Video games and your finances have a lot in common. It’s easy to keep score, there are multiple strategies that lead to winning, and there are always tips and cheats available if you look, among other similarities. Below are the similarities and how you should strive to play your finances.

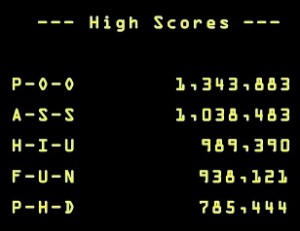

- Go for that high score – Not necessarily the highest on the board, but your own personal best. Whether it is PacMan, getting your mage to level 80, or your saving account balance, aim high, and really try for your personal best.

- When things don’t work out, just load a save game – Sometime we do things or try things and it doesn’t work out. Fine, go back to how you did it before, or try an entirely new method. The message is that if it doesn’t work for you, don’t do it. This could be budgeting and tracking every dollar, or the cash envelope method. Some things just click, and others don’t

- Get bigger weapons – Maybe the problem is you’re just not using a big enough club against your debt. Go get the BFG and go big on your problem. Go and see a professional and get your tax problem cleared up. Maybe you need a CFP to talk to you about retirement problems. Sometime you just need the big guns.

- Have fun – It’s going to be hard to convince yourself to do something unpleasant for extended periods of time. You need to either change how you feel about some, reframing it to see the benefits instead of the costs, or use some type of system to keep you motivated like the WAVE method of saving.

-

Are you lost in the financial forest? Level up – You should actively work to increase your intelligence, endurance, speed, and agility in a financial sense. Read blogs and books, work at trying to save diligently, pay your bills automatically as soon as they arrive, and build your emergency fund so that you’re agile enough to respond to whatever happens. Work toward higher levels and bigger challenges. With experience, you’ll be able to tackle them.

- Work with others on that hard quest – If you find yourself having trouble on something, start working on a team. Go find others who want the same thing and use them for accountability and assistance. Bring your spouse into the financial fold and work together on all the tough challenges. Even if you end up splitting the take, part of some success is better than all of failure.

- Play the game to your strengths – Some people are fighters, some people are mages, play to your strength. If you work best kicking and slashing your way through something first hand, making the mistakes and having the hit points to sustain you, go for it. If you like to plan things out, build up your fireball spell and then strike at an opportune moment, more power to you! Actively shape events so that you can use your desired strategy on them.

- Have a strategy – Whether you kill the biggest monster in the room first, or pick off all the little rodents first doesn’t really matter. It’s that you have a strategy and follow it. Use the snowball to pay off your highest rate debt first, or send in the $6 to finish off that low debt and cancel the card. Just have a plan and stick to it.

- Save your progress often – Progress in the financial sense is usually money. Save it often in case you run into one of those problems and you need to load a game. If you have saved something, it is significantly easier to deal with the problems. So save often and save as much as you reasonably can, as you’ll need it when you unexpectedly wonder into that guy with the super enchanted elven katana.

-

Do you have a map to guide you to treasure? High reward means high risk – Do you go for that last level of the dungeon even though your health is low, or play it safe and go back to the inn at the nearby town? Understand that with higher reward comes higher risk. There are no free lunches, so if an investment promises 40% returns, understand that the odds are quite high you’ll end up with nothing.

- Real people play better than computers – you may be able to be the computer on the hardest level, but when you’re out there playing with the human players in the world, they do unexpected things, come up with unique strategies, and are hard to predict. All the planning and work in Excel can only go so far, remember to get out there with the humans and implement your plan.

So play your finances like a video game. Create your character, put in the time it take to get good, level up, and save often. You’ll have fun doing it, and who knows, maybe you’ll set the high score that everyone else will aspire to.

Readers, are you able to have fun while having a strategy to win? Or are you constantly throwing your financial controller against the wall in frustration? What’s your high score?

Karl Nygard is the original founder of Cult of Money and created the website to share his ideas on investing, personal finance, and more.

I think having a strategy to win for your personal finances is a fun way to challenge yourself. Sometimes you win, sometimes you lose. But over the long run, if you are persistent, you will be successful.

We’ve developed some games over time, like how fast could we save up x dollars, who can have the cheapest week, things like that. Makes it a bit more interesting. 🙂

Another big bonus to thinking of your finances in terms of scoring is that it dissociates the emotional cues that get triggered regarding money. This can be very helpful in the realm of investing because you are able to think more objectively about buying and selling.

Yup, take the emotion out. Is your score going up or down? Down? Then maybe look at changing things.

Interesting and useful analogy. Nobody throws away their video games because they can’t get to the next level. It’s always interesting to me that so many people “throw away” their financial security in frustration when they can’t get their financial life on track. Just because you made a little financial mistake, doesn’t mean you should give up on the whole “game”. Practice and persistence in video games and and life is what gets people ahead. There will be dragons that are hard to slay, but like you said, maybe you just get a bigger weapon (or a bigger salary) to fight the dragon.

Yes, so many people see a big debt number, and just give up thinking they can’t do anything about it. It just takes some practice. Ever play a first-person shooter online? The first few times, you get completely owned. Then you learn, get better, and before long, your the one fragging the new guys…

Great post Karl. Having a strategy and being persistent are two key elements that can help people get through most things in life such as rebuilding your finances, dealing with health issues and even just trying to lose weight.

The fun part for me is watching our investments grow every month.

I’m glad you like it. I’ve been on a bit of a kick with the posts for “apply this random thing to your finances”, and glad that at least this one is still working. And great point, having a strategy is important, even if it isn’t the optimal one.

Creative post! I really enjoyed this.

It’s so important to have a plan and be headed somewhere (hopefully in the proper direction). All of these principles are important in your overall financial life.

Another great analogy post Karl. For some people it would really help to look at finances differently like this. When you are trying to work towards long term financial goals it can be tough knowing that it will take a long time to reach those goals. You can make it more rewarding by thinking of it as a game that you want to do everything to beat. If in doubt, whip out the cheats or walk-throughs and see what the experts recommend.

Any post that uses “BFG”is a winner. You must have a sheet of terms with point values….”I get 20 points for using BFG!”

I like that in video games people are rarely intimidated going in. They’re not afraid to linger a little on the tutorial levels and get the swing of the controller before going off to kill some baddies.

I tried to find an analogy involving NOOBs, but it isn’t coming to be….

You’ve caught on, it’s actually blogger bingo though. In fact, that may be a cool game to play…

Maybe I should have my husband read this… maybe it would make him more enthusiastic about our finances!

I do treat our finances like a game… maybe not a video game, though. More like Scrabble!

At least that’s better than hang-man!

I think this approach is bloody brilliant.

Slightly off-subject, but still on topic, I’ve always had a special knack for collecting an obscene amount of cash/gil/rupees/bells/souls/humanity/simoleons in video games.

I’m hoping this skill will translate in real life.

Ha! I love this analogy. I’m currently trying my best to “level up” in my finances, particularly when it comes to investing. I’m a noob in that field, but I hope to learn more so that I can start investing intelligently.

I tried this once and a giant monkey kept throwing barrels at me… 🙂

Great stuff, Karl!

Fun post! I loved video games as kid and I was excited when my son started getting back into them. These are some good lessons to consider.

I treat my main savings account like a game, where money is points. I didn’t think others did the same but I guess it’s a common thing.

There are a few times in my life where I wish I could have simply hit the reset button; or at least saved my progress instead of having to start over again.

Isn’t that the truth. A reset button would be great. You can sort of get something similar depending on what exactly we’re talking about and correct sizing or contribution of cash…

“getting your mage to level 80” Do I sense a WOW player amongst the flock? Hmm… no to mages! Assasins rule!

Anywhoo.. great analogy. I think #4 is the main thing people need to focus on sometimes. Finances doesn’t have to be boring or serious. Budget in the fun stuff to maintain your sanity!

Nope, never played WOW, but I do have the elder scrolls 4 that I’m working through. Once all the bugs are worked out, I’ll get skyrim too. Sounds like you’ve donated some time to the WOW gods though… 🙂

Great analogy. I’m certainly leveling up in certain areas of my life. The only disappointing thing is that in video games, everything is much cheaper!