DeFi platforms provide consumers with modern banking services.

By "modern," we mean things like fewer fees, high savings rates, and low-interest borrowing without all of the traditional paperwork. Another core component of DeFi is that there’s no middleman.

MyConstant is a DeFi platform that focuses on lending and borrowing. It's a peer-to-peer platform. That means if you invest as a lender, you're lending directly to someone. There isn’t an intermediary trying to capture fees or slow down the process. Let’s take a look at why someone might want to invest or borrow with MyConstant.

MyConstant Details | |

|---|---|

Product Name | MyConstant |

Product Type | Crypto Lending And Borrowing |

Interest Rates For Investors | 1% APY to 7% APR |

Interest Rates For Borrowers | Starting at 6% APR |

Promotions | $4,000 Trial Bonus For 15 Days |

Pros And Cons

What Is MyConstant?

MyConstant (Const LLC) is a peer-to-peer lending, crypto-based DeFi platform. Its founder and CEO is Duy Huynh. The company was founded in 2018 and is based in Riverside, CA. It doesn’t appear that any funding rounds have been raised.

What Does It Offer?

MyConstant is a DeFi platform. DeFi stands for "decentralized finance" and consists of lending and borrowing in crypto. DeFi’s goal is to replace traditional banking operations by providing a better customer experience.

DeFi provides ways to transfer money across borders effortlessly. Borrowers can often get loans with minimal or no credit scores. And most all DeFi services come without the many fees involved in traditional banking services.

DeFi is based largely on stablecoins and the Ethereum blockchain (because of its programmability). Stablecoins don’t have the volatility that Bitcoin and other cryptocurrencies have, which is essential to maintaining reliable interest rates on collateralized loans and for investors backing those loans.

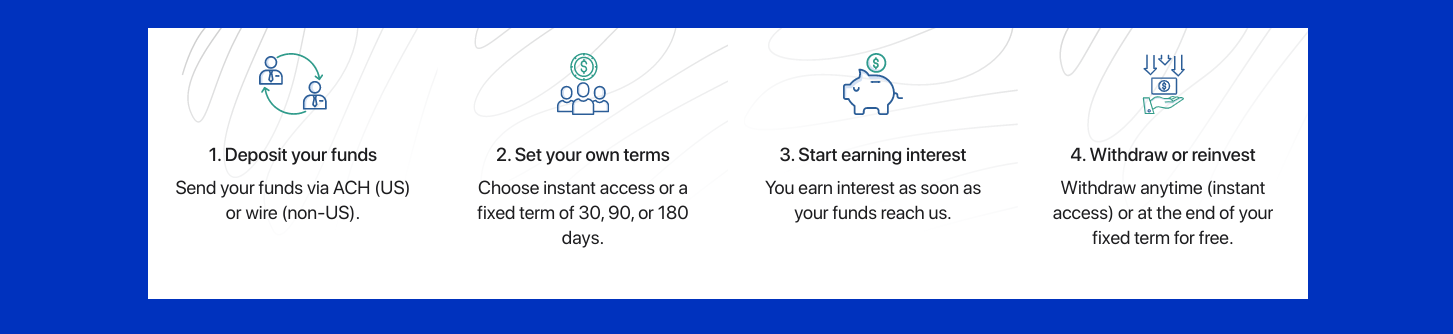

Earn Interest As A Lender

Lenders can earn 1% to 7% interest on MyConstant, depending on the loan term. If you need maximum flexibility, you can loan your cash or crypto out with no loan terms. No-term loans pay lower rates but interest is paid out every second and you can withdraw your assets whenever you want.

Lenders can also choose to enter MyConstant's "Lending Lottery" for a chance to win up to $10 million. You'll earn 1% APR on your lent funds and you'll get one ticket to the platform's weekly lottery for every $100 you invest. Lending Lottery loans have 1-month terms. You can end the term early at any time, but you'll forfeit all the interest earned, lottery tickets, and any winnings.

If earning the highest interest rates is your top priority, you'll want to commit to a fixed term. MyConstant's fixed-term loan options are 1 month, 3 months, or 6 months. But you can end the term at any time and still earn 2% APR%.

MyConstant is also offering investors a $4,000 free trial bonus for 15 days. After the 15 days has elapsed, MyConstant takes back the $4,000 but you get to keep the interest!

Here's a quick comparison of all MyConstant's investment options:

Instant Access | Fixed Term | Crypto Lend | Lending Lottery | |

|---|---|---|---|---|

Interest Rate | 4% APY | 6-7% APR | 4% APY | 1% APR |

Interest Paid | Every second | End of the term | Every second | End of the term |

Term | None | 1-6 months | None | 1 month |

Min Deposit | $10 | $50 | Varies (0.005 for BTC) | $100 |

End Term Early | N/A | You earn 2% APR | N/A | You lose interest earned, lottery tickets, and winnings |

Low Borrowing Rates

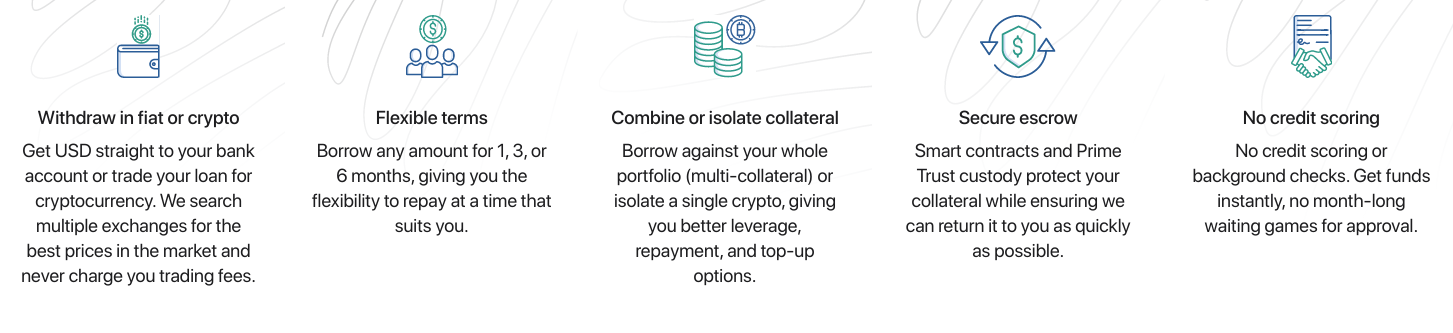

Borrowing on MyConstant doesn’t require a credit check or any of the paperwork that traditional banks need. Just stake crypto as collateral.

There are 73 cryptocurrencies available to borrow against. Loan rates start at 6% and terms are 30 days, 60 days, or 180 days. You can receive your borrowed funds in cash or crypto.

To take out a loan with MyConstant, you'll need to put up at least 150% of the amount that you borrow in collateral. But unlike other platforms, MyConstant will allow you to recall excess collateral if your cryptocurrency gains in value to the point that your CTV (collateral to value ratio) exceeds 165%.

MyConstant offers a few more advanced borrowing options including: Short Selling Simple, Short Selling Advance, and Futures. However, these services are not currently available for U.S. customers.

Pro/Advanced Interface

The Pro interface is for advanced crypto traders who want an investing interface similar to a crypto trading interface. If you plan to use MyConstant’s investment platform frequently, the Pro interface can simplify investing.

Are There Any Fees?

For investors/lenders, there are no fees. However, borrowers pay a 3.5% matching fee in addition to the agreed-upon interest rate. Here are a few more fees that borrowers may face:

- Repay With Collateral Fee: 2%

- Prepayment Penalty:

- Before 75% of the term has elapsed: 50% of the remaining interest

- After 75% of the term has elapsed: 100% of the remaining interest

- Late Payment Fee: 10% of the total interest due

All deposits are fee-free with MyConstant and fiat withdrawals are fee as well. However, you'll pay a fee to withdraw crypto assets. Crypto withdrawal fees vary by coin.

It's unclear what your costs could be if you decide to buy or sell crypto on MyConstant. The company says that it never charges trading fees. But it's very likely that you'll still pay a spread. Unfortunately, rather than giving an average spread, MyConstant simply says: "We search multiple exchanges for the best prices in the market..."

How Does MyConstant Compare?

There are a lot of fintechs that will let consumers take out a loan. While their application process is more efficient than traditional bank loan applications, qualifying for those loans is still a problem. Borrowers will need to have a good credit score and credit history.

Coinbase is a cryptocurrency trading platform and not really DeFi. It does have a borrower feature where customers can put up Bitcoin as collateral. Rates on those loans are 8%. However, there is no way to become a lender/investor like there is on MyConstant.

Celsius is more of a direct competitor to MyConstant. In many cases, it offers higher investor rates for lenders and lower rates for borrowers. Depending on how much collateral they put up, Celsius borrowers in most states can get rates as low as a 1%. And Californians are eligible to borrow at 0%. Check out how MyConstant compares in this quick chart:

Header | |||

|---|---|---|---|

Rating | |||

Interest Rates For Investors | Up to 7% | Up to 17.78% | N/A |

Interest Rates For Borrowers | Starting at 6% | Starting at 0% | 8% |

Supported Collateral | 70+ coins | 40+ coins | Bitcoin |

Loan Terms | 1,3 or 6 months | 6 to 36 months | Flexible |

Matching Fee On Loans | 3.5% | N/A | N/A |

Cell |

How Do I Open An Account?

There are three main steps to open an account with MyConstant. The first is email verification. That happens fairly quickly. Next is KYC (know your customer). That can take longer and, in some cases, a few days. The final step is to link your bank account so that funds can be transferred.

The entire process can take a few hours to a few days. The longest step is KYC and can vary greatly from individual to individual. Some info that will be required for KYC is a driver’s license or passport, social security number, photo of you holding your ID, and proof of address.

The MyConstant website says that KYC verifications should take no longer than three business days for U.S. residents. But if you live outside of the United States, it could take up to 14 days.

Is It Safe And Secure?

MyConstant is not a bank and invested funds deposited are not insured by the FDIC or SIPC. So investors would have no protection if MyConstant were to cease as a business. (Note that uninvested cash is stored across multiples insured banks and protected up to $130 million).

Even if MyConstant succeeds as a company, investors can still lose all of their money on individual investments. MyConstant tries to protect against, this, however, by requiring all loans to be collateralized with crypto. And if the value of the underlying crypto begins to drop, MyConstant will issue a margin call and require more capital to be deposited. If funds aren't deposited promptly, MyConstant can liquidate the assets to satisfy the loan.

Still, this doesn’t mean that your lent funds are 100% protected. If there is a quick and deep drop in the price of crypto, secured funds could be lost before the margin call process has enough time to run its course.

Also, it should be noted that you don’t really have any way of knowing if MyConstant is collateralizing loans in the way they say they are.

How Do I Contact MyConstant?

There are several ways to contact MyConstant:

- Phone: 646-809-8338

- Web chat

- Facebook Messenger from the MyConstant website

- Booking a call

- Email: [email protected]

Operating hours are Mon-Fri 9am-5pm and Mon-Thurs 7pm-4am PST.

MyConstant also has the following web presences:

Customer Service

MyConstant has a 4.5/5 star review on Trustpilot from 1057 reviews. However, MyConstant is not accredited with the Better Business Bureau (BBB) and it has an F rating due to negative complaints, mainly around moving funds into and out of the company.

Is It Worth It?

Certainly, the interest rates on MyConstant's loans can be enticing for investors (i.e., lenders). And MyConstant is following the same playbook as other DeFi platforms in how it is collateralizing those loans to protect investors.

Still, there are zero protections provided by federal regulatory bodies such as the FDIC. So as with other DeFi platforms, you should only invest money with MyConstant if you're willing to take on the risks in exchange for the chance to earn attractive returns.

If you think that MyConstant is the right investing platform for you, you can get your $4,000 free trial bonus here >>>

MyConstant Features

Product Type | Crypto lending and borrowing |

Min Deposit |

|

Interest Rates For Investors (i.e. Lenders) |

|

Interest Rates For Borrowers | Starting at 6% |

Loan Terms |

|

Credit Check Required On Loans | No |

Matching Fee | 3.5% |

Maintenance Fees | No |

Repay With Collateral Fee | 2% |

Early Repayment Penalty |

|

Late Payment Fee | 10% of the total interest owed |

Deposit Fees | None |

Withdrawal Fee |

|

Supported Coins | 70+ |

Insurance | No insurance on invested assets

|

Security | Loans are over-collateralized (150% to 200%) Website is encrypted Two-factor account authentication is supported |

Mobile App Availability | Yes, Android and iOS |

Desktop Availability | Yes |

Customer Support Phone Number | 646-809-8338 |

Customer Support Email | |

Promotions | $4,000 trial bonus for 15 days |

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page, or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications including the New York Times, Washington Post, Fox, ABC, NBC, and more. He is also a regular contributor to Forbes.