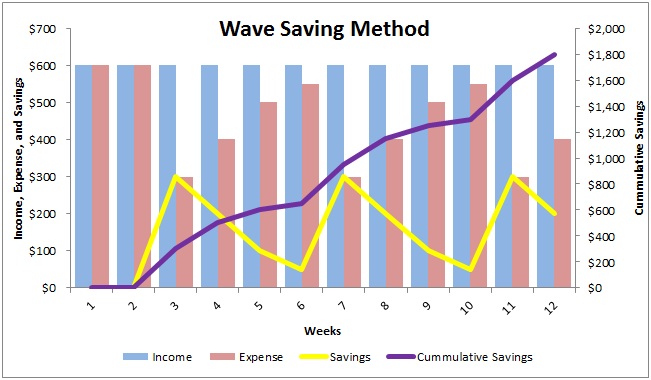

The WAVE method for saving money is a multifaceted plan in order to trick your brain and allow you to save more money over longer periods of time than you otherwise would. The reason it is called the WAVE method, is if you take a look at a graph of your expenses, savings, and cumulative savings, you can see a wave-like structure in each graph. The secret to saving money is to make your brain think it is pleasurable to save money and that doing without some things is just fine.

The WAVE method for saving money is a multifaceted plan in order to trick your brain and allow you to save more money over longer periods of time than you otherwise would. The reason it is called the WAVE method, is if you take a look at a graph of your expenses, savings, and cumulative savings, you can see a wave-like structure in each graph. The secret to saving money is to make your brain think it is pleasurable to save money and that doing without some things is just fine.

The reason you need help is your lizard brain is fairly smart in knowing what it wants. It knows that less money for things it wants probably won’t be that much fun. And your lizard brain is right. Saving money and depriving yourself of things usually isn’t much fun. In order to trick your brain, we’re going to do three things.

- First, turn saving money into a challenge or game, with your savings as the score

- Second, work in waves of savings so that your brain isn’t continually focused on what you don’t have

- Third, reward your brain for doing a good job of saving.

Of course I’m making the assumption that you’ve decided that you really do want to save more money or cut your debt aggressively. If you don’t have some fairly basic goals, goals which you can simply articulate, you probably won’t be able to maintain savings long-term, even with all the benefits of the WAVE saving method.

Details of the WAVE method

One of the principles of the saving method is to turn saving into a game or challenge. Part of that is collecting metrics and details on your savings and/or debt levels. In performance management cycles, that which gets measured gets better. Posting a chart updated weekly on the fridge so that you see it every day is a great way to remember that there is a good reason you’re eating ramen. Additionally, keeping track of your savings each week will keep you focused on your savings goal.

We recommend using Personal Capital to automatically keep track of everything online. It’s free!

Another tenet of the saving method is to have periods where to keep motivation high, you really need to see results, so you hit it hard. Don’t go out to eat at all, bring your lunches to work, cut everything that you can cut. And by cut I mean don’t spend, not defer. However, this is not sustainable. That is the problem most people run into when attempting change. You can’t live so low for an extended period unless you have especially high internal motivation. This is the primary reason for the name WAVE method. Look at the yellow line in the included graph. This is the net savings amount each week (simply the difference between income and expenses). Note that never are you spending more than you make, as negative savings. There are weeks that you may fall back to breakeven, but never exceed income, at least that is the goal.

Finally, you need to have these up spending cycles to reward yourself and your lizard brain. If all you get for doing a good job and limiting spending is less and less, your lizard brain will make the connection that saving money leads to less pleasure. You want to reverse this, and reward yourself for saving money and paying down debt.

What must you keep and what can you cut?

First, determine what part of your expenses are really and truly necessary. These are your fixed expenses. Things like rent, some amount for food, and insurance. Then everything else is variable costs, and subject to be cut. Things like your daily coffee, eating lunch out, eating dinner out, clothes, anything. Your goal is to live very low during the down weeks.

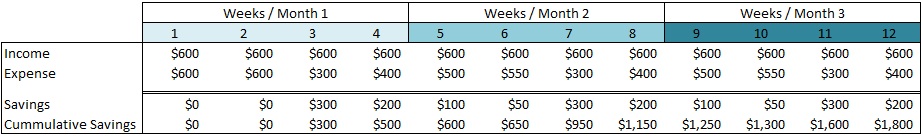

The data for the above graph is shown here:

This just shows 3 months, but even someone making only $2,400 a month can still put away $1,800 in just a few months. Average spending each month is fairly stable, but it’s the WAVE within the month that makes the lizard part of your brain happy.

In conclusion, you need to have set the goal to save money or get out of debt, you have to turn it in to a challenge or game and track it diligently, you need to see results for motivation, but live realistically enough to be sustainable in the long term, and you need to reward yourself and your brain for job well done.

So what are your secrets to saving money, staying motivated while doing so, while still being able to live life?

Karl Nygard is the original founder of Cult of Money and created the website to share his ideas on investing, personal finance, and more.

I like the idea of not living without for extended periods of time. The week or two of withdrawl at least gives me something to look forward to in the other weeks. I think this could really help me save more, knowing that I don’t have to do it for ever.

Yes, keeping motivation high is a real issue with many people. Saving money is like dieting, you can’t always be on a diet. FYI, that is also why I think the South Beach Diet works, as it has difficult to easier phases, you know you only need to eat salad for a couple weeks. 🙂

Very, very interesting. I like the wave theory, but not sure if it would work with me as I would worry that I’ll spend harder than I save on those down weeks! But I have definitely started to view saving/paying off debt as a game. Posting on my blog gets me encouragement and involvement from readers. Next, seeing balances go down every month and actually being cash flow positive feels fantastic. The next step is aggressively increasing income. I have some ideas on this, but they are big commitments. But hey what else am I doing with my time? Have you set up your RSS feed yet?

I’ve never heard of this strategy – but being able to sock away $1,800 on that modest of a budget is pretty impressive!

I save a little amount of my total earning on monthly basis but was not familiar with WAVE method. I am already following some points suggested by you for money saving but not all. Some points are really useful and hope it will assist me to enhance my saving.

Lesson learned: live low. This is definitely helpful this Christmas season. Thanks for sharing this!

It seems with a paycheck once a month we (and I guess the majority) have the waves without even thinking about them. Thus, for the first couple of days of each month all the deposited money are gone to pay what we have to pay. We leave only money for food and gas, knowing from counting spending for the previous month, how much we will need, planned buys and planned extras like going to the theater or out. If we want to spend more, like to buy something unplanned, yes, we can do that but sacrificing for food.

So, if to budget tight, the waves will happen and the last week or two of each month will be very low. The prize comes from knowing you are tight because you paid a debt, put money in a saving account or did something else to improve your financially. To not feel always streched and low and poor, some even smallesh extras have to be planned, for example a day in the museum.

Of course, all that assumes no usage of credit cards, or just usage of them for small automatic regular payments which paid off every month if the dicipline allows not to reach them in the end of month when a friend suddenly invited to go out or some other spending ideas come into mind. I hate count money every week, but with my plan it is enough to do it once a month and see that everything is under control. And yes, it is also nice to remember that emergency money are not for going out or buying beer in the end of the month to cope with the stress of being streched. Money is all about dicipline — this is the reason why the credit score is considered as an important factor by employers. And I think it is fair while against the privacy because how one spends and manages the money is a very private issue.

I bumped to your site reading about ROth IRA. Thanks for educating the crowd!