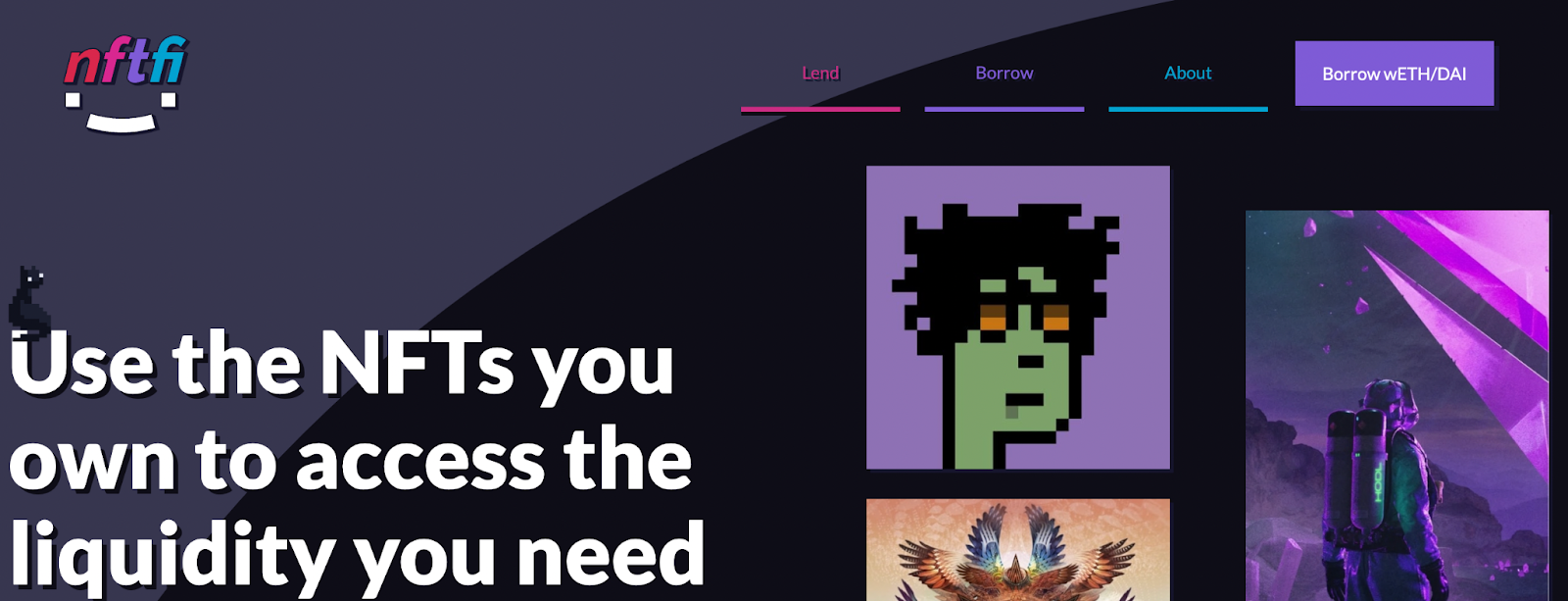

NFTfi is a protocol that aims to unlock the liquidity for non fungible tokens.

It is a simple peer-to-peer (p2p) marketplace for collateralized NFT loans. It basically allows borrowers to put up their collectibles, art, or any approved NFT (ERC-721) for a loan and lenders to make offers to lend in return for interest.

They are the one of the early pioneers in the space since 2020. Let's dive in and learn more about NFTfi.

Quick Summary

NFTfi Details | |

|---|---|

Product Name | NFTfi |

Product Type | P2P Lending Platform |

Supported Coins | wETH and DAI |

Interest Rates | Varies |

Promotions | None |

Pros & Cons

Pros

Cons

Who Is NFTfi?

NFTfi is one of the earliest pioneers in the NFT borrowing and lending space - effectively a liquidity protocol for NFTs.

They allow NFT owners to use the assets they own to access the capital they need by receiving secured wETH and DAI loans from liquidity providers, peer-to-peer, in a completely trustless manner.

Liquidity providers (i.e. lenders) can earn attractive yields or — in the case of loan defaults — to have a chance at obtaining NFTs at a discount to their market value.

NFTfi was founded by Stephen Young in 2020 and has raised a $5 million seed round.

Becoming A Borrower

Borrowing against your NFT is one of the main use cases for NFTfi.

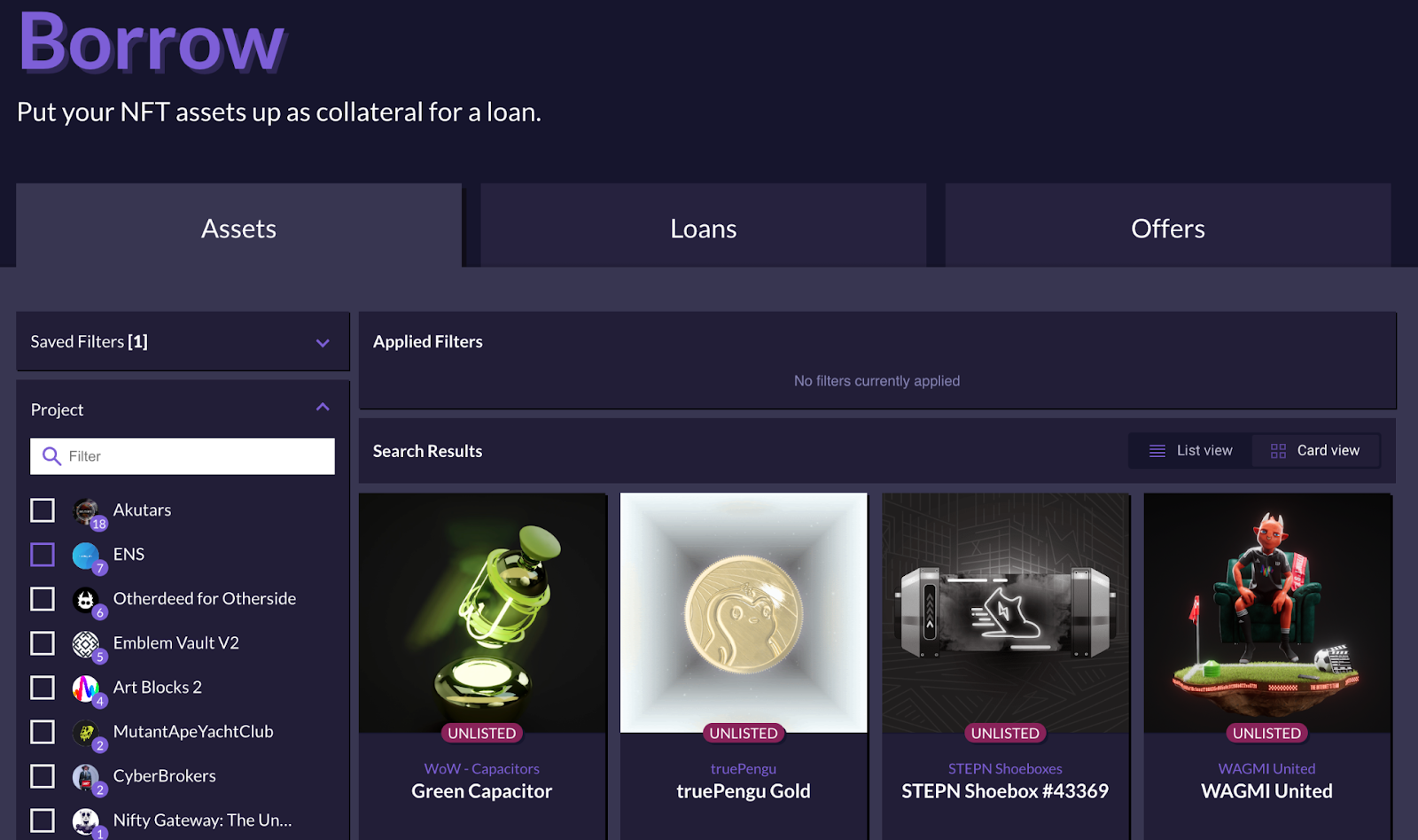

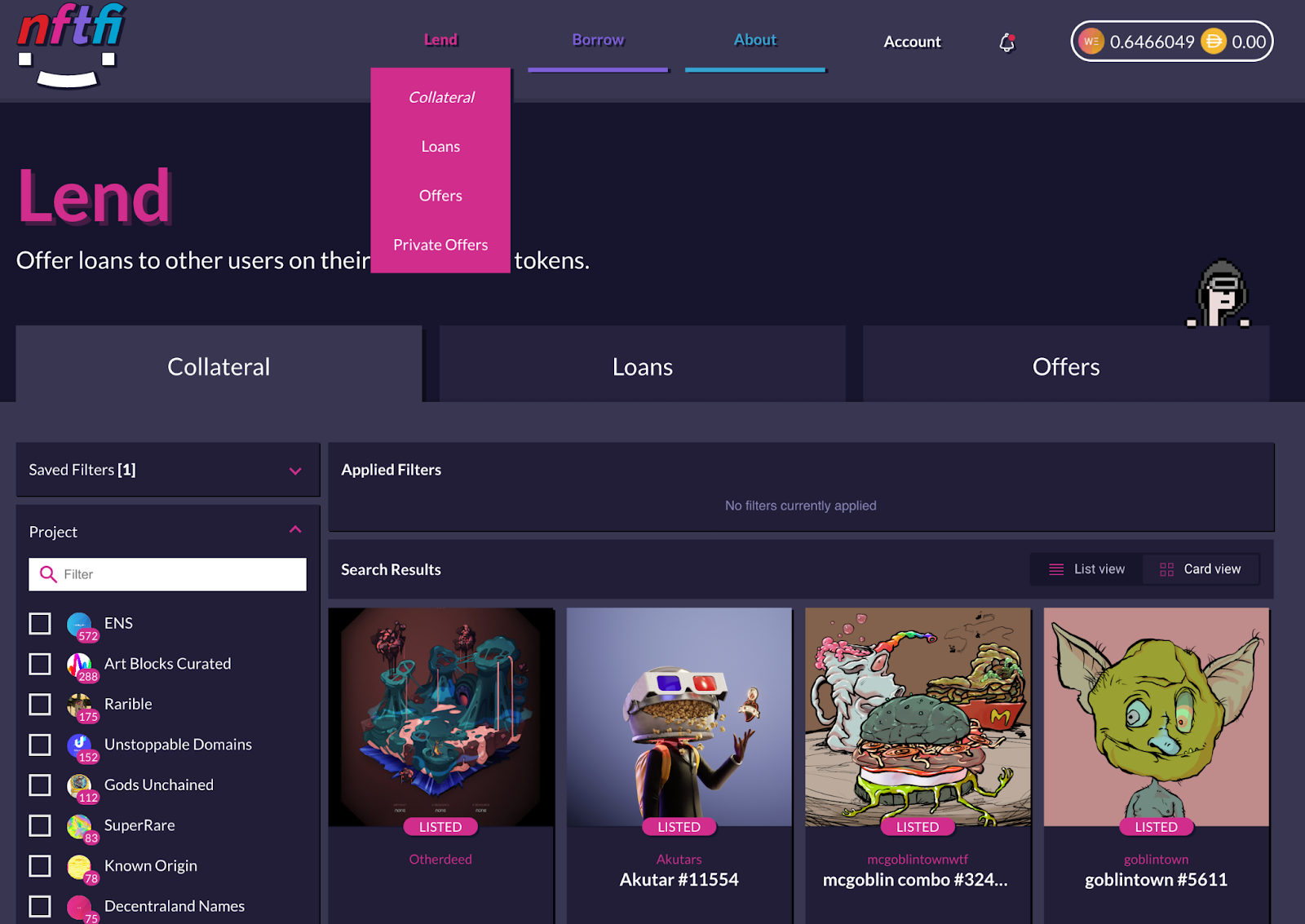

On the first page hover over “Borrow” a drop down option will appear: Assets, Loans and Offers. Selecting the assets tab will take you to a list of available projects that you can utilize as collateral.

The Loans tab highlights both your current and previous loans as a borrower. Lastly the Offer tab highlights offers received broken down by the asset, category, offered by, duration, loan value, repayment and APR.

How To Borrow Against An Asset

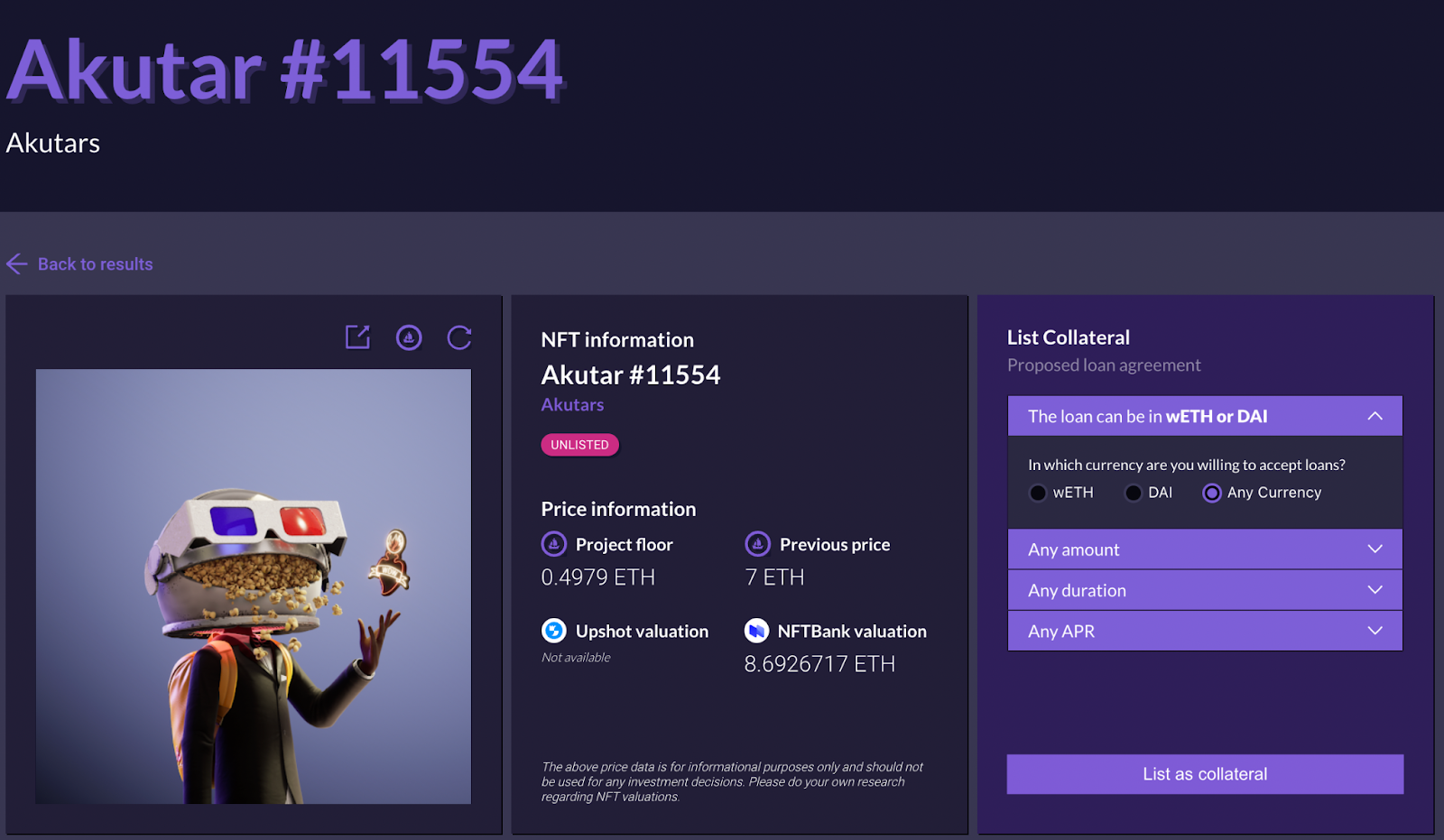

Once you select which NFT you want to use as collateral you can put the parameters you are requesting. The terms breakdown goes as follows: Loan in either wETH (wrapped ETH) or DAI(decentralized stable coin on Ethereum) , amount, duration and APR.

For your first initial NFT that you list as a collateral NFTfi will request permission to manage that asset from your collection. This will allow NFTfi to have the NFT used as collateral locked in escrow through the contract. It will only happen if the borrower accepts the lender’s offer.

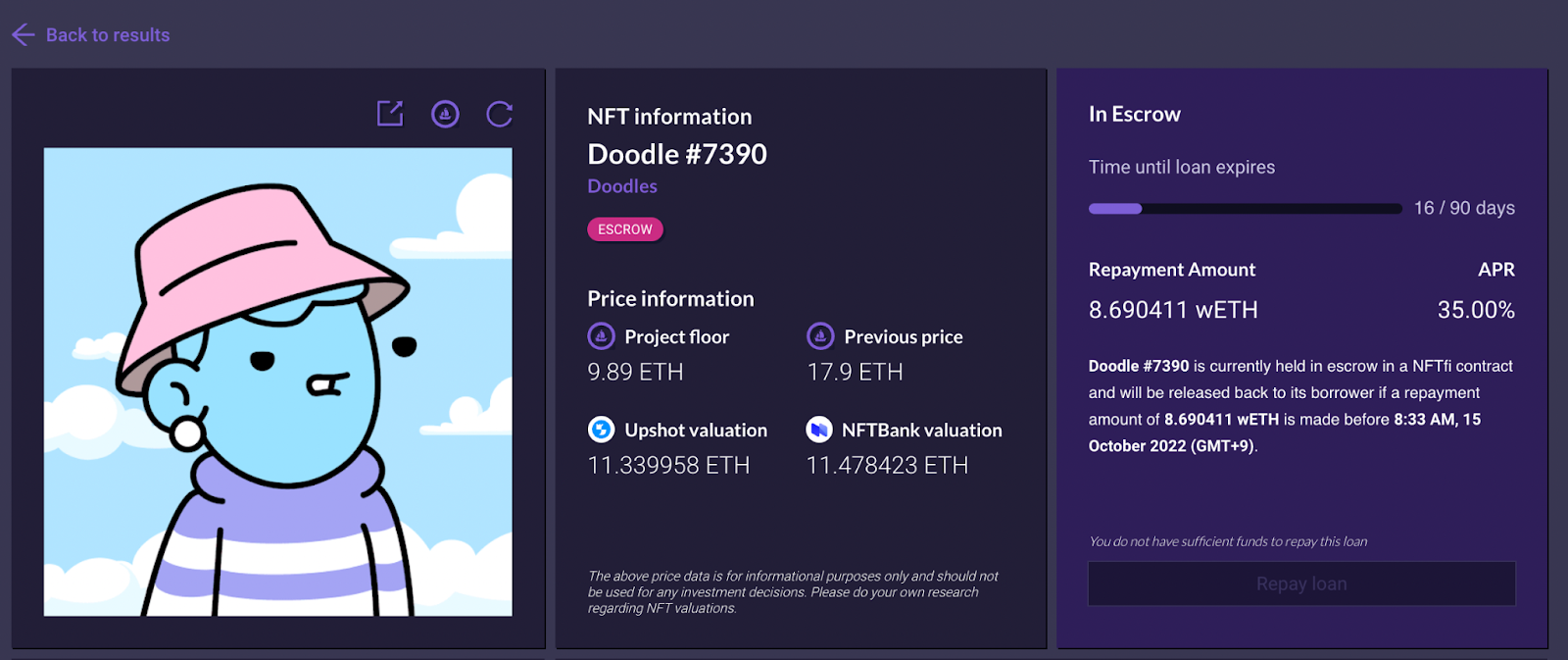

Now to repay the loan go to your loans tab and select the outstanding loan. Once there it will show you the information such as the time until the loan expires, repayment amount and APR. If you do not have sufficient funds it will not allow you to repay the loan.

After the loan is repaid on time, your NFT will be transferred back to you.

Becoming A Lender

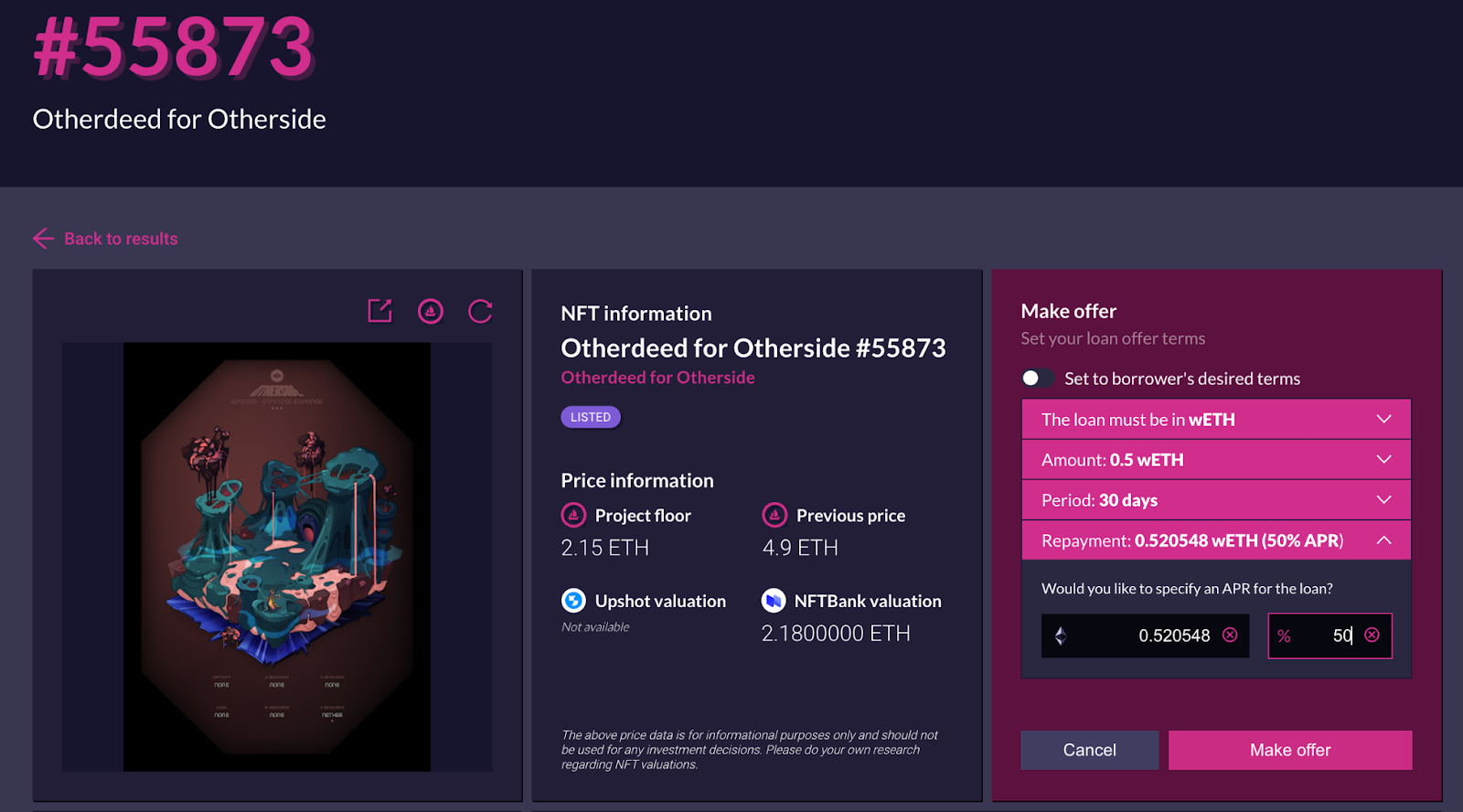

You can lend in either wETH or DAI. Results will show the most recently listed NFT that is used as collateral. Select one of your desired NFTs, On the right side it will have the option to make an offer either based on the borrer’s desired terms or one you can set as the lender. Once you fill out the information of which cryptocurrency the loan will be, the amount, period and APR you will have to confirm the transaction.

How To Lend On NFTfi

The loan isn’t set until the borrower accepts the offer in which case the NFT gets locked up in escrow until the loan is paid off. If the borrower defaults on the loan the lender the NFT becomes available through foreclosure It is simple, enabled by NFTfi’s contract, they allow lenders and borrowers to interact in a safe, trustless and decentralized way.

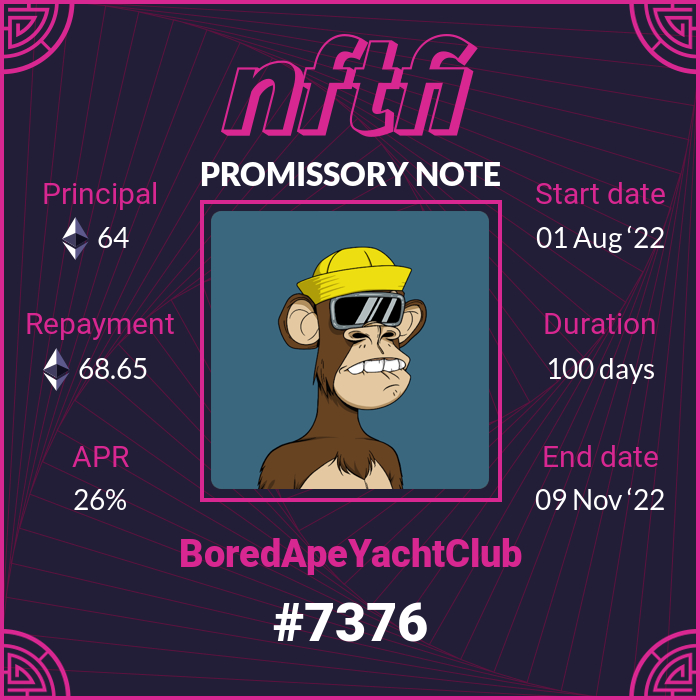

Once the offer is accepted, you'll have a promissory note with the terms and conditions of the loan.

Are There Any Fees?

There are no charges to borrowers, fees are already paid to the lenders. NFTfi takes a 5% share of the interest that the lender has earned on successful loans.

How Do I Open An Account?

You can create an NFTfi account by connecting your wallet at NFTfi.

Is NFTfi Safe?

NFTfi is as safe to use as you personally allow it to be.

NFTfi is a peer-to-peer platform connecting NFT holders and liquidity providers directly via permissionless smart contract infrastructure. The NFTfi team at no point has access to any asset or is involved in any way in the negotiation of terms between Lenders and Borrowers.

However, this is cryptocurrency and NFTs. You need to make sure that you're only signing contracts you understand, never giving away your seed phrase, and following other security best practices for your own wallets.

Is It Worth It?

There is a lot of risk when it comes to crypto and especially NFTs. NFTfi provides a great resource for liquidity if needed. As one of the earliest protocols, NFTfi is the leader when it comes to using your NFTs as collateral for loans. They are able to cater to both lender and borrower creating a win-win scenario.

Mike Damazo is a personal finance video creator. He is incredibly passionate about the NFT space, as well as cryptocurrency and DeFi in general. He also is known as BAYC #916.