Appropriately refinancing your home mortgage is likely the pinnacle of the frugal living meme that you can accomplish in your lifetime.

Go ahead and compare this to not buying a coffee every morning, or living like a pauper for 30 years. You can save thousands of dollars by refinancing, and still have the exact same house you have now!

And most people don’t put in the few hours of effort that it takes, essentially turning down consulting work paying several thousand dollars an hour.

Promo: If you're looking to refinance, get a quote at Credible Mortgage in minutes and see if it makes sense (and how much you'll save). Get a quote here >>

Free Refinancing Is Always Better

I have refinanced my mortgage four times over the course of owning a home for 5 years now. I lowered my rate from 6.25% when I first purchased, to 5.5%, to 4.5%, to 3.875%. Only once did I pay for doing so, yet my mortgage payment dropped hundreds of dollars a month. It almost always pays to take a slightly higher interest rate on your loan in exchange for a zero closing cost loan.

By higher rates, I mean a 1/8th of a point of interest (0.125%), and by zero closing cost loans I mean that in exchange for that higher loan rate, that the closing costs are paid by your lender or broker, and not rolled into the loan amount.

Now some people will say that you should always get the lowest rate, or you should base it on how long it takes to break even as to whether or not to refinance.

Amazing savings for something you already own

The reason I say you should always take the "free refinancing" is because most other people are comparing the two options of refinance if the breakeven is some number of months, or don’t refinance.

However, they forget to compare the options of differing rates, namely the lowest possible rate at a refinancing cost of usually around $3,000, or a free option at a slightly higher rate.

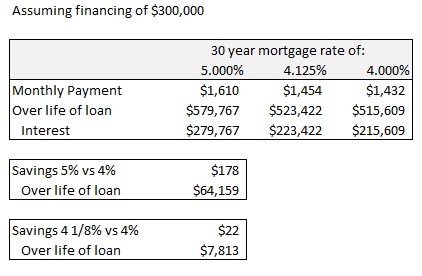

The reason is that a 1/8th of a point on a $300,000 loan is worth about $24 per month (or about $8 per $100,000 per month) over the course of a 30 year loan. In order to breakeven on $3,000 of closing costs would take about 10 years. That’s longer than most people live in their house!

Even a 1/4th point would take 5 years to break even, and that’s not considering the time value of money.

How To Negotiate A Better Mortgage Rate

Depending on the general trend of interest rates, there are a couple of different strategies.

In a rising rate market, you generally want to lock in as soon as you can, because if you wait then rates will tend to be higher. In a downtrend of rates, you generally want to wait to lock, as you can get a better rate by waiting a few weeks or months.

Now when I say generally trending interest rates, I mean take a look at the yield on the 10-year and pull up a one or two year chart. What is the general direction? That is what I mean by rate trend. Any more specific, and if you can predict interest rates accurately, there are plenty of hedge funds that will pay you a bucket of money.

I like to ask my current lender what they can do for me and help me get a lower rate. This is the easiest type of refinancing, because the lender already has all your information, and they are already receiving payments from you, so they may be willing to forego an inspection, income verification, and a host of other information. I had good luck with my Wells Fargo mortgage, and I have heard that many credit unions are also good at doing this.

I also like to have multiple refinancing options going at the same time. This is an advantage during periods of decreasing rates. When you call up a mortgage broker and they ask you to lock your rate, that’s it, your rate is set. To reset your locked rate, you usually need to start the process over again with a different lender, or wait 6 months. If you have a mortgage broker, they work with several lenders and will get you the best rate at the current time. But by the time closing rolls around, if rates are a quarter-point or more (0.25%) less than your lock, start the process over, or ask for the lender to bump down, though they usually won’t. If you have multiple lenders in the works, then you can just let one lock expire and move to the next lender in your list.

Finally, make sure that you have all your information available and correct, especially if you don’t have the best credit.

Mortgage Refinancing Summary

Let's recap!

- Free is always better

- Ask your current lender to help you lower your rate

- Work multiple lenders simultaneously

- Use government programs to your advantage if you qualify

Karl Nygard is the original founder of Cult of Money and created the website to share his ideas on investing, personal finance, and more.

I recently refinanced with zero closing cost. This was my first experience with zero closing cost and I loved it. I’m going to try it again it the 30 year fixed interest rate drops below 3.75%

That’s my view, why pay so much for a difference of a few bucks per month per $100,000. It takes a lot of months to break even paying off $4,000 in closing costs at $25 a month. That’s almost as bad as minimum payments on a credit card.

I’m surprised to hear you had good luck refinancing with Wells Fargo – or, at least, negotiating and avoiding all the closing costs. WF is also my lender, and we had to jump through the same old hoops to refinance our mortgage several years ago. Maybe things have gotten better in the intervening years?

My husband and I refinanced in December. If you’ve seen our debt breakdown, yes, it was sadly about $10,000 MORE at that time. We were able to consolidate down to one mortgage (had 80/15 before), pay off a bunch of debt (still have a lot more to go unfortunately), and are saving about $200/mo with said refi. Now is definitely the time if you have enough equity built up.

That is great! Although, even without the normal 20% equity, I’d still encourage folks to talk to a mortgage broker or their existing lender to see what can be done via the government refinancing programs. Some of these will refinance even underwater homeowners without requiring mortgage insurance.

MY recent refi on my jumbo income property saved me over $800/month! 🙂

Great post!

Nice! That is some serious savings! That kind of money adds up quick. Were you able to refinance for free? Did you still have enough equity for a normal refi or did you need a government program to help get the refi finalized?

I’ve never owned a home before, but I know so many people who benefit from refinancing. I’ll definitely do it (if it’s free) when we own a home. 🙂

You are so cool! I don’t suppose I’ve truly read anything like this before.

So nice to discover somebody with a few genuine thoughts on this topic.

Really.. thank you for starting this up. This site is one thing that’s needed on the web, someone with some originality!