KuCoin, which sometimes calls itself “The People’s Exchange,” is a small but rapidly-growing crypto exchange that gives traders access to hundreds of crypto tokens including many up-and-coming stars.

Traders who are interested in finding the next Solana or Dogecoin before the market does may be able to find them on KuCoin. If you’re interested in buying altcoins, KuCoin may be the best exchange for it. Here’s what you need to know about the hot exchange.

KuCoin Details | |

|---|---|

Product Name | KuCoin |

Supported Digital Assets | 400+ |

Supported Fiat Currencies | 28 |

Maker/Taker Fees | Up to 0.10% |

Promotions | Earn a bonus of up to 500 USDT |

Pros And Cons

Pros

Cons

What Is KuCoin?

Launched in 2017, KuCoin is a crypto exchange that specializes in lesser-known altcoins. It supports over 400 types of tokens and has over 8 million active users spread across 207 countries.

The exchange has had over $655 billion in total trade volume since its inception. According to CoinMarketCap’s rankings, KuCoin is the sixth-largest crypto exchange by volume.

Over the past year, KuCoin has experienced huge growth, and it recently introduced its first fiat-to-crypto buying option (USD) which is now expanded to 28 fiat currencies. Users can access KuCoin through a mobile app or through the website.

What Does It Offer?

KuCoin is a trading-forward crypto exchange. It encourages trading between crypto tokens and is now making it easier to trade on margin, buy crypto using fiat, and even buy crypto futures.

In some ways, KuCoin has a dizzying array of features, some of which seem to be more gamification-oriented than investment-oriented. These are a few of the more notable platform features.

Extensive Asset Support

KuCoin is well known for supporting a huge range of tokens. The exchange supports over 400 digital assets and 800+ crypto trading pairs. This huge range makes it a great choice for crypto enthusiasts seeking exposure to altcoins.

Buy Crypto Using Fiat

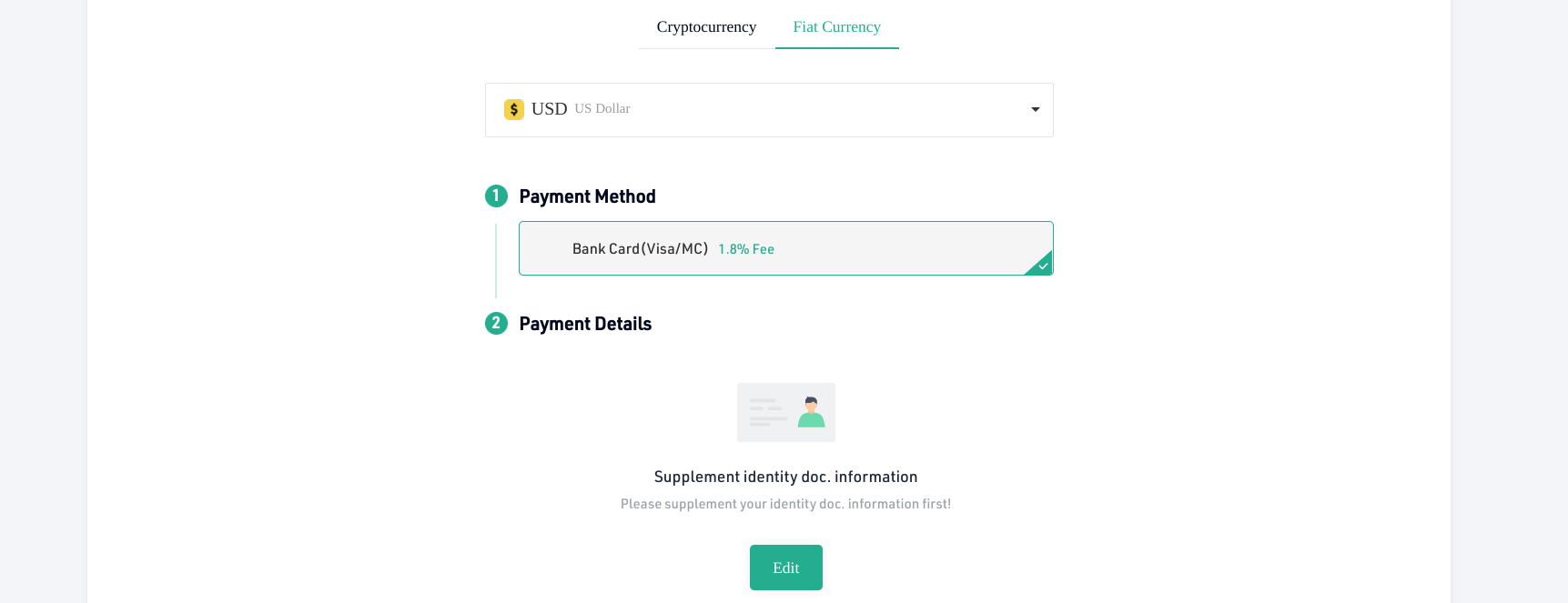

KuCoin recently introduced the option to buy crypto using US dollars and 27 other fiat currencies. Before this was introduced, KuCoin was a crypto-only exchange which made tended to be difficult for newbies to navigate. Users can use KuCoin’s fast buy functionality to buy USDT or BTC.

Lend Or Stake To Earn Interest

Users can choose to lend tokens to peers through the KuCoin exchange. The peer-to-peer lending platform. Interest earned is variable depending on demand and other aspects, but many coins pay more than 10%. Most tokens are loaned for a period of 7 to 28 days.

KuCoin also supports staking for popular coins like Polkadot and ETH 2.0. It calls its staking platform Pool-X Earn. And unlike other platforms, KuCoin allows you withdraw staked coins whenever you want.

Trade On Margin

KuCoin introduced trading on margin in 2019 and it allows users to leverage their trades up to 10X. Rates on margin fluctuate depending on the available pool of margin on KuCoin.

It should be noted that margin trading amplifies losses as well as profits, which makes it riskier than non-leveraged trading. Learn more about the risks and potential benefits of margin trading.

KuCoin Shares (KuCoin Token)

KuCoin Shares (KCS) is the native token of the KuCoin exchange. The token is now traded on several other larger exchanges. People who hold KCS on the KuCoin platform are eligible for maker and taker fee discounts. KuCoin uses some of the profits of the exchange to buy back KCS tokens, which give it some intrinsic value.

No KYC Verification In The United States

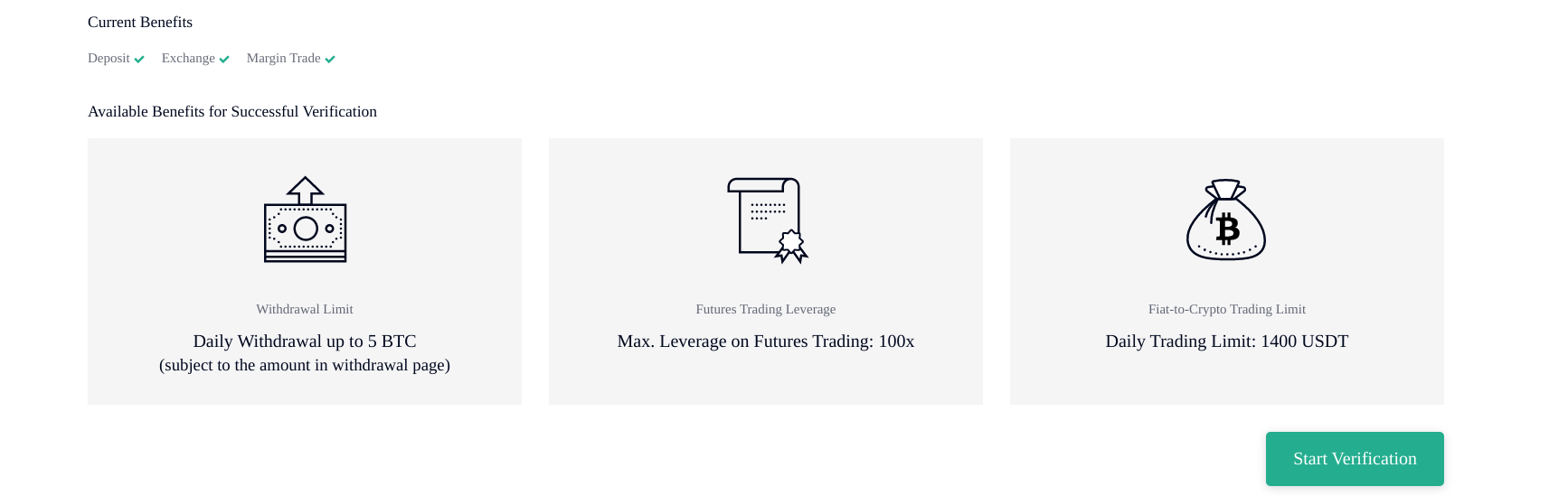

KuCoin provides fairly strict trading volume and withdrawal limits on accounts that have not completed KYC verification. For example, it was recently announced that non-verified users can only withdraw 1 BTC per day whereas verified users get daily withdrawals of up to five BTC.

You also won't be able to buy crypto using fiat (e.g. USD) until you've been verified.

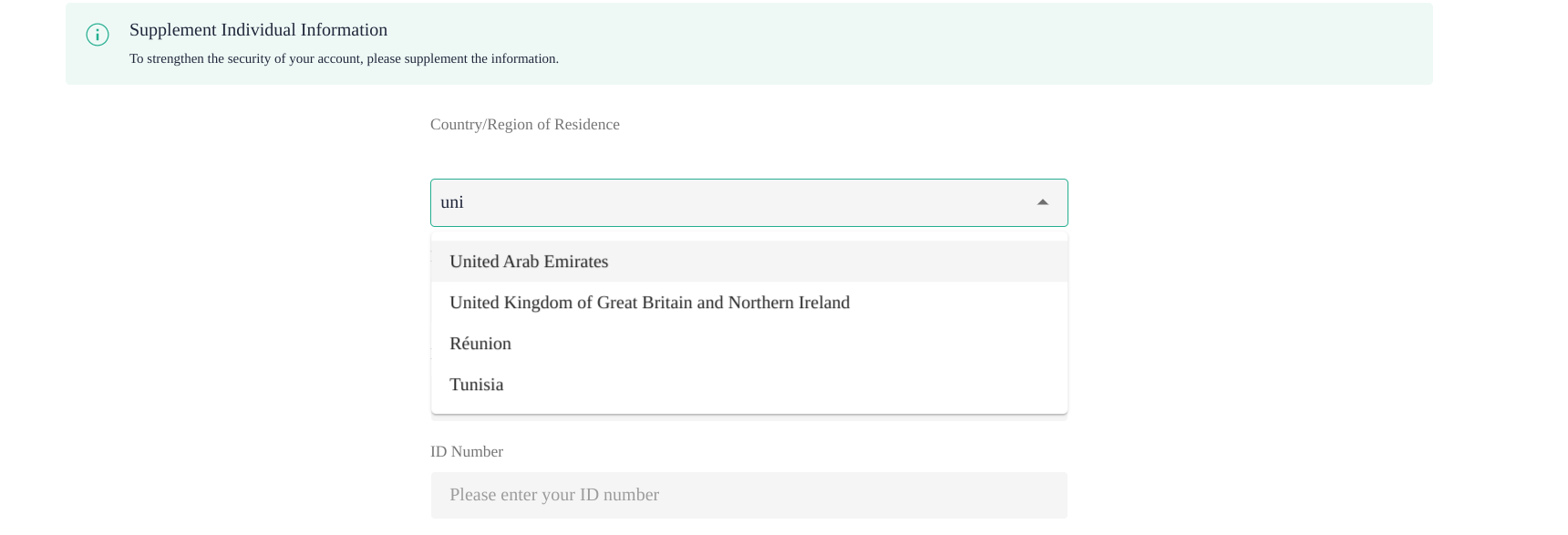

Unfortunately, KuCoin isn't licensed yet to operate in the United States. That means U.S. residents aren't able to become verified users. If you try to go through the KYC verification steps, you'll notice that when you're asked to select your country of residence, the United States isn't an option.

All of this means that U.S. residents are more restricted in what they can do on the KuCoin exchange compared to users that reside in other countries.

Are There Any Fees?

Like most crypto exchanges, KuCoin charges three primary types of required fees to its users. These fees are among the lowest in the industry.

Withdrawal Fees. Withdrawal fees vary based on the coin being withdrawn. On average, these fees translate to $1-$5 depending on the coin.

Maker fees. Maker fees are the fees charged to individuals who “make” or initiate an available trade on the exchange. The base fee is 0.1% of all trades. However, the fee can fall as low as 0.0125% depending upon KuCoin Shares balance and trading volume on the platform.

Taker fees. Taker fees are charged to the individual that fulfills another person’s order on the exchange. KuCoin charges industry-low base fees- starting at 0.1% of all trades. Discounts can cut the fee to 0.03%.

How Does KuCoin Compare?

KuCoin is less popular than Coinbase and Kraken, but it's an incredible exchange for altcoins. Crypto enthusiasts who want to get in on crypto “unicorns” may find that KuCoin is a great place to get in before a coin becomes hot. It also has excellent trading features, such as candlestick graphs and other visuals, and low fees.

However, if you live in the U.S. you may want to stick with an exchanges that's licensed to operate there such as Coinbase. KuCoin isn't nearly as flexible of a platform for users who haven't completed KYC verification. Plus, using a non-licensed exchange could lead to U.S. regulatory problems down the road.

Here's a quick look at how KuCoin compares:

Header |  |  |  |

|---|---|---|---|

Star Rating | |||

Trade Fees | Up to 0.10% | Up to 1.49% | Up to 1.50% |

Supported Currencies | 400+ | 100+ | 50+ |

US Licensed | |||

Mobile App | |||

Cell |

How Do I Open An Account?

To open a KuCoin trading account, you’ll first need to download the app or navigate to the website and choose to sign up. Users can start by providing their phone number and inputting the verification code that KuCoin sends. KuCoin uses Captcha to ensure that users are humans. In our test, it took less than 3 minutes to create an account.

To verify their identity (in countries where KYC verification this is available), users will need to provide a form of photo ID and a handwritten note. The handwritten note should include your name, the most recently generated code, and the day's date. Instructions on all of this are given in the app. KuCoin requires multi-factor authentication for all verified users and gives users options once they're verified.

Is It Safe And Secure?

In September 2020, KuCoin suffered a cyber attack on their exchange. Hackers (possibly North Korean-based) stole $285 million in user access. However, the company’s quick response allowed it to recover most of the funds. And users who didn’t have their tokens restored were refunded through KuCoin’s insurance.

Despite the attack, KuCoin appears to have topline security and it allows rapid transfers from hot trading wallets to cold hardware wallets. This allows users to keep their funds safe. Overall, this is the exchange's biggest security feature.

Some App Store reviews claim that KuCoin is a scam. However, it seems like the negative reviews could be the result of a misunderstanding of how crypto works. KuCoin has begun active education campaigns to become more friendly to crypto newbies.

How Do I Contact KuCoin?

KuCoin is headquartered in Victoria in The Republic of Seychelles. Users who want to contact the support team can submit a request directly through the app or website, or they can initiate a live chat. Users can request support through [email protected].

Is It Worth It?

KuCoin may be the ideal trading platform for people seeking exposure to lesser-known altcoins. Its recovery from its 2020 hack also indicates that it's an exchange that can be trusted to make things right if future security breaches occur.

KuCoin also offers excellent perks such as the ability to lend USDT to earn interest. Overall, it's an excellent crypto exchange that's available in over 200 countries around the globe.

However, U.S. users may want to hold off on using KuCoin until it's able to obtain the proper licensing. And, regardless of residence, crypto newbies may prefer something easier to use like Coinbase since it specializes in onboarding new users.

KuCoin Features

Product Type | Crypto exchange |

Min Deposit | $0 |

Min Balance Requirement | $0 |

Interest Rate On Crypto Deposits | Varies by coin |

Lending Terms | 7, 12, or 28 days |

Trading Bots | Yes |

Margin Trading | Yes |

Futures Trading | Yes |

Staking | Yes |

Maintenance Fees | None |

Trade Fees | Maker orders: 0.125% to 0.10% Taker orders: 0.03% to 0.10% |

Deposit Fees | None |

Withdrawal Fees | Varies by coin and market performance (generally $1-$5) |

Supported Digital Assets | 400+ |

Supported Fiat Currencies | 28 |

Insurance | Yes, through Lockton |

Security | Aside from your password, account security enhancements include: |

Mobile App Availability | Android and iOS |

Desktop Availability | Yes |

Customer Support Options | Contact form and a helpdesk FAQ |

Promotions | Earn a bonus of up to 500 USDT |

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page, or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications including the New York Times, Washington Post, Fox, ABC, NBC, and more. He is also a regular contributor to Forbes.