When you trade on popular cryptocurrency exchanges, you’re trading through a centralized exchange (CEX). This means a single company or organization controls funds and wallet keys, so you don’t have true ownership of your assets.

In contrast, decentralized exchanges (DEXs) cut out the middleman, give ownership back to users, and avoid as many regulatory hurdles as possible.

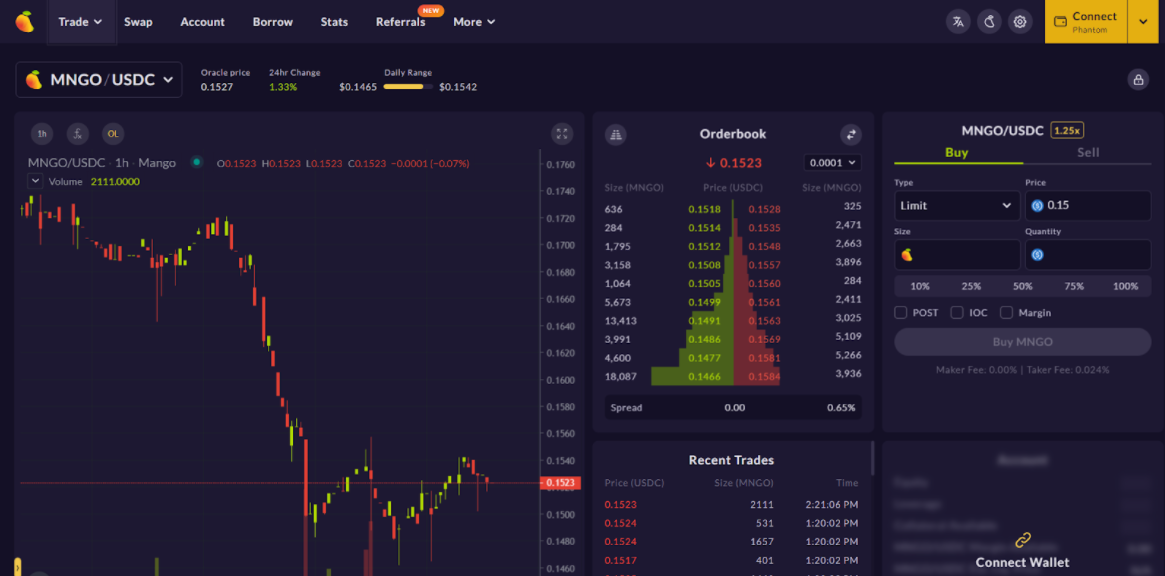

Mango Markets is one popular DEX that operates on Solana’s blockchain. It also has its own native token, MGNO, with a current market cap of over $150 million.

But should you use Mango Markets over centralized crypto exchanges? And, if you like what Mango Markets has to offer, is the MGNO token a good investment?

Quick Summary

- Solana-based decentralized exchange

- Offers margin trading and perpetual futures

- No KYC requirements and low trading fees

Mango Markets Details | |

|---|---|

Product Name | Mango Markets |

Product Type | Decentralized exchange |

Supported Coins | 10+ |

KYC Requirements | None |

Pros & Cons

Pros

Cons

About Mango Markets

Mango Markets is a decentralized exchange on the Solana blockchain. It's also a decentralized autonomous organization, or DAO for short.

This means there isn’t a single entity controlling the exchange. Rather, decentralized finance (DeFi) projects like Mango Markets rely on smart contracts and community governance to operate.

Mango is completely open source, so developers from around the world can join and contribute to the project. On its website, Mango states its goal is to merge the liquidity and usability of centralized financial platforms with the permissionless innovation of DeFi.

This is an impressive goal, but Mango is off to a strong start.

In August of 2021, Mango Markets raised over $70 million by selling its governance token $MGNO. Like other DAOs, Mango grants voting rights to its token holders. Anyone with at least 0.1% of MGNO’s token supply can propose a governance action, like adding a new asset or updating the DEXs protocol.

What It Offers

Overall, Mango has had an incredibly successful token sale, and the future looks promising for this decentralized exchange. Additionally, there are several features that are enticing for active crypto investors.

Spot Margin Trading

With Mango Markets, you can spot trade numerous cryptocurrencies with up to 5x margin. Currently, it supports popular cryptos and stablecoins like:

The DEX also offers trading for lesser-known cryptos like Serum (SRM), the token for another Solana-based DEX, and Raydium (RAY), an automated market maker (AMM) that’s also on Solana’s blockchain.

You need USDC to purchase various cryptocurrencies since this is the only available trading pair. Furthermore, you need a cryptocurrency wallet that’s compatible with Solana’s blockchain.

Mango recommends using the Phantom wallet, especially if you’re new to DEXs. This desktop and mobile-friendly wallet lets you buy, send, receive, and swap tokens and even NFTs on the Solana blockchain.

To place a trade, you can choose between limit or market orders. You can also make orders immediate-or-cancel (IOC) orders or post orders that cancel unless they’re the maker order.

Overall, Mango Markets doesn’t support nearly as many cryptocurrencies as exchanges like Coinbase and Binance do.

Perpetual Futures

Mango also lets users trade perpetual futures for most of the assets it supports.

A normal futures contract is an agreement to buy or sell a security or asset at a predetermined price on a specific date in the future. Perpetual futures are similar, except there isn’t a specific expiration date, so you can theoretically hold your position for as long as you want.

Mango perpetuals grant up to 10x initial leverage and maintenance leverage of 20x. This means you can open a position with 10x leverage, but if the value of your collateral drops and your leverage surpasses 20x, Mango can liquidate your account to mitigate risk.

For everyday crypto traders, futures and perpetual futures aren’t a smart investing choice. Trading with so much leverage is risky if you don’t know what you’re doing. But having more trading options is a plus since Mango caters to beginner and active traders alike.

Borrowing And Lending

One Mango Markets feature that’s similar to crypto savings accounts like BlockFi and Celsius is its borrowing and lending platform.

Once you connect a wallet to Mango, you can deposit or borrow different cryptocurrencies and stablecoins.

Here are Mango’s current deposit and borrow APRs:

Mango Markets Deposit & Borrow APRs | ||

|---|---|---|

Cell | Deposit APR | Borrow APR |

USDC | 0.09% | 0.99% |

MGNO | 0.00% | 0.08% |

BTC | 0.00% | 0.06% |

ETH | 0.04% | 0.38% |

SOL | 1.45% | 2.27% |

USDT | 0.13% | 0.98% |

SRM | 8.39% | 11.95% |

RAY | 21.40% | 29.55% |

COPE | 0.00% | 0.18% |

FTT | 0.22% | 0.96% |

MSOL | 0.00% | 0.06% |

BNB | 17.99% | 22.97% |

AVAX | 0.00% | 0.13% |

LUNA | 0.38% | 1.28% |

When borrowing, you can select different collateral ratios which impact your interest rate. Interest payments occur continuously from your deposits, and Mango suggests monitoring interest rates regularly since rates change depending on pool utilization and liquidity.

For earning interest, this happens automatically when you deposit into your margin account.

However, crypto savings accounts like BlockFi and Celsius support significantly more cryptocurrencies and have higher interest rates. SRM and RAY are interesting passive income options on Mango, but for earning interest with other cryptos, Mango isn’t worth using unless you’re actively trading on the DEX.

No KYC Requirements

One of the main advantages of using DEXs is that you maintain anonymity and don’t have to jump through complex know your customer (KYC) requirements to open an account.

This means you can open a Mango Markets account without providing your name, address, or uploading government ID. Additionally, Mango holds all data on-chain and is completely permissionless.

In contrast, exchanges like Coinbase and Gemini are heavily regulated. This means you need to verify your account if you want to trade, and both exchanges report trading activity to the IRS.

Low Trading Fees

Another advantage of trading on DEXs like Mango is that you usually find lower trading fees than centralized exchanges.

On Mango, maker and taker fees vary depending on the trading pair and liquidity. But it’s possible to find zero maker or taker fees at certain times, and fees are generally low if there are any.

Low transaction fees and low latency are two advantages of Solana’s rapid blockchain. In comparison, Ethereum-based projects often struggle with high ETH gas fees and slower transaction times.

Mango Markets Referral Program

The Mango Markets referral program pays you 16% of trading fees if your referrals place perpetual futures trades. Your referrals also get a 4% discount on trades, so it’s a win-win.

This isn’t the most lucrative crypto bonus offer out there, but if you refer friends who are active trades, the 16% trading fee bonuses can add up quickly. However, lending platforms like Celsius pay you up to $600 for funding new accounts, so it’s worth exploring other bonuses that are on the market.

What Is The MGNO Token?

As mentioned, the MGNO token is the governance token for the Mango DAO. The token has a maximum supply of 10 billion tokens, with an initial circulating supply of 1 billion tokens.

Currently, 90% of MGNO tokens are available for the DAO itself. This means anyone can purchase MGNO tokens, and if you hold at least 0.1% of Mango tokens, you can propose and vote on governance actions. This is how Mango lets shareholders decide its future and make changes to existing protocols.

As for the other 10% of MGNO tokens, 5% is held in the DAO treasury to serve as an insurance fund. This helps protect Mango from extreme volatility and also covers perpetual futures contracts that lead to bankrupt accounts and excessive losses.

The final 5% of MGNO tokens are for creators who help develop Mango Markets. This is important since it incentivizes developer talent from around the world to contribute to the platform.

You can read more about Mango’s plan for its MGNO token and project roadmap on its Litepaper.

How To Buy MGNO Token

There are several options to buy MGNO tokens if you want to support Mango Markets and unlock governance rights.

As mentioned, an initial token sale of MGNO to the public raised over $70 million. But you can still buy MGNO by using Mango’s spot trading feature after funding your account.

You can also buy MGNO tokens on several other DEXs:

Currently, centralized exchanges like Coinbase, Gemini, and Kraken don’t support MGNO token. Given the token’s low market cap of around $150 million, it’s also uncertain if major exchanges will offer trading for this token.

Is MGNO A Good Investment?

MGNO token has a historical high of approximately $0.42. Currently, the token is hovering around $0.15 and has a market cap of approximately $150 million,

Trading volume on MGNO is also low, and according to CoinMarketCap, MGNO trading volume is typically under $1 million per 24 hours.

So, is MGNO a good investment?

Well, the token is at an all-time low. However, there isn’t much trading volume currently that’s causing token prices to jump dramatically. This means there’s less opportunity to day-trade the token or quickly buy and sell like some investors were doing with Dogecoin and Shiba Inu.

Really, investing in Mango Markets means you believe in the future of the DEX. This means investors should read the Litepaper, keep track of the project roadmap, and also use the platform to understand its inner workings.

MGNO still has billions of tokens to release into circulation. But if this Solana-based DEX gains traction, there’s the potential for these tokens to appreciate.

That said, MGNO is a speculative investment. You should always do your due diligence, and never invest money into cryptocurrencies that you can’t afford to lose.

The Bottom Line

If you want to use a decentralized exchange that runs on the Solana blockchain, Mango Markets is a compelling choice. Plus, a lack of KYC requirements and low trading fees are perks of staying decentralized.

As for investing in Mango tokens, it’s a much more speculative play than investing in established cryptocurrencies like Bitcoin and Ethereum. Mango Markets is a popular DEX, but there’s no telling if it can continue to grow and if MGNO adoption is going to increase.

The bottom line for investors is that you have to decide how important decentralization is for you. Exchanges like Bisq and Mango Markets are useful for maintaining privacy and control. However, to keep crypto investing simple, centralized exchanges like Coinbase and Binance are better choices.

Mango Markets Features

Product Type | Decentralized cryptocurrency exchange |

|---|---|

Supported Coins | 10+ |

Maintenance Fees | None |

Trading Fees | Maker and taker fees depend on the trading pair and liquidity but are extremely low |

Insurance | Mango Markets has its own DAO treasury |

Security | Mango Markets relies on smart contracts to requires collateral to trade on margin |

Mobile App | No |

Desktop App | Yes |

Promotions | None |

Tom Blake is a personal finance writer with a passion for making money online, cryptocurrency and NFTs, investing, and the gig economy.