100 investment on fees.

Invest In Low-Cost Index Funds

Cryptocurrencies and NFTs are an exciting way to invest $100 or even less. But if you're still building your portfolio, it's sometimes wise to stick with more stable investments.

One example of a classic investment vehicle are index funds. These are that track the value of various stock market and investment asset indices. For example, if you invest $100 in an S&P 500 index fund, the fund manager will pool that $100 with other investors to buy you $100 worth of the 500 stocks in the S&P 500 index.

Low-cost index funds are often available with no trading fees as an ETF, or exchange-traded fund, at most large online brokerage firms.

Index funds charge an annual fee to investors called an expense ratio. The best low-fee index funds charge less than 0.10% per year to manage your investments.

Target-Date Funds

A target-date fund is an investment fund where a fund manager picks a combination of low-cost index funds based on the date you plan to retire. In most cases, that means a portfolio made chiefly of stocks when you’re younger and more fixed-income investments as you near retirement.

Again, keep an eye out for high expense ratios. Target date funds may be available as a mutual fund, but with $100 to invest, you’re probably better off with an ETF.

You can buy and sell an ETF similarly to stocks, while mutual funds have different rules and sometimes require higher investment minimums.

Invest In Fractional Shares

If you want to build a diverse portfolio and pick your own stocks or funds, a fractional share portfolio could be your best choice.

For example, commission-free brokers like M1 Finance let you select a combination of stocks and funds and choose what percentage of your portfolio you want to invest in each.

When you deposit your first $100 and any additional in the future, M1 Finance does its best to keep your portfolio aligned to those percentages. And you can always log in and make additions or updates as well.

If picking your own stocks and funds is too challenging, or you want to hand it off to someone else, a robo-advisor like Betterment or Schwab Intelligent Portfolios could be best.

Betterment and Schwab both have $0 account minimum requirements, making them excellent choices for investing $100 or less.

Buy An Investing Book

While this isn't a traditional way to invest $100, it could be one of the most impactful investments you ever make.

After all, one of the best investments you can make is in yourself and your financial literacy. And the lessons you learn from a $10 or $20 book could offer many thousands of dollars in returns as you put that knowledge into action over your lifetime.

Some top books for investors include:

- The Intelligent Investor by Benjamin Graham

- The Automatic Millionaire by David Bach

- The Little Book of Common Sense Investing by John Bogle

- I Will Teach You To Be Rich by Ramit Sethi

You can also invest in books about cryptocurrency to expand your knowledge on digital assets and blockchain technology.

Books like The Basics of Bitcoins and Blockchains by Anthony Lewis or Cryptoassets: The Innovative Investor's Guide to Bitcoin and Beyond by Chris Burniske are two great starting points.

Frequently Asked Questions

Is It Worth Investing $100?

Investing $100 might seem trivial because this is a small sum of money. However, successful investing requires building good habits and having patience.

Even though $100 won't change your life, everyone has to start somewhere. Use your starting $100 to learn the basics of investing, and focus on the process, not your immediate returns.

Money tip: If you don't have an emergency fund yet, hold off on investing your $100. Learning to invest is important. But you should ideally have three to six months' worth of expenses set aside in a savings account to help cover emergencies.

Can I Invest In Stocks With Just $100?

Online brokers like M1 Finance let you invest in stocks with $100. You can also use investing apps like Robinhood that have a $0 account minimum to start investing.

How Much Money Do You Need To Invest In Crypto?

Leading crypto exchanges like Coinbase let you invest in crypto with just $2 of your local currency. And Coinbase supports over 100 coins, so there's plenty of choice.

You can even stake certain cryptos and stablecoins on Coinbase to earn additional income. Alternatively, crypto savings accounts like Celsius and Hodlnaut are also beginner-friendly ways to dabble in crypto.

The Bottom Line

Investing might sound like an intimidating process, but it’s relatively simple once you get the hang of it.

If you already use online banking, you’ll likely find the online investing experience very similar. Signing up for a new crypto account or other investment accounts usually takes about five to ten minutes, and your first investments are then just a few clicks or phone screen taps away.

And now, you know some of the best ways to invest $100 in 2022 and beyond. Just remember to do your research so you're an informed investor and actually understand the assets you're investing in.

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment. His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, HuffPo, Investor Junkie, and other fine financial blogs and publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.