Most popular cryptocurrency exchanges aren’t truly decentralized. In other words, when you buy and sell crypto on an exchange like Coinbase, you’re still dealing with a middleman, regulations, and identity verification requirements.

This arrangement is fine for everyday traders, but it also strays farther from cryptocurrency’s strength of staying decentralized. And that’s where Bisq, a leading decentralized exchange, can come in handy.

Bisq lets you privately buy and sell cryptocurrencies and fiat on your own terms. Our Bisq review is covering exactly how this exchange works, why it’s different, and how to decide if it’s right for you.

Bisq Details | |

|---|---|

Product Name | Bisq |

Product Type | Cryptocurrency Exchange |

Supported Coins | Varies Depending On Market |

Fees | 0.10% Maker And Taker Fee |

Promotions | Starts at 0.00005 BTC |

Pros & Cons

Pros

Cons

What Is Bisq?

Bisq is an open-source, peer-to-peer exchange that lets you buy and sell crypto or fiat with people from around the world. The company began in 2014 and was originally called Bitsquare before rebranding due to trademark issues.

Bisq is also a decentralized autonomous organization (DAO). This means there’s no headquarters or central office like you’ll find with other exchanges.

Rather, Bisq stakeholders decide on the future of the exchange through voting. Code is also open-source so developers from around the world can contribute to the project.

What Does It Offer?

Decentralization is the name of the game with Bisq. This means the features you’re used to with exchanges like Coinbase or Gemini might look a little different when you start using Bisq. However, if you value privacy and want to get rid of middlemen, these Bisq features are what you need.

Private Peer-To-Peer Trading

Bisq supports peer-to-peer trading of dozens of cryptocurrencies, including:

Bisq also supports different national currencies, making it globally-friendly.

Technically, you can trade in any cryptocurrency or any currency since Bisq is all peer-to-peer. However, you’re less likely to find trading partners if you have an obscure altcoin or fiat that’s not widely accepted.

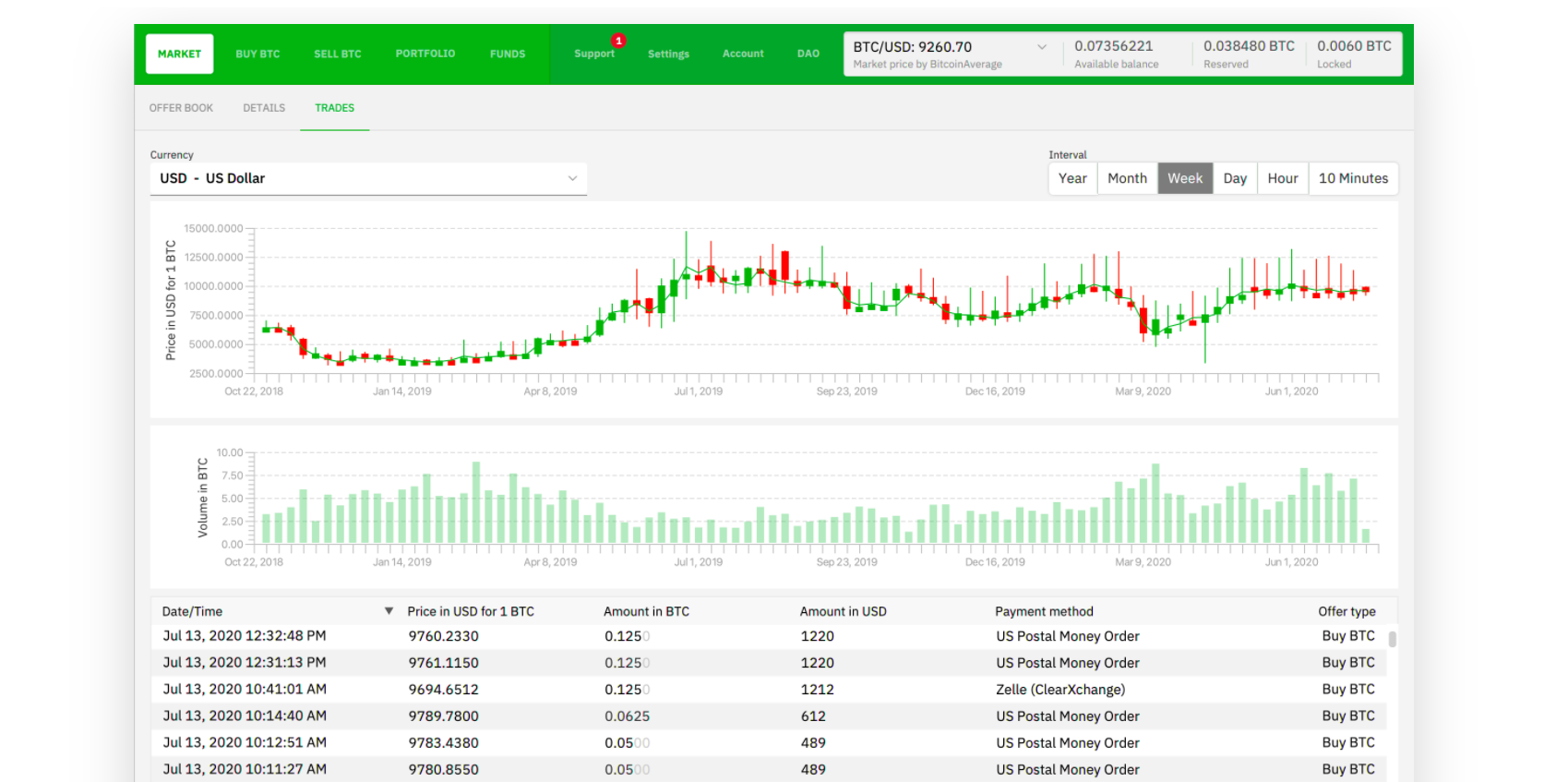

The main difference between trading with Bisq and trading on an exchange like Gemini or Kraken is that there isn’t automatic order matching.

With Bisq, you don’t just place a trade for 1 ETH and have it complete automatically. Rather, you need to search for offers on the peer-to-peer marketplace and find someone who is selling ETH for BTC.

You can also create offers where you outline the cryptocurrency you want to buy and your offer price. Note that with Bisq, you’re always buying or selling Bitcoin; BTC is what’s paired for every transaction.

When you find an offer you like at the right price point, you accept the offer, transfer funds to the seller, and receive your cryptocurrency when the seller receives their funds. The same process works for selling your crypto; you place an offer on the Bisq network, wait for buyers to accept the offer, and then carry out the trade.

This might sound like more work, and it’s true that trade settlements take longer with Bisq than automatic market makers (AMMs). However, the trade-off is that you remain private. Bisq also utilizes security deposits from buyers and sellers to improve trading security. Furthermore, funds lock in multi-signature escrow, a crypto wallet that requires more than one private key to access.

No KYC Requirements

Most cryptocurrency exchanges follow know-your customer (KYC) requirements and anti-money laundering (AML) regulations. Typically, this means you have to verify your identity before using these exchanges by uploading some government ID. Many exchanges like Coinbase also report to the IRS.

Even if you find exchanges that don’t force KYC requirements like KuCoin, non-verified users often have lower trading and withdrawal limits. This is all done in the name of security. But if you want to protect your privacy, these requirements largely prevent that.

Bisq doesn’t require registration or identity verification. Additionally, you store data locally on-disk rather than Bisq servers. Bisq also uses Tor to enable anonymous communications between nodes in its network. You can read more about Bisq’s privacy commitments on its website. But the bottom line is that privacy is this exchange’s competitive advantage.

Security

Using a peer-to-peer network to trade cryptocurrency and fiat might sound like an invitation for scams. However, Bisq has several security features in place that are once again different from centralized exchanges.

For starters, you need to have Bitcoin to trade on Bisq in the first place. This is because every trade requires a BTC security deposit from the buyer and seller. Buyers must post at least 15% of the trade amount, with the minimum amount being 0.001 BTC (worth about $50 at the time of writing). Sellers also post at least 15% of the trade value plus 100% of the asset being sold.

From there, funds are locked in a multisignature address until the seller confirms they received their funds and wants to release their crypto to the buyer. Bisq also limits fiat payment methods to reduce the risk of chargebacks. For example, Cash App, PayPal, or Venmo aren’t available since it’s too easy for buyers to request chargebacks with these platforms.

Bisq limits trading on accounts with less than two months of history. This means brand new accounts can’t buy or sell massive amounts of BTC on Bisq and attempt to defraud other users. Some accounts also require signing, which means a trusted peer on the Bisq Network has to verify a new account for the aging process to begin.

Between these security measures and Bisq’s trading rules, trading is actually very secure. If something goes wrong, you begin remediation by chatting with your trading partner. Bisq also has mediation and arbitration steps in which community-appointed members help oversee a resolution.

Contributor Rewards

Since Bisq is a DAO, it relies on community members and stakeholders to keep things running smoothly.

To incentivize community involvement, Bisq lets contributors earn BSQ, the platform’s own token, for becoming contributors. According to Bisq, BSQ is “real Bitcoin with a few extra parameters that make it a colored coin. This “coloring” allows the Bisq application to recognize these Bitcoins as BSQ.”

So, for all intents and purposes, you’re getting paid with BTC for making Bisq a better network. There are also several ways to become a contributor, including:

- Creating videos and tutorials about how to use Bisq

- Writing blog posts about Bisq

- Translating Bisq help and wiki documents

- Programming tasks or helping to develop the tech behind the network

In short, if you can find a way to help Bisq grow and succeed, you can earn BSQ for your efforts. As a DAO, Bisq also has preset roles that you can apply for like document maintainers, administrators, and moderators.

Are There Any Fees?

One advantage of using Bisq over centralized exchanges is that the fees it charges to support its network are usually lower than what many centralized exchanges charge in trading fees.

You can pay fees with BTC or BSQ. Here’s how maker/taker fees work for each coin:

Bisq Trading Fees Per 1 BTC | ||

|---|---|---|

Order Type | BTC | BSQ |

Maker | 0.001 | 15.14 |

Taker | 0.007 | 105.97 |

Note these are the fees per 1 BTC. The minimum combined trading fee for BTC is 0.00005 BTC, worth about $2.58 at the time of writing. Trading with BSQ grants a discount of around 50% to incentivize using the network’s token.

This fee structure means BSQ makes small and large trades viable. Yes, trades can take longer to execute. But you’re not getting dinged with massive trade or payment processing fees as with some centralized exchanges.

How Does Bisq Compare?

Bisq isn’t nearly as popular as exchanges like Coinbase, Binance, or other more centralized exchanges. However, verification requirements and trading fees are significantly different with Bisq as a result. Here’s how Bisq compares against two of the leading crypto exchanges in the world.

Header | |||

|---|---|---|---|

Star Rating | |||

Supported Cryptos | Varies by market | 100+ | 500+ |

KYC Requirements | No | Yes | Yes |

Trading Fees | Starts at | Starts at 0.50% | Starts at 0.10% |

Cell |

Coinbase and Binance are both more user-friendly than Bisq. But if you want to avoid KYC requirements and pay lower fees, Bisq is an excellent alternative.

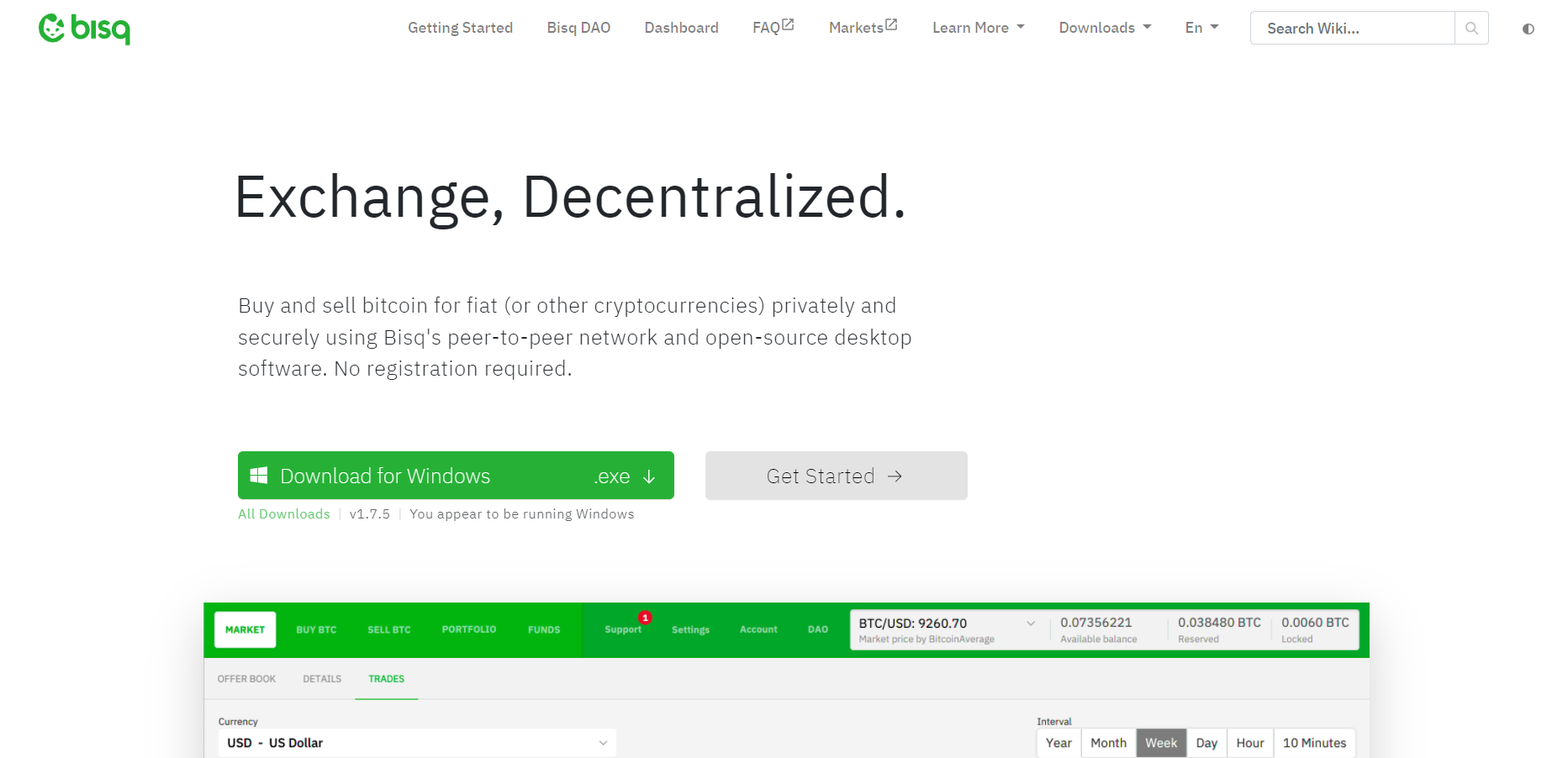

How Do I Open An Account?

If you want to begin trading on Bisq, the process takes four steps:

- Download Bisq for Windows, Mac, or Linux from its website.

- Write down your wallet seed and store it somewhere safe. You also backup your Bisq data and can store it on your computer or a spare harddrive.

- Create a payment account which can include various bank accounts, money-transfer apps, and altcoin accounts.

- Fund your wallet with BTC for security deposits and begin trading.

Bisq has a guide for signing up and making your first trade. However, the main hurdle people have with Bisq is that you need BTC to start trading.

Furthermore, Bisq discourages using a centralized exchange to get your first Bitcoin. This is because a hack or breach on a centralized exchange could theoretically connect your centralized wallet address to your new Bisq address.

Instead, Bisq has tips for getting your first BTC without going centralized. These tips include using Bisq’s informal market for small BTC trades, borrowing from friends, or even using a Bitcoin ATM in your area.

For complete beginners, these precautions make Bisq less appealing than just opening an account with Coinbase and trading with funds from your bank account. But if you value privacy and decentralization, this is what you have to do.

Is Bisq Safe?

Bisq is a non-custodial exchange, meaning Bisq doesn’t have access to your wallet and funds like exchanges like Coinbase do.

This is a double-edged sword. The bright side is that hackers can’t compromise Bisq and drain funds right from your account. However, you’re completely responsible for maintaining your own security and protecting your wallet information.

Bisq was hacked in 2020. Hackers were able to steal $250,000 from seven traders after a software update. Bisq refunded the traders, but this shows that even non-custodial exchanges can be hacked.

Who Should Use Bisq?

Bisq isn’t as beginner-friendly as exchanges like Coinbase or crypto brokers like Voyager, but that’s alright. Really, Bisq caters to cryptocurrency investors who value decentralization, security, and privacy.

The peer-to-peer marketplace takes some getting used to and you need at least 0.001 BTC for your starting security deposit. But if you want an anonymous way to buy and trade crypto and avoid high exchange fees, Bisq is for you.

Bisq Features

Product Type | Cryptocurrency exchange |

Min Purchase | Varies depending on trading pair and marketplace offer |

Supported Coins | Depends on the peer-to-peer marketplace |

Free Wallet | Yes |

Maintenance Fees | No |

Deposit or Withdrawal Fees | None |

Trading Fees | Start at 0.0005 BTC |

Supported Payment Types | Bisq supports numerous cryptocurrencies and currencies; the peer-to-peer marketplace is what determines trading pairs |

Insurance | Bisq doesn’t have insurance but it’s non-custodial, meaning it never has access to your wallet and funds |

Security | Bisq uses BTC security deposits and a multisignature address to process trades more securely. There’s also a mediation and arbitration process if you encounter a trading problem |

Mobile App Availability | Android and iOS |

Web/Desktop Availability | Yes |

Custom Support Options | Bisq has a community forum where you can ask questions |

Promotions | None |

Tom Blake is a personal finance writer with a passion for making money online, cryptocurrency and NFTs, investing, and the gig economy.