Since I’ve started working for myself in October of 2013 I’ve had a big realization: I can never go back to work for someone else again.

Since I’ve started working for myself in October of 2013 I’ve had a big realization: I can never go back to work for someone else again.

I know that for those of you who are working on self-employment you can picture the freedom. But once you experience it, my guess is that you will never be able to go back to a 9-5. Yep, it’s that awesome.

(Okay, it’s not all puppies and rainbows but its way better than coming home every day to bitch about your day job. No complaining here.)

The one thing that isn’t so glamorous for me though, is that increasing my income has been a very slow process. I’m lucky to have consistently brought in enough money each money to pay my bills plus have a little extra left over. But my income is still growing at a pretty tiny rate.

So for the rest of the year I want to work on the bigger picture. You know, do things now that will benefit me for years to come.

Here’s what I’m working on.

Dividend Stocks

I had made it my goal this year to get started investing and I’ve actually followed through.

But, you see, my first stock picks were TERRIBLE choices. I thought I was going to make some money buying penny stocks. #rookiemistake

But in fact, I lost almost all of my money doing that. (And just in case you were wondering the penny stocks I bought where medical marijuana. I thought for sure those stocks would go up. Boy was I wrong!)

So after that mistake I decided to buy dividend stocks.

My first pick was my best. It was in the maker of the Blue E-Cigarettes. My logic behind this was that since there is now a healthier alternative to cigarettes that smokers would obviously choose to go the E-Cigarette route. And Blue E-Cigarettes are the only ones I see commercials for.

(And in case you are wondering I come from a family of smokers and many are trying to quit by using E-Cigs.)

My second picks was in Ruger, a company that makes guns. My Dad owns two sporting goods stores and I believe guns are a solid investment over the long haul. Plus, the price of guns spike anytime there is mention of anti-gun laws.

Seriously, my Dad’s stores had record years when Obama was elected. Thanks Obama 😉

Unfortunately my Ruger pick is down. However, I’m confident that with time we’ll see it go back up.

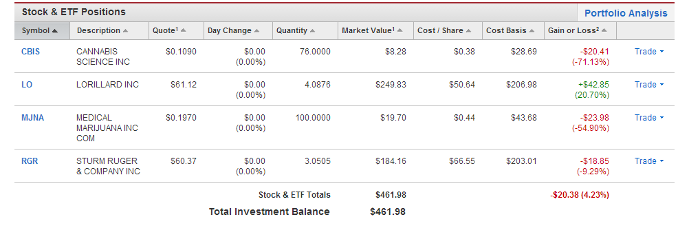

Here’s a snapshot of my stock picks right now. You’ll see I’m in the negatives thanks to the penny stocks.

I’m showing you this so that you can PLEASE learn from my mistakes. I know I certainly have.

So my plan was to continually buy dividend stocks each month but for now I am putting that on pause so I can save up some money.

Real Estate

My second goal for the year is to save enough money to put down on an investment property.

I found a foreclosure last weekend that is not yet listed that I am in love with. I figure I’m going to have around 6 months before this property is listed seeing as it was just foreclosed on at the beginning of the month.

So I want to hustle so I can have enough money for a down payment by the end of the year.

Websites

Right now I have one website that brings in on average $500/month.

I have a second website that has been in the works for a little while and a third I just started. I’d like to make both of these profitable, bringing in around $300/month each within the next three months.

Freelance Jobs

The bulk of my monthly income comes from freelance jobs. This includes things like writing and virtual assistant work.

In order to quickly increase my income I need to increase the amount of hours I work right now. Then hopefully I can cut back down on these jobs when other income sources start to do well.

Retirement Accounts

Lastly, I just opened a retirement account and started investing.

This is obviously a long term strategy and I have $100 a month going into this account.

Conclusion

I think it’s really important to diversify your income. You never know what life will throw your way.

With that said I think the best way to do this is by focusing on one thing at a time.

For me this will be first getting my websites set up, adding a couple of freelance jobs, and using all of that extra money to save for a real estate investment.

After that? Who knows.

Is your income diversified? If not, do you have any plans to diversify?

Alexa Mason is a freelance writer and wanna be internet entrepreneur. She is also a newly single mom to two beautiful little girls. She chronicles her journey as a single mom trying to make it big at www.singlemomsincome.com.