DAO is short for “Decentralized Autonomous Organization.”

Part of the digital currency and blockchain ecosystem, DAOs are groups that pool funds together using cryptocurrency and that allow members to vote on the future of the organization.

While they have not been problem-free, DAOs are a unique and forward-thinking way to manage a cryptocurrency or an entire organization using blockchain technology. Keep reading to learn how they work.

What Is A DAO (Decentralized Autonomous Organization)?

A Decentralized Autonomous Organization, most commonly called a DAO, is a collaborative system of working with others to manage an organization and commit funds to a specific use.

A DAO allows strangers with internet access to collaborate and vote using a completely transparent system. Behind a DAO is a smart contract, a tamper-proof piece of code stored on a blockchain, such as Ethereum.

Anyone can join a DAO through its public governance rules. Some DAOs manage membership through ownership of a specific cryptocurrency token. In this case, anyone who buys and owns the token can vote and participate in the DAO. Others may require joining a liquidity pool or contributing to a proof-of-work (PoW) pool.

Overall, you can think of a DAO like a public company. But instead of shareholders voting for a board of directors to make decisions, cryptocurrency holders vote on the use of funds and the future of the DAO.

The Rise And Fall Of "The DAO"

So far, we’ve been talking about DAOs in general. But one specific DAO lives in infamy, known simply as "The DAO." The DAO was a DAO founded in 2016 on the Ethereum blockchain. It raised the equivalent of $150 million intended for venture capital investments.

Unfortunately, the smart contract behind The DAO had a fatal weakness and was hacked for $60 million of ether. The event was such a big problem that Ethereum eventually split into two versions in the fallout, Ethereum (ETH) and Ethereum Classic (ETC), in a move to restore the stolen funds.

Other Notable DAOs

While "The DAO" led to a less-than-ideal outcome, these DAOs have done a better job of meeting the organization’s goals:

- MakerDAO: MakerDAO runs the Maker currency and the Dai currency. MKR holders control the governance of MakerDAO. DAI is a stablecoin pegged to the dollar. The MakerDAO tokens now power an entire ecosystem of apps.

- PhoenixDAO: This DAO focuses on secure authentication and identity verification for Decentralized Finance (DeFi).

- Pillar: Pillar is a DAO powering a multi-blockchain wallet so users can transact across Ethereum, Polygon, Binance Smart Chain, and other networks with low costs. Holders of the Pillar token (PLR) can vote on the future of Pillar.

Another DAO that recently made headlines was Constitution DAO - which sought to buy a copy of the US Constitution. They weren't able to succeed at auction and are now offering refunds to those that participated.

How To Vote In A DAO With Cryptocurrency

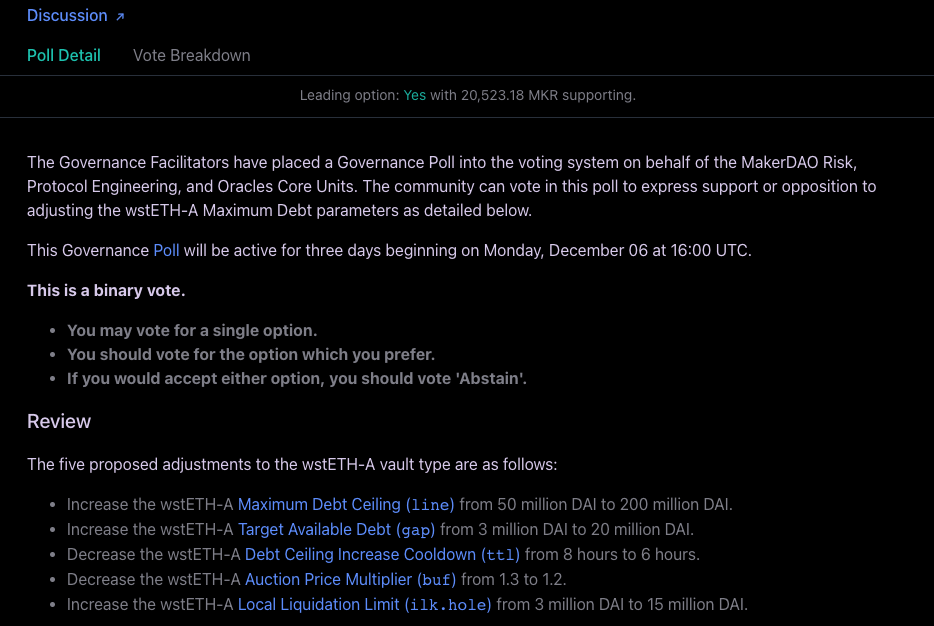

Every DAO has its own voting process. As an example of voting in a DAO, here’s a look at voting with MakerDAO.

To start, you’ll need Maker currency (MKR) in a compatible digital wallet. Once you own MKR, you can head to the Maker Governance website to connect your wallet and begin voting.

The button to connect your wallet is at the top right. You’ll need a wallet compatible with your DAO to vote.

Once connected, your wallet and Maker holdings give you the right to vote. You can click on the active polls page to view each proposal and the time remaining to vote. The smart contract is updated when the poll time concludes if the vote passes.

Anyone with an internet connection and the proper credentials (in this case, MKR balance) can vote. It’s an excellent system for managing assets internationally, semi-anonymously, and collaboratively with like-minded DAO members worldwide.

Pros & Cons Of DAOs

Should You Join A DAO?

Some people feel that DAOs are the corporate governance model of the future. Those who hold this opinion like that the autonomous structure of DAOs helps to eliminate the power plays that are common with the typical "board of directors" model used by publicly-traded companies.

However, it's still early days with DAOs. We'll have to wait to see if this management structure will really catch on or will be a passing fad. And it's important to understand that even without a hierarchical governance structure, a DAO's investment choices could still fail.

As with any company or cryptocurrency, it's important to carefully research a DAO before you decide to join and invest in it. But if you’re interested in a DAO's goals and feel confident about its underlying governance token or currency, it could make sense to move forward.

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment. His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, HuffPo, Investor Junkie, and other fine financial blogs and publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.