You heard me. And this isn’t about whether you should be putting money in a Roth IRA or a Traditional IRA first. It is simply that those contributing directly into a Roth IRA are being stupid.

The reason I say this is because contributing to a Roth IRA are missing out on a great benefit that the IRS has allowed a few years ago. Starting in the 2010 tax year, the IRS allowed all taxpayers, regardless of income, to convert traditional IRAs to Roth IRAs. Besides being a benefit to those that wanted to invest via a Roth IRA but were above the income limits, this also lets everyone else convert traditional IRAs to Roth IRAs, whether the contributions to the traditional IRAs are deductible or non-deductible. So what you ask? That just makes me go through two steps to get what I could have gotten in one. Thanks random italicized type, I was getting to that.

The benefit you get from converting a traditional IRA to a Roth IRA, is that it also allows you to recharacterize that conversion should you want to do so. And what is recharacterization? That means that you can essentially undo the conversion from the traditional IRA into the Roth IRA, going back and recharacterizing the IRA back into a traditional IRA. The reason that you would want to do this is perhaps your Roth IRA decreased in value after the conversion. Now you could just sit on those losses and complain about it, but I’d rather not pay taxes on money that I don’t have any more. This is one of those things that really is a free lunch given the circumstances.

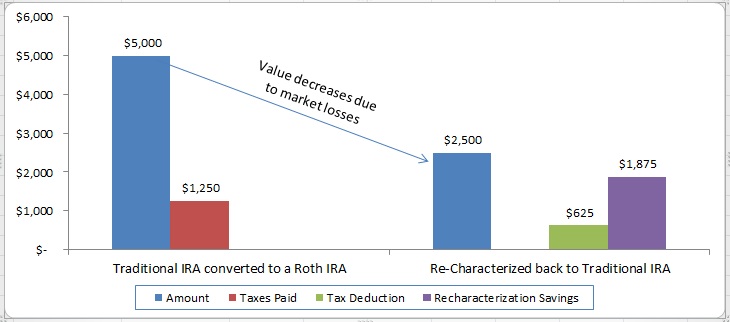

How about an example? Traditional IRA to a Roth IRA and re-characterized back:

Let’s say you’re in the 25% tax bracket (each marginal dollar of income at this point you would have to pay 25% tax on). If you had put $5,000 that you’ve already saved into a deductible traditional IRA, you would have saved $1,250 in taxes (you income is $5,000 less x 25% tax rate = savings). You immediately convert that traditional IRA into a Roth IRA. Since it was deductible, the conversion to Roth makes you pay taxes on the converted amount, so we’re back to where you started if you had contributed directly to the Roth (which, would have been stupid). The reason is, let’s say your Roth decreased in value because of a downturn in the market. You Roth is down 50% to $2,500 in value. Before the deadline of October 15 of the tax year due (2011 taxes are due April 17, 2012, re-characterizations must be requested by October 15, 2012) you could re-characterize that back into a traditional IRA.

Think ahead when doing taxes! Your 2012 contribution could be made today, and you’d have until Oct 15, 2013 to potentially recharacterize the conversion! That’s 18 months of downside risk protection! Looking at that red bar, who wants to pay that red bar of taxes when you don’t have to?

Now instead of paying $1,250 in taxes on income that is now only $2,500 because of market losses, you have $2,500 of income that is deductible, which saves you $625, a net savings in taxes of $1,875 using calculator. The government almost pays back your losses in tax credits! It’s even better than a government job, because you don’t have to work! Even if it was a non-deductible traditional IRA, the benefit is that the recharacterization lets you harvest some of those losses (which you normally can NOT do in IRAs). Non-deductible in the above example still lets you save the $625 in taxes paid on a losing investment.

You do want to do this immediately and with separate accounts each time. By this I mean set up a new traditional IRA, and convert it into its own Roth IRA. Don’t covert it into an existing Roth IRA. This is a pain, but it gets around IRS rules making you convert or recharacterize taxable and non-taxable portions of an IRA pro-rata, and relieves you of the burden of potentially calculating gains or losses in either account again. You report a re-characterization to your trustee and on form 8606 to the IRS, then file an amended tax return with the additional label of “Filed pursuant to section 301.9100-2” on the return. See IRS publication 590 for more details on recharacterization.

So don’t be stupid, contribute to a Roth IRA via an intermediary traditional IRA, and let the government pay any losses you may incur. If you’d like to see other posts about Roth IRAs, take a look at the Roth IRA Movement. There are over a hundred bloggers contributing to this movement.

Readers, do you think I’m being stupid by suggesting this? What do you think about Roth IRAs as a retirement vehicle? Do you like to pay known taxes today or unknown taxes in the future?

Karl Nygard is the original founder of Cult of Money and created the website to share his ideas on investing, personal finance, and more.

Very nice write up of the benefits of converting a traditional IRA to a Roth. I’m willing to bet that most people don’t realize the protection they receive (via recharacterization) by following this path. Sure its a bit more work, but considering the potential savings of a few thousand dollars it’s work I would take any day of the week.

Very insightful information on traditional IRA conversion to Roth. Retirement planning is such an important topic. your article could be helpful to many.

thanks for sharing

I think this is a great concept, but I don’t know if it’s something I would want to spend much time doing.

Also, if you “recharacterize” it back then you’re still stuck with a taxable account. I simply don’t want a taxable account. Sure…the benefit looks good today, but what about 15-30 years from now when TAXES GO UP?

I’m with you. I’m in a really low tax bracket now and I have no interest in paying taxes later even if it starts out with a little bit of tax savings. This strategy involves something too akin to market timing and I like to keep it simple. I’ll keep this in mind for the middle period of my career when I’m unsure of whether or not my tax rate will be lower or higher in retirement.

If you’re in a lower tax bracket now, then that is one of the times that Roth IRAs definitely make sense. Few things when it comes to taxes are easy and straight-forward, but the option does exist. If we were having this discussion in late 2002 or 2008, then it probably would make sense to do because a huge loss like that takes so much time to recoup, even if the proceeds are tax-free.

This sounds like a smart option to give yourself more flexibility with your IRA. I would look into this more, but this is not something that is available in Canada. I do wonder if there is some similar setup between RRSPs and TFSAs though.

I think you may be double dipping a bit. When you recharacterize back to a traditional IRA, either in whole or part, you don’t get to reap the extra $625 in your example. Form 8606 instructions and Pub 590 are both very clear about this. In fact, From 8606 instr has an example of doing exactly what you describe, under “recharacterizations” on pg 3, item #1.

So, if you value having your money in Roth accounts, you’ll, at best, delay paying the taxes by at least a year (and you hope you don’t have to delay at all). You can make an argument that in your example above, you’ll have at least $1250 to invest elsewhere, which could give it at least a year to grow and compound. In theory, if you invest in security xyz from the start, and reinvest the $1250 in xyz when you recharacterize, you’ll be the same place with after-tax dollars, maybe a little worse off if the $1250 goes into a taxable account.

You also run the risk of being in a higher tax bracket next year or in the future, either through a windfall and/or change of a tax brackets. The argument works in reverse as well, but who here is hoping to make less and who hopes to make more?

I don’t really see the value of this exercise…

It’s not double dipping, though it does involve a bit of work in that you also need to file an amended tax return for the prior year in order to claim your traditional IRA deduction, assuming you are eligible. This is really just insurance against severe market downturns. The price you pay is in effort to do all these machinations and conversions. Plus, the tax issue the next year is different, because the money doesn’t need to come out of that tax-deferred vehicle until retirement. So not a next-year tax thing necessarily. From those Form 8606 instructions:

Amending Form 8606

After you file your return, you can change a nondeductible contribution to a traditional IRA to a deductible contribution or vice versa. You also may be able to make a recharacterization (discussed earlier). If necessary, complete a new Form 8606 showing the revised information and file it with Form 1040X, Amended U.S. Individual Income Tax Return.

But you’re right, some people do value having money in a Roth account. However, now that you can recharacterize any amount from a traditional IRA to a Roth regardless of income limits, the value of this has greatly diminished.

What is suggested above is double dipping, as I understand it, because you are deducting the $5000 contribution ($1250) and you are deducting a loss ($625) from an IRA. Is that not what is proposed? You cannot deduct or harvest losses within an IRA, so I don’t really understand how that is possible. And I am skeptical the IRS would knowingly allow you to get away with that.

Again, this is just kicking the can down the road, as you have to pay taxes eventually. And if taxes are the same at contribution and distribution, essentially you aren’t making anything, but rather doing a lot of work.

If you invest $5000 for the long haul, why pay attention to the short term noise? Yes, you can defer tax liability with some work for as long as you would like, but eventually, you’ll have to square up.

Not quite. In summary, you start with a traditional IRA and immediately convert it to a Roth, paying the same taxes you would if you were just contributing to a Roth. The difference is, that if you start with a traditional IRA, you can undo the conversion to a Roth, and recharacterize it back to a traditional. Doing this, you won’t need to pay taxes on the money that was lost in the market the way you would just with the Roth. The government gives you a limited undo that you don’t have just with the Roth. And the difference in taxes is on money you’ve already paid taxes on, so saving there isn’t just can kicking. I’d rather pay some tax on gains in the future, rather than no tax on a loss.

Pretty interesting stuff, Karl. I’m a two-stepper myself. 🙂

While I’m obviously a fan of this strategy (OG wrote a similar article two weeks ago covering similar ground), I think someone just dipping their foot in the water is better off with a Roth IRA than a Traditional/Conversion flip. Because money invested in a Roth IRA is eligible to come out whenever you choose without tax consequence, there have been times that a reluctant investor felt comfortable enough to “try it” because they knew they had options later to remove the cash.

Of course this is slightly more advanced than simply sending cash into your broker each year for your Roth IRA, but most of the tax benefits go to those who are willing to do a bit of work (as you know since I did read the article you posted a couple of weeks back). That is part of the issue with tax breaks and loopholes, they have to be just complex that most people won’t use them. Just this little bit of extra work will prevent most people from ever doing this.

Joe,

You can’t just take money out of a Roth IRA at any time you choose without consequences. It is a retirement account so it’s subject to all the normal rules of an IRA. You have penalties before 59 1/2. You also could still have taxes after age 59 1/2 if you are still in the 5 year tax window.

Actually, you can take contributions out of a Roth IRA at any time without consequences, but not profits. This is one of the main benefits of a Roth IRA vs other IRAs. For example if you contributed $5,000 to your Roth in 2010 and $5,000 in 2011, you have contributed $10,000 total. Let’s say that your account is now worth $11,000. You can take out the $10,000 you contributed, but not a cent more. The extra $1,000 is profits and may not be withdrawn without penalty.

First, I’m happy to see you take a different stance on the Roth/Standard IRA posts I’ve been seeing this week. That said, I’ve NEVER heard of this, and to be honest (shame-faced) I’m not really sure I understand it. Your argument makes sense on the surface, but I’m going to have to re-read your post and digest it again before making any final decisions!

Elizabeth, I really do think the Roth is a good idea, just not the normal idea of funding one. The bit of extra effort allows you to have partial protection against large draw-downs if you go from traditional–>Roth–>traditional.

Amazing job on explaining the benefits of re characterization. It’s actually not that much work to do. And like you said, you get some serious downside protection.

Definitely drew me in with the title, especially after all the reading I’ve done about Roths today thanks to the Roth IRA movement. I have to admit I’m still learning a lot about retirement planning, so posts like this are very helpful.

I admit that I purposely chose a title that would stand out a bit from the obvious “we love Roths” theme. 🙂 Got to do something to stand out in a crowd of 140+ super bloggers all talking about the same subject.

Very cool Karl. I love money hacks (even though my brain took a minute to wrap itself around this)

Hello!

I have to re-read again too:). But interesting concept! I started out with a traditional IRA in 2006 after graduating college, then when I learned about the tax benefits of a Roth, I converted and paid the taxes on it while it was still a small account. Now I’m Roth all the way.

I think It’s a great concept and is not so easy for many to choose Roth IRA, but given the situation I think is perfect.

Karl, question for you on a related issue. I made the mistake, or more like an error of putting 5K directly into my Roth this year instead of my traditional IRA. I don’t work, but my husband does and he has a retirement plan. As I read the rules, I am still eligible for a tax deductible IRA contribution up to 5K because my husbands AGI income is less than 169K (The amount I believe when the deduction begins to phase out for me). In order to reduce our tax this year, I’d like to recharacterize my Roth direct contribution I made in Jun 11 into a traditional IRA, take advantage of the deduction, then convert it back to Roth after 30 days…can I do this? if so what potion of the transaction would be taxable if any?

Aren’t you allowed to do a recharacterization of a Roth to traditional IRA (or viceversa) without going through a conversion first?

For example lets say you contribute directly to a Roth IRA, I think you can simply recharacterize that contribution as a traditional IRA before the time to file an extension is up… Am I mistaken?

You make a good point. Many people think that Roth IRA conversions are irreversible, but this is not true. You have the right to change your mind later (up to October 15th of the following year) and get your taxes back that you paid for the conversion.