Dave Ramsey is well-known for his advice on how to get out of debt. However, over the years, he’s branched out into more than just folksy advice on tackling your credit cards. As part of his “Baby Steps” program, Dave Ramsey also includes investment tips. He also has an entire investment philosophy around the focus on growth funds and how much you should set aside.

But does Dave Ramsey’s investment strategies make sense for your situation? Maybe not. While Ramsey might have good advice on getting rid of that high-interest credit card debt, his philosophy on investing might not work as well.

Let’s take a look at Dave Ramsey’s approach to investing — and consider when you might try something different.

What Is Dave Ramsey's Investing Philosophy?

You can see Ramsey’s investing philosophy on his website. In general, his advice has five main tenets:

- Get out of debt and fund your emergency account.

- Put 15% of your income in tax-advantaged retirement accounts.

- Invest in growth mutual funds (and he has recommended stock funds).

- Invest consistently with an eye toward a long-term perspective.

- Use a financial advisor.

On top of these tenets, Ramsey bases his philosophy on the idea of a 12% average annual return.

When taken at face value, this approach seems like sound advice. After all, it takes the long view and recognizes the importance of using investments to build wealth over time. Once you dig a little deeper, things start to look a little bit different. Maybe this approach doesn’t quite hold up. Let’s take a look at how these strategies might not reflect some of the realities of investing.

Should You Get Out Of Debt Before You Start Investing?

One of the biggest strategies Ramsey talks about is getting out of debt before you even start investing. He says there are “no exceptions” to paying off all your debt (except your home) and then saving between three and six months for emergency expenses.

But does that really make sense? Yes, you want to get out of debt as quickly as possible. But does that mean you shouldn’t set aside money for retirement as well?

Many financial experts believe that you can start investing — even if it’s a small amount — while you work on paying off debt. This is especially true, according to experts, if you receive a 401(k) match from an employer. A 401(k) match is free money that you can invest for the future, earning compounding returns.

Ramsey’s advice to put off all investing until after you pay off your debt could mean thousands of dollars left on the table. Let’s say your employer matches your contributions up to 3% of your income each month. If you make $3,500 per month, you would contribute $105 and your employer would match that amount. That’s $210 going into your retirement account each month (and you only account for half of it). After 30 years, that could be a little more than $238,000 in your account, assuming 7% annualized returns.

Now, let’s say it takes you seven years, following Dave Ramsey’s plan to pay off the debt and save up your emergency fund. Then you start with the employer match. You’ve only got 23 years of investing with the match, and your account balance is $134,659. That’s $100,000 less in your account!

Don’t assume that you can’t start getting those compounding returns until after you pay off your debt — especially if your employer is offering free money to help you grow your wealth.

Where Should You Put Your Money?

When Ramsey talks about investing in tax-advantaged retirement accounts and using growth mutual funds, he doesn’t go much beyond that.

For example, he talks about 401(k) and IRA accounts, including their Roth counterparts, and TSPs. But he leaves out a very important tax-advantaged account — the Health Savings Account. If you have a high-deductible plan and qualify for an HSA, you could potentially grow your wealth with tax-free dollars.

An HSA allows you to contribute money up to the annual limit with pre-tax dollars. The money in the account grows tax-free — even when you invest. Finally, when you use the money for qualified healthcare costs, you can withdraw the money tax-free. One way to grow your wealth is to use the HSA to sav eup for future medical costs, particuarly healthcare costs in retirement. Finally, the HSA can be used as a sort of “back up” IRA later on. Once you reach age 65, you can withdraw money for unqualified expenses without paying a penalty. You have to pay taxes on the money, but you aren’t penalized.

By simply following Ramsey’s strategy, you could miss out on this amazing tax-advantaged wealth-building tool.

What About Mutual Funds?

Again, on the surface, it seems like good advice to focus on mutual funds. After all, mutual funds take away the guesswork of trying to pick the “right” individual stocks. However, Ramsey’s investment strategies focus on growth funds, particularly actively managed funds. He talks about looking at his recommended funds or looking for funds with managers who beat the market.

However, actively managed funds often underperform index funds in the long run. Plus, they come with higher fees. Rather than trying to beat the market, you might be better off just getting a low-cost index fund and being consistent in buying those shares.

He talks about adding “diversity” to your portfolio by using international stock funds. While this is generally a good idea — geographic diversity can be a good thing — it misses out on asset class diversity.

In fact, Ramsey suggests staying away from bonds and real estate investment trusts (REITs). He even recommends that you avoid exchange-traded funds (ETFs). Many investment and financial planning experts suggest that you include bonds and other investments in your portfolio to help you have a more diverse asset allocation.

While not all investments are suitable for everyone, you could end up paying higher fees for worse results when you follow Ramsey’s advice to stick with these managed mutual funds.

Carefully consider your own portfolio goals and, as Ramsey says, consider working with an advisor. You might be surprised to find that a good investment advisor will help you better diversify your assets allocation to better meet your long-term needs. You might even find that adding a limited amount of certain ETFs, REITs and even crypto assets can provide you with a portfolio that offers you better results for your long-term wealth.

About That 12% Average Return...

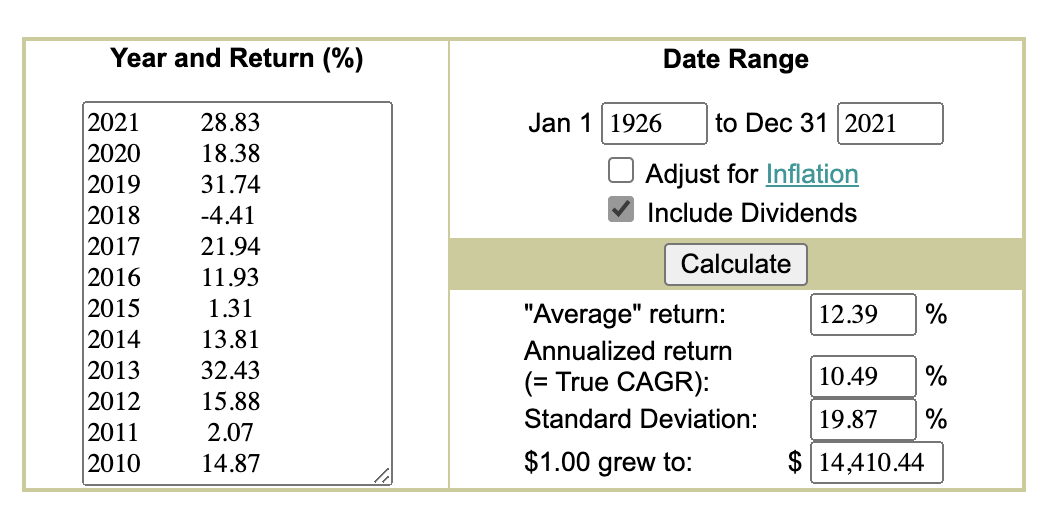

When recommending that you use stocks, Ramsey isn’t wrong. It’s a good idea to include stocks in your portfolio to build wealth over time. But you need to have a realistic idea of what you can expect over time. A calculator Ramsey uses to justify this claim is one from MoneyChimp, which looks at the S&P 500. You see the “average” return at just above 12%.

But there’s the rub. It’s an average return. As the calculator points out, the annualized return, or true compound annual growth rate (CAGR), is closer to 10.49%. Now, adjust for inflation and you’re looking at an annualized return of 7.37%. This is why, when many financial planners and other professionals look into planning ahead, they suggest that you use a 7% annualized return. If you’re using Dave Ramsey’s assumptions, it could be problematic.

Let’s say you make $3,500 per month. Based on Dave Ramsey’s 15% rule, you’d set aside $525 per month in retirement. After 30 years, you’d have a little more than $1.5 million. Sounds good, right? Goal achieved! But if you look at the 10.49% true CAGR, you’d actually only have $1.1 million. Still ok, if $400,000 less. But once you factor inflation? Now you’re at $636,226. What happens to those who follow Ramsey’s advice and now find themselves having nowhere near what they expected in terms of spending power during retirement?

By deciding to plan for a 7% or 8% annual return, and set aside 20% of your income for retirement (or work toward setting aside that much), you’re likely to have a more realistic outcome. And if you outperform that 7% or 8%? Well, that’s gravy. But when planning ahead with your money, it’s often a good idea to stick to the conservative side, rather than assuming bigger returns than you’re likely to see.

Bottom Line

When looking for financial help and advice, it’s important to carefully consider your goals and where you’re at in your financial journey. Dave Ramsey has helped a lot of people set up plans to get out of debt. However, for many people, his investment strategy might not help them reach their goals.

It’s ok to add alternative assets to your portfolio (just limit how much exposure you have to them) and consider at least getting your employer match even if you have debt. Don’t assume that you’ll get a 12% average return. By planning for the worst, you’ll be in a better position to receive the best.

Miranda Marquit, MBA, has been covering personal finance, investing and business topics for more than 15 years, and covering crypto topics for more than 10 years. She has contributed to numerous outlets, including NPR, Marketwatch, U.S. News & World Report and HuffPost. She is an avid podcaster, co-hosting the podcast at Money Talks News. Miranda lives in Idaho, where she enjoys spending time with her son playing board games, travel and the outdoors.