Keeping track of your investment portfolio can be daunting and time consuming. And this is especially true if you invest in multiple asset classes like cryptocurrency and stocks.

There are numerous independent stock and cryptocurrency portfolio trackers. However, if you don’t want to manage multiple accounts and prefer tracking your entire portfolio from a central dashboard, these solutions don’t work.

Thankfully, there are several cryptocurrency and stock portfolio trackers that let you monitor your entire portfolio’s performance.

The Best Crypto And Stock Portfolio Trackers

We’ve outlined the best portfolio trackers depending on how new you are to cryptocurrency investing and what your overall investing goals are.

Kubera: Best Overall Crypto & Stock Portfolio Tracker

Kubera states it’s the “world’s most modern portfolio tracker,” and it’s sleek design and ease-of-use certainly help support this claim.

With Kubera, you can track the value of all of your assets in a central dashboard, including asset classes like:

- Cryptocurrency

- Domain names

- Traditional securities

- Precious metals

- Your car

- Your home

This is basically as comprehensive as you can get for tracking the different asset classes contributing to your net worth. And Kubera makes collecting all this data seamless. Just connect your online brokerage account, cryptocurrency wallet, exchanges, and bank accounts to your Kubera account.

As for the portfolio tracker itself, it’s essentially a souped-up Excel spreadsheet. You can track your entire portfolio’s growth in a clean table format that breaks out holdings by asset class or view historical performance in chart format.

In terms of security, Kubera states it doesn’t have access to any of your personal login information or credentials. Rather, Kubera uses partners like Plaid to securely connect to your various accounts, which is the same process most leading Fintech companies use.

Kubera costs $15 per month or $150 if you pay annually. There’s also a 14-day free trial for you to play around with this modern portfolio tracker.

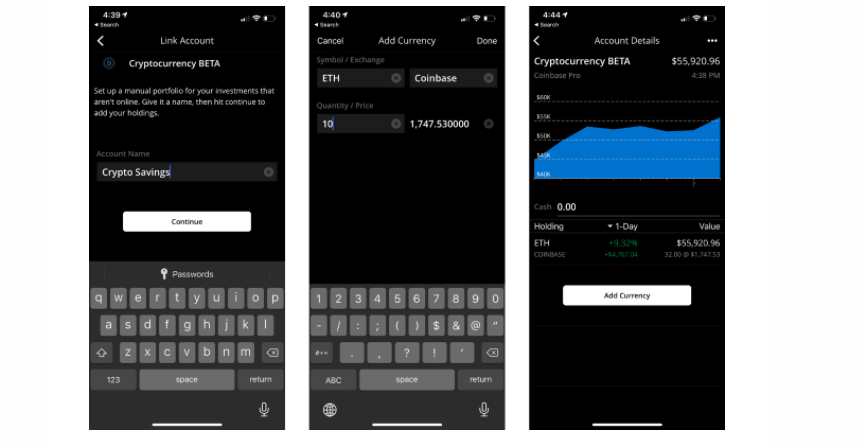

Personal Capital: Best For Portfolio Visualization

Personal Capital is one of the most popular portfolio trackers and wealth management tools on the market. And with tools like a retirement planner calculator and fee analyzer for your 401k, it’s also more robust than a simple net worth tracking spreadsheet.

As of March 9th 2021, Personal Capital users can now track their cryptocurrency holdings as part of their net worth. But you can't actually connect your cryptocurrency wallet or exchange account to your Personal Capital account. Rather, you manually enter the quantity of cryptocurrencies you hold (like Bitcoin or Ethereum) and Personal Capital updates prices using public data.

This manual entry requirement makes Personal Capital less useful for active cryptocurrency traders. But if cryptocurrency is a smaller and more stable part of your investment portfolio, Personal Capital gets the job done.

One advantage of using Personal Capital as your crypto and stock portfolio tracker is that it’s free. Personal Capital tries to funnel free users to the wealth management side of the business, but you’re not obligated to use its advisors.

For security, Personal Capital uses a variety of security protocols, has multi-factor authentication, and keeps your data private. In short, if you want a free and secure portfolio tracker for your regular investments and cryptocurrencies, Personal Capital is a good fit.

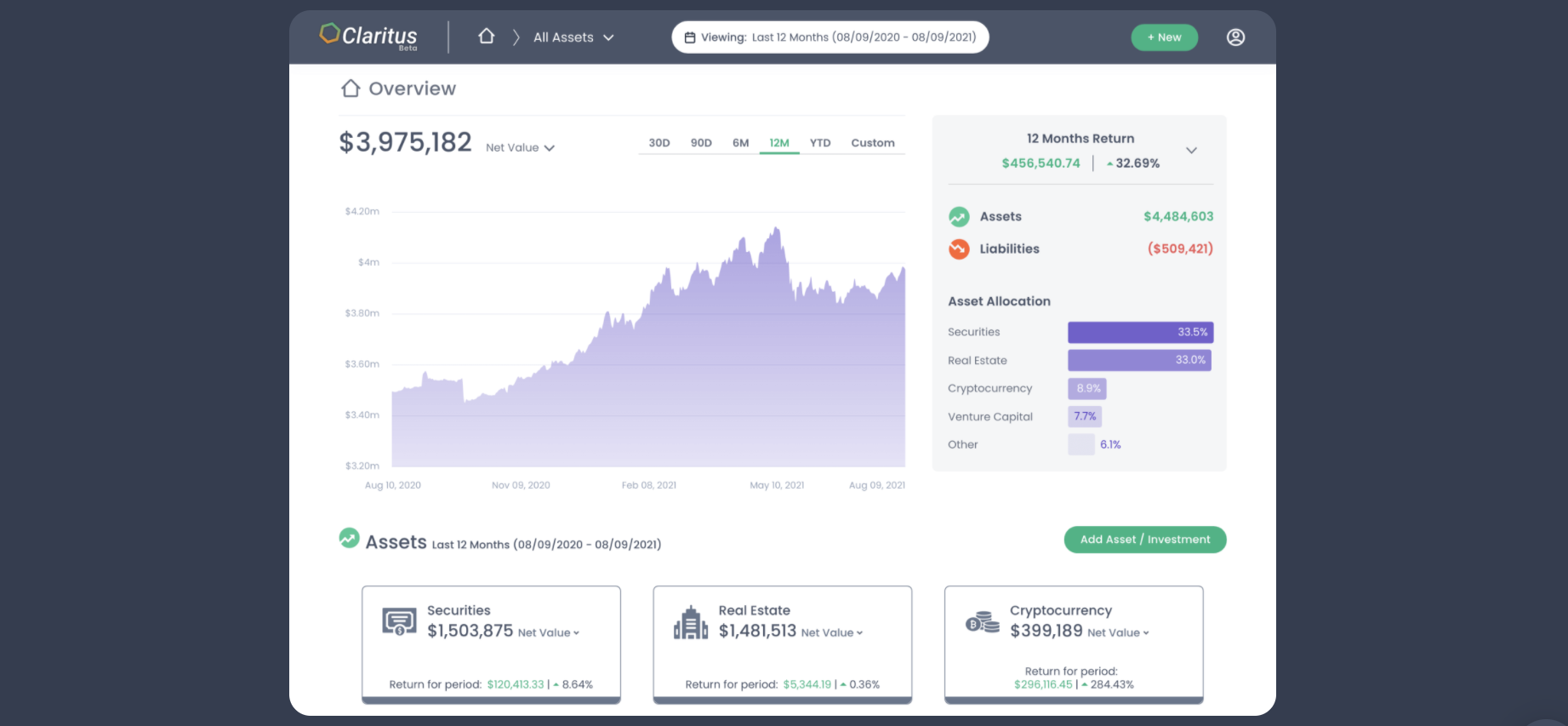

Claritus: Best For Simplicity

Despite being in Beta, Claritus is an emerging portfolio tracker that’s giving Kubera a run for its money in terms of how many asset classes investors can track. With Claritus, you can truly track your entire portfolio, including assets like:

- Cash

- Collectibles

- Cryptocurrency

- Personal business

- Private equity and venture capital

- Real estate

- Securities

Claritus also lets you track debt like your mortgage or any outstanding loans, giving you a complete picture of your net worth. The user interface is also a strength. You get clean visualizations your net worth and asset allocation and can track the return for each asset class.

Another strength of Claritus is that it offers both automated and manual tracking. If you don’t want to share data, you don’t have to. But the option is there to connect your brokerage account, bank, and cryptocurrency exchange. According to its website, it can link with over 17,000 financial institutions.

For security, Claritus uses AES-256 encryption like Personal Capital and Yodlee to connect to your financial institutions.

Since it’s in Beta, Claritus is giving a free annual membership to new users. Unfortunately, there isn’t any information regarding Claritus’ post-Beta pricing, although its website states it will have a “low subscription cost.”

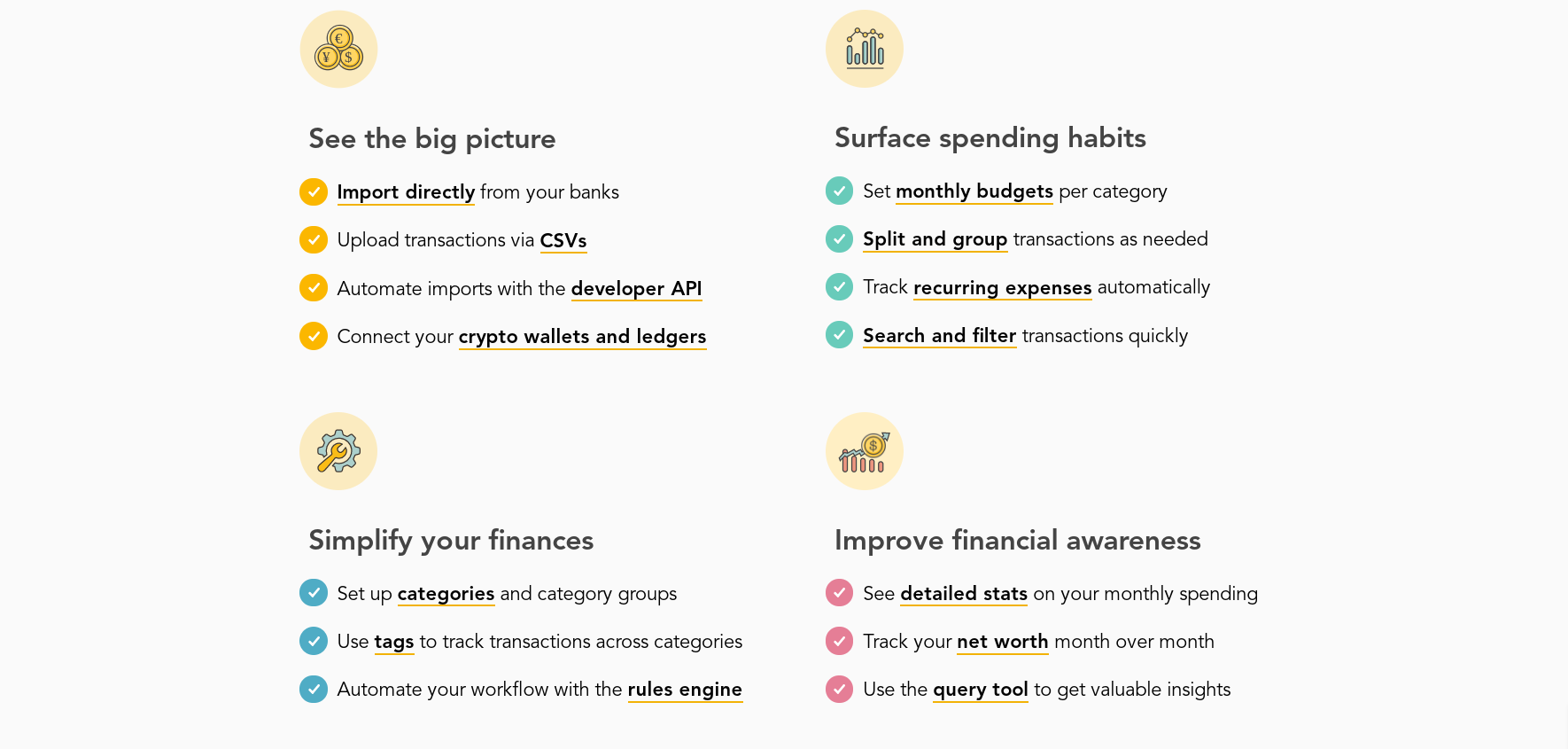

Lunch Money: Best For Portfolio Tracking & Budgeting

Lunch Money is similar to other personal finance management apps like Mint and You Need A Budget. And with its net worth chart, you get a quick snapshot of all your assets and liabilities, which covers assets like regular investments, cryptocurrency, and cash.

You can enter this information manually through an Excel spreadsheet upload or connect your financial accounts. Lunch Money also supports manual tracking for over 1,000 cryptocurrencies, so it’s a comprehensive solution if you invest in a variety of lesser-known altcoins and stablecoins.

That’s just the portfolio tracking side of Lunch Money. From there, you can create your own budget, automatically tag transactions into different categories, and monitor your spending patterns over time.

Lunch Money uses AES-256 encryption and Plaid like leading portfolio trackers. Unfortunately, there isn’t a mobile app, so this isn’t the best portfolio tracker for monitoring your investments while on the go.

Lunch Money costs $10 per month or $100 if you pay annually. Sales can drop annual pricing to around $70, and there’s also a 14-day free trial.

Overall, the portfolio tracker isn’t as sleek as what you get with platforms like Kubera or Claritus. But, if you want to track your spending and create a budget within the same app, Lunch Money is for you.

StockMarketEye: Best For Active Investors

Many popular crypto and stock portfolio trackers focus on providing a seamless user-interface and have a more minimalist feeling. This provides an easily digestible snapshot of your portfolio, but it comes at the price of less data.

With StockMarketEye, however, you can access loads of data by connecting to your brokerage account, inputting data manually, or uploading a variety of data formats like QIF, OFX, and Excel files. From there, you can group your various holdings into portfolio groups.

StockMarketEye displays all of your performance data in a table, and you also get charts for technical analysis if you click on a specific asset. It has several other features that are useful for more active trading and investing, including:

- An asset allocation breakdown

- Customizable stock alerts

- Dividend income tracking

- Gain and loss performance reports

- Six chart styles and 14 technical indicators

- Stock watchlists

- Value chart to track your portfolio’s growth

StockMarketEye’s software is available on Windows, Apple, and Linux. You can also use a simpler version of the software on Android and iOS. There’s a free 30-day trial, and StockMarketEye costs $74.99 annually.

For security, StockMarketEye uses AES-128 encryption to keep your data private. You can also enable password protection which requires a password to login to your account.

The bottom line is that StockMarketEye is one of the more advanced portfolio trackers for stocks and cryptocurrency. If you’re a passive investor and don’t need much data, this isn’t the right choice. But for active investors and traders, StockMarketEye is better than basic portfolio tracking apps.

Delta: Best For Beginner Investors

The Delta app is another popular cryptocurrency and stock portfolio tracker that’s best if you’re just starting out with investing.

With Delta, you get an incredibly sleek and user-friendly app that lets you track asset classes like cryptocurrency, stocks, ETFs, and mutual funds. You can view a clear breakdown of your portfolio’s performance in the app’s main dashboard or dive into different asset classes and specific holdings.

As a free Delta user, you can only connect two cryptocurrency exchanges and two wallets to your account. Delta provides live updates on cryptocurrency prices, but if you’re trading across several exchanges, the free plan has limitations.

The main downside of Delta is that you can’t currently connect brokerage accounts to automatically sync your investing data. However, Delta recently announced brokerage connections are coming soon.

If you want more wallet and exchange connections and advanced portfolio metrics, you have to pay for Delta Pro. This premium plan is on an early backer plan currently and costs $60 to $70 annually for iOS and $70 to $80 annually for Android.

For security, Delta states your wallet keys are only stored on your device and are never sent to Delta servers. At this time, there isn’t information for how users will integrate their regular brokerage accounts with Delta.

Until Delta adds brokerage connections, paying for Pro isn’t worth it. But the free app is still a simple way to track your cryptocurrency holdings and other investments, especially if you’re new to investing and have a smaller portfolio.

When Should You Use An All-In-One Portfolio Tracker?

The advantage of using a portfolio tracker that supports multiple asset classes is that you don’t have to juggle multiple apps or websites to monitor your portfolio. If you want to centralize your financial information, using a portfolio tracker that supports crypto and more traditional securities makes sense.

However, more specialized portfolio trackers often have more features than platforms that try to support every asset class.

For example, FTX (formerly named Blockfolio) is one of the most popular cryptocurrency portfolio trackers on the market. The platform also lets you buy various cryptocurrencies and earn up to 8% APY on crypto and fiat you deposit. FTX also supports over 500 exchanges and offers detailed coin price charts, price alerts, and breaking industry news.

This is just one example of how a specialized service can open more opportunities for investors. Use an all-in-one portfolio tracker for simplicity. But don’t be afraid to explore more comprehensive trackers for both crypto and regular securities.

Methodology

Cult of Money wants to help readers learn more about cryptocurrency and decentralized finance (DeFi) to benefit from this revolutionary technology. To accomplish this goal, our team regularly reviews the best crypto-related products and services on the market to help investors make the right decision.

There are numerous portfolio tracking apps and software on the market. For our reviews, we consider factors like ease-of-use, fees, security, supported cryptocurrencies, and a variety of other factors. There are still other crypto and stock portfolio tracking platforms on the market. But we believe this includes the very best trackers currently available to investors.

Final Thoughts

A few years ago, the idea of needing a portfolio tracker that also includes cryptocurrency might have been laughable to many people. But cryptocurrency investing is more popular than it’s ever been.

This momentum bodes well for the future of cryptocurrency and DeFi. The next few years should see more companies adopt the technology, including online brokerages, personal finance apps, and even our banks.

For now, use one of the all-in-one portfolio trackers outlined in this list to monitor your entire portfolio. But keep an eye out for what’s around the corner. Cryptocurrency is a dynamic space and new tools are becoming available for investors all the time.

Tom Blake is a personal finance writer with a passion for making money online, cryptocurrency and NFTs, investing, and the gig economy.