These days, it’s easier than ever to buy crypto. For example, cryptocurrency exchanges like Coinbase let you buy over 100 cryptocurrencies and stablecoins with funds right from your bank account.

However, many leading exchanges take a few days to verify your identity. Furthermore, you might find daily buy limits take a long time to increase, which can be painful if you’re trying to buy a dip in the market.

But with MoonPay, you get a much snappier way to buy and sell crypto. If you want a simple transaction process and to get in on the action fast, MoonPay could be for you.

Quick Summary

MoonPay Details | |

|---|---|

Product Name | MoonPay |

Product Type | Cryptocurrency Payments |

Supported Coins | 80+ |

Fees | 1% to 4.5% |

Promotions | None |

Pros & Cons

Pros

Cons

About MoonPay

MoonPay is a cryptocurrency payment solutions company that began in 2018. The company was founded by Ivan Soto-Wright and Victor Faramond and currently operates out of Miami, Florida.

Despite being a young company, MoonPay already has over 5 million customers and is available in over 160 countries. According to its website, MoonPay’s technology has helped deliver over $2 billion worth of crypto assets since its founding.

For U.S. investors, MoonPay is available in every state except for Hawaii, New York, Louisiana, Rhode Island, and Texas.

What It Offers

MoonPay’s goal is to make it easy for people to invest in crypto regardless of where they live and what currency they’re using. It also aims to help businesses enable cryptocurrency payments on their websites.

In this sense, MoonPay is similar to payment processors like PayPal, just for crypto. To accomplish its goal, there are several MoonPay features you can take advantage of.

Quickly Buy Cryptocurrencies

The main reason to use MoonPay is to buy and sell cryptocurrencies quickly. In fact, this is the only feature the consumer-facing side of the platform offers.

Once you visit MoonPay’s website, you click the “buy crypto” button to get started. Currently, MoonPay supports over 80 virtual currencies, including:

MoonPay also supports several tokens for metaverse games like The Sandbox and Decentraland, as well as altcoins you might not even know about. Overall, there’s no shortage of choices for crypto customers.

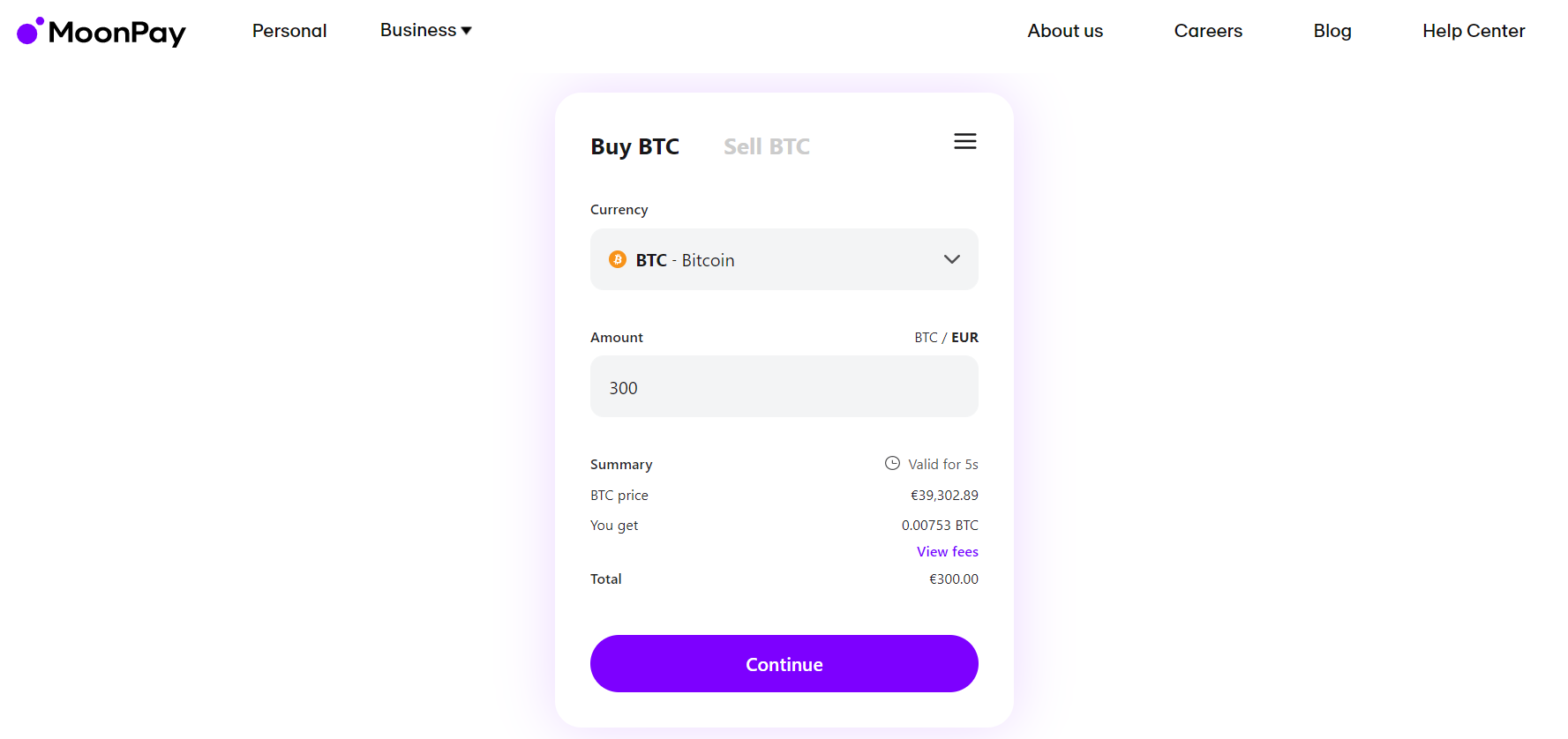

Executing trades is also simple. You select the crypto you’re buying, the quantity, and your currency. One perk of MoonPay is that it supports dozens of currencies, so it’s useful for international investors.

MoonPay displays how much crypto you’re purchasing and refreshes quotes every 10 seconds for more volatile coins. Once you enter your wallet address for the given coin, you can checkout.

If it’s your first MoonPay purchase, you complete know your customer (KYC) verification before completing the purchase. This involves confirming your phone number, name, address, and uploading government ID like a passport or driver's license.

MoonPay states most verifications complete automatically if you upload clear images. Otherwise, verification can take between several minutes or a few days.

However, the instant verification for many accounts and simple purchasing process makes MoonPay a fast and simple way to buy dozens of different cryptocurrencies.

Numerous Payment Methods

MoonPay offers several payment methods for international customers, including:

- Credit and debit card

- Apple Pay

- Google Pay

- SEPA and SEPA Instant for Euro-denominated transactions

- UK Faster Payments for UK users

U.S. residents can use:

- Credit and debit cards

- Apple Pay

- Google Pay

- Samsung Pay

A downside of MoonPay is that you can’t swap cryptocurrencies. In other words, you can’t swap Bitcoin you own for Dogecoin. If you want to swap, exchanges like Coinbase and Gemini are better choices.

But for quickly buying crypto with cash, MoonPay is very hassle-free.

Sell Crypto

Users in the EU, UK, and United States can sell crypto with MoonPay in exchange for fiat. Currently, cryptocurrencies you can sell for cash include:

- Bitcoin (0.001 BTC minimum)

- Bitcoin Cash (0.05 minimum)

- Ethereum (0.01 minimum)

- USD Coin (30 minimum)

- Tether (30 minimum)

MoonPay states it’s expanding its list of sellable cryptos. Like buying crypto, MoonPay displays a quote that’s an estimate of how much cash you’re going to get for the crypto you’re selling.

There’s a 1% payment processing fee or minimum of $3.99 in USD, British Pounds, Euros, or currency equivalent. You receive money in your bank account within one to four business days.

If MoonPay can’t process your sale for whatever reason, you get your crypto back. Just note that network fees can alter how much crypto you’re actually selling. And, according to MoonPay, if it receives significantly less crypto than the minimum sell amount it “might not be able to process your sale and your crypto might be lost.”

For this reason, avoid selling cryptos if you’re close to the minimum sell amount, especially if fees like ETH gas fees are high at the time.

Account Limit System

One perk of using MoonPay is that you can quickly increase your account purchasing limit to buy more cryptocurrency.

Purchasing limits depend on your level of verification. Purchase history, region, and payment types also influence how much you can buy.

There are five tiers of verification you can complete. But uploading your ID and completing a video or selfie check gets you up to €334 worth of purchasing power in your chosen currency for a 30-day rolling period. Adding information about your employment and verifying your income by uploading a bank statement lets you spend over €1,000.

Granted, MoonPay has some pretty invasive KYC steps. For example, you can even verify your address to unlock a higher spending limit.

However, in my experience, MoonPay gave me a higher starting buy limit than Coinbase which held me at around $300 USD for my first month.

If you try to purchase more crypto than your current limit, MoonPay prompts you to complete additional verification to complete your purchase. For users currently dealing with frustratingly low buy limits on exchanges, MoonPay could be a viable alternative to try.

Business Crypto And NFT Payments

MoonPay’s B2B side lets businesses offer crypto and NFT transactions on their websites.

Notable MoonPay partners using its tech include:

- Abra

- Binance

- Bitcoin.com

- OpenSea

- Trust Wallet

- ZenGo

In fact, there’s a chance you’ve used MoonPay’s tech without even realizing it if you use other exchanges to buy and sell crypto.

MoonPay Pricing & Fees

MoonPay charges different fees depending on the payment method you use:

- Card Payments: 4.5% with a minimum of $3.99, €3.99, £3.99 or currency equivalent.

- Bank Transfers: 1% with a minimum of $3.99, €3.99, £3.99 or currency equivalent.

MoonPay also charges dynamic network fees that depend on blockchain conditions. This is the same process other exchanges use, and during periods of congestion, network fees can get pretty high, especially for cryptos like Bitcoin and ETH.

You see the network fees before executing a trade. Overall, MoonPay is more expensive than exchanges like Binance which charges a 0.10% Maker/Taker fee, so you certainly pay more for the convenience.

MoonPay Alternatives

If you want a speedy way to buy crypto, MoonPay is an excellent choice. However, if you want more coin support and lower trading fees, exchanges like Binance and Coinbase are better options.

Furthermore, many exchanges offer their own wallets. And, you can usually earn passive income with your crypto with methods like staking. In comparison, MoonPay is just a payment processor.

As for businesses and website developers looking for crypto payment solutions, you also have options. There are plenty of fiat-to-crypto gateways out there like Simplex which is one of the most popular options, or Onramper, which charges low transaction fees.

Customer Service

There are several ways to contact MoonPay’s customer service team. The first method is to email [email protected] for support. You can also use a chat bot feature to find helpful articles for your problem or to leave a message with MoonPay’s customer service team.

Account Opening Process

You sign up for MoonPay with your email address. Once you verify your email, you complete KYC verification to unlock buying.

The first level of verification involves entering your:

- Name

- Address

- Phone number

- Date of birth

- Photo of government-issued ID

Additional levels of verification unlock higher purchasing limits. But you can sign up and purchase crypto with MoonPay within a few minutes.

Safety & Security

According to MoonPay, all data is encrypted with AES-256 block-level storage encryption. Overall, MoonPay is safe and secure and is a technology partner for many leading exchanges and NFT marketplaces like Binance and OpenSea.

That said, MoonPay isn’t invulnerable. For example, in 2020, Iota, a cryptocurrency project that supports the Internet of Things, was hacked due to a vulnerability in MoonPay’s tech.

On the bright side, MoonPay has a 4.2 rating on Trustpilot and is an overall secure payment processing system.

However, it’s important to control your own security as a crypto investor. First and foremost, this means double-checking your wallet addresses before purchasing crypto so you actually send it to the right address. If you suspect your MoonPay account has been compromised or if you have issues with payment, get in touch with MoonPay support as quickly as possible.

Finally, use a reliable crypto wallet like Ledger or Trezor to hold your funds. Keeping large amounts of crypto on an exchange increases risk because you don’t actually control your wallet keys, so mitigate this risk whenever possible.

The Bottom Line

MoonPay is more expensive than many leading crypto exchanges. However, if you want to quickly buy crypto with funds from your bank account, paying for the convenience might be worth it.

This is especially true if you currently face low buying limits on other exchanges. If anything, you can use MoonPay to supplement your cryptocurrency investing by unlocking higher buying limits.

Just be aware that network fees and transaction fees can add up quickly. If you want to avoid high fees, exchanges like Binance or KuCoin are superior.

MoonPay Features

Product Type | Cryptocurrency payments |

Supported Coins | 80+ |

Free Wallet | No |

Maintenance Fees | No |

Trading Fees | 1% to 4.5% depending on payment method |

Supported Payment Types | Credit card |

Insurance | MoonPay doesn’t have insurance but you don’t hold funds directly on MoonPay like you do with cryptocurrency exchanges |

Security | MoonPay uses AES-256 block-level storage encryption and also has two-factor authentication |

Mobile App Availability | No |

Desktop Availability | Yes |

Customer Support Options | MoonPay has a live chat customer support option and you can email [email protected] for assistance |

Promotions | None |

Tom Blake is a personal finance writer with a passion for making money online, cryptocurrency and NFTs, investing, and the gig economy.

Why does moonpay insist on card payment rather then collecting fees from the transaction directly

Our guess is that card payments are one of their revenue sources. They likely keep a percentage of the processing fee.