As one of the largest cryptocurrency exchanges in the world, OKX, formerly known as OKXe, certainly has a lot going for it.

A wide variety of trading options and tools plus low trading fees makes it an appealing option for international traders. Plus, it has numerous passive earning options and DeFi integrations that make it stand out from your average exchange.

However, OKX isn’t available in the United States or Canada unlike many of its competitors. And past regulatory and legal issues have even prevented users from withdrawing funds in the past.

Let’s take a look at how OKX works, its pros and cons, and how to decide if it’s ultimately right for you in this review.

Quick Summary:

Pros:

Cons:

About OKX

OKX is a Seychelles-based cryptocurrency exchange that was founded in 2017. It’s one of the top 10 exchanges in the world, with over 50 million members across 100 countries, although the exchange isn’t currently available in the United States.

Like other major exchanges, OKX lets you buy, sell, and swap hundreds of tokens. It’s also known for some of its more advanced trading options, cryptocurrency bots, and earning programs.

OKX Features

As an OKX customer, you have several options for buying, selling, and swapping cryptocurrencies. And the exchange has numerous other features you can take advantage of to generate yield and expand your portfolio of digital assets.

1. Cryptocurrency Trading

At the time of writing, OKX supports trading for 350+ cryptocurrency tokens. This includes major tokens like Bitcoin and Ethereum as well as a wide selection of altcoins and stablecoins.

There are also several trading options on OKX depending on the currency you want to use and how much control you need:

- Express Buy: Quickly buy and sell cryptocurrency using 95 currencies and funds from your bank account or credit/debit card.

- P2P Trading: Set your own trading pairs and rates and trade with other members in the OKX community.

- Third-Party Payments: OKX lets you buy and sell crypto with popular payment gateways like Banxa and Simplex.

These trading options are quick and simple ways to convert crypto or fiat into your asset of choice.

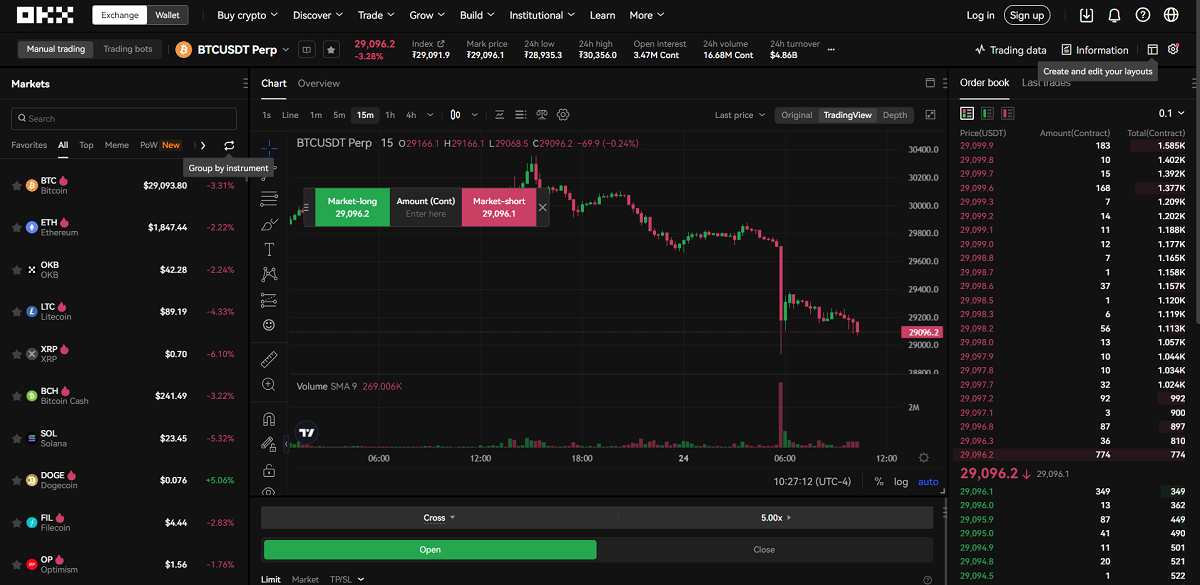

OKX also has a more advanced trading dashboard you can use if you want more technical indicators and market data. You can also place market and limit trades in addition to spot trading.

This structure is similar to exchanges like Coinbase in that there’s basic trading functionality for beginners but more advanced options for regular traders.

2. Copy Trading

One fairly unique OKX feature is its copy-trading option. This lets you mirror the trades of top traders on the OKX platform so you can theoretically enjoy similar returns.

Members on the copy-trading dashboard have a total win rate, 30-day profit and loss breakdown, and public asset-under-management information. This lets you find traders with similar strategies you’d like to emulate and guides you to do the same.

Of course, copy trading doesn’t guarantee similar returns, so you have to use your best judgment.

3. Crypto Bots

Another unique selling point for OKX is its support for crypto trading bots. These bots let you automate trading on the platform based on certain trading rules and levels of risk tolerance you have.

There are different types of bots as well, including arbitrage bots, volatility (grid) bots, and dollar-cost averaging bots. Like its copy trading, OKX also highlights bots with strong historical performance and long run-times. And I like that you can search for bots based on the assets they trade and total profit/loss ranges.

Just note that like copy trading, using a crypto bot doesn’t guarantee performance and can result in trading losses.

4. Derivatives & Margin Trading

With OKX’s portfolio margin option, you can trade margin, futures, options, and perpetual swaps from one single account.

You need to have at least $10,000 USD net equity in your account at all times to maintain margin. You also need to confirm that you understand how margin trading works, as well as the risks, since OXK doesn’t want inexperienced traders dabbling in this higher-risk form of trading.

Margin trading is a powerful way to increase your leverage. However, it’s not wise for beginner investors due to the potential for massive losses on bad trades.

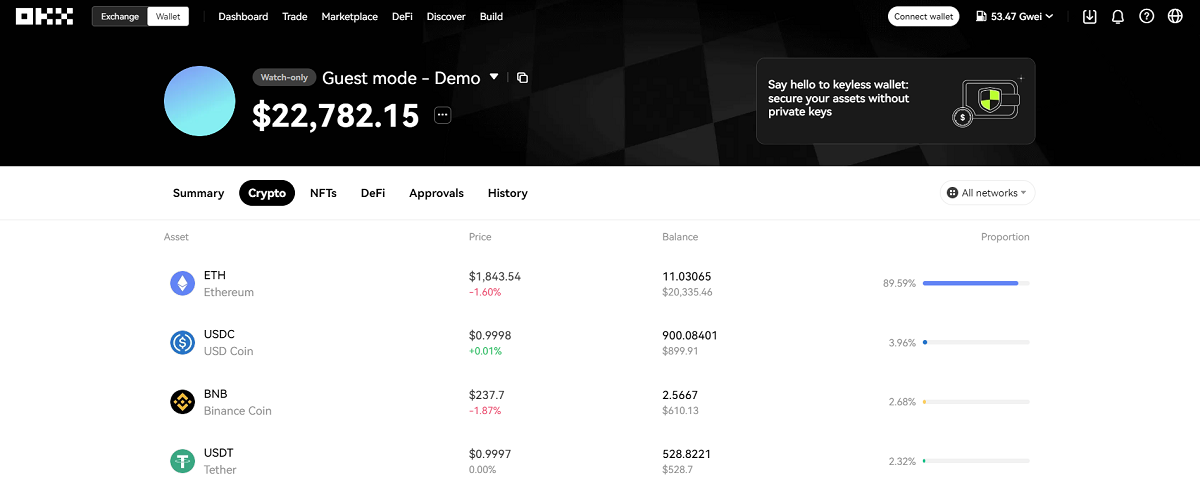

5. OKX Wallet

If you’re looking for a DeFi-friendly crypto wallet, you’re in luck with OKX. It has its own digital wallet that’s available via a mobile app, desktop app, and on Google Chrome.

This wallet lets you consolidate all of your digital assets under one roof, including cryptocurrencies and NFTs. It’s really an easy portal to Web3, letting you access thousands of DApps and dozens of blockchains.

I also like that OKX’s wallet works with 10+ NFT marketplaces so you can create and trade NFTs from your OKX wallet.

6. Crypto Earning

With OKX Earn, you can earn passive income with your digital assets. There’s a variety of products under the Earn umbrella to choose from, including:

- Simple Earn: Earn up to 10% APY by depositing tokens and stablecoins like USDT and USDC in flexible contracts.

- Structured Products: These investments earn interest based on derivative markets and have various levels of risk and yields.

- On-Chain Earn: Generate yield by leveraging DeFi protocols and lending pools.

Some tokens and stablecoins have APRs ranging from 5% to 15% or even higher depending on the asset. And OKX makes it simple to deposit and begin earning without needing any technical knowledge.

You can also read our post on the best staking platforms for more ways to earn.

7. Loans

OKX lets you post your cryptocurrency and fiat as collateral to take out loans. You can take out loans with instant approval unlike going through a traditional lender, and you start at a 65% loan-to-value LTV ratio. And with APRs as low as 1%, it’s a cost-effective way to borrow against your assets.

This loan option can also help you take out tokens that generate higher-yields through OKX Earn.

8. OKB Chain

While this OKX feature doesn’t pertain to most investors, the OKX Chain is worth mentioning because it’s a pretty unique element for an exchange to have,

The OKB Chain is OKX’s “Ethereum scaling solution” that lets developers create more scalable, decentralized applications. And since it’s tied to the main OKX exchanged, it’s easy for DApps on its ecosystem to integrate with OKX’s integrations and tools.

OKB is also the network’s native token, and you can gain trading discounts and earn through OKX Earn as a token holder.

OKX Pricing & Fees

OKX doesn’t charge account management fees or monthly membership fees. You don’t pay deposit fees either, except for the gas fees you pay for on-chain transactions.

As for trading fees, OKX charges variable amounts depending on the type of trades you’re making and your 30-day trading volume.

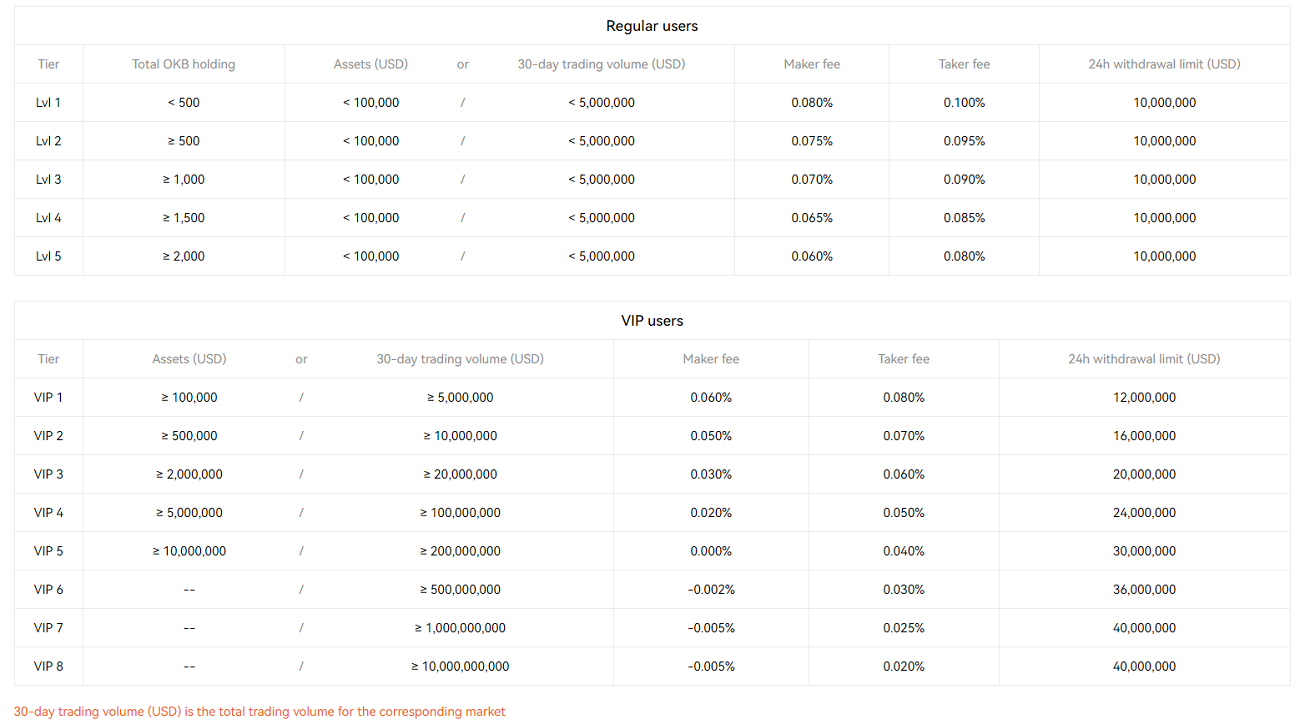

Here’s a look at OKX’s fee structure for spot trading:

As you can see, Level One users trading less than $100,000 per 30 days have a 0.080% maker fee and 0.10% taker fee.

However, you gain VIP status and trading discounts if you hold over $100,000 in assets and trade more than $10 million in a 30-day period.

This program rewards serious, high-volume traders and isn’t exactly beginner-friendly. That said, OKX’s base maker/taker fees are still competitive with other major exchanges.

OKX Alternatives

With low fees and a wealth of features, it's clear why OKX is one of the world's leading exchanges.

However, OKX isn't available in the United States or Canada. And there are several alternatives worth considering if OKX isn't available to you or if you don't want such advanced trading features.

- Binance: Binance is the world’s largest cryptocurrency exchange that also has competitive earn products, loans, and trading bots.

- Cake DeFi (bake): A comprehensive platform for generating yield.

- Coinbase: Another leading exchange that’s available in the United States unlike OKX and is very beginner-friendly.

Account Opening Process

You sign up for OKX using your email address or by logging in with Google or Telegram. From there, you verify your email address and create a password to finish signing up.

OKX then requires account verification to help protect its exchange from fraud. There are two levels of verification you must complete to access the exchange’s features:

- Level One: Verify your identity by providing information like your name, address, date of birth, and a type of government-issued ID.

- Level Two: Upload your ID and a selfie to finish confirming your identity.

Verification takes up to 24 hours according to OKX. This process is standard these days for centralized exchanges as they generally follow some type of KYC compliance.

If you value privacy too much to use OKX, decentralized options like Bisq and Uniswap are better alternatives.

Safety & Security

OKX has several processes in place to help increase security for its customers. Some of these processes include:

- Holding 95% of funds offline in cold storage

- Creating several backups and having storage limits on wallets

- Keeping private key backups in secure bank vaults

- Using multi-sig wallets when hot (online) storage is necessary

OKX’s security page does an excellent job at outlining its security measures and philosophy for different areas of the business. I actually found it to be the most informative security page out of any exchange I’ve used or researched.

OKX also has a “risk shield” program in which it deposits a percentage of earnings to create a reserve it can use to help mitigate risk.

However, customers should note that OKX’s founder Mingxing Xu has been detained by Chinese authorities in the past. In 2020, this caused OKX to temporarily pause exchange withdrawals, so regulatory concerns are very real with this exchange like any other.

Customer Service

OKX also has a Discord server where you can get in touch and ask questions. For more serious account issues, opening a ticket is also how you can get in touch.

The Bottom Line

If you’re an international cryptocurrency investor who wants advanced trading tools, bots, and earning programs, OKX is a compelling choice. And when you consider it has some of the lowest fees in the business, it’s clear why this exchange is so popular.

However, OKX certainly isn’t for everyone. If you’re brand new to digital assets or want stellar customer support, look elsewhere. And avoid putting all of your eggs in this basket, like any exchange, to reduce the chance regulatory or insolvency risks lock up your funds.

Tom Blake is a personal finance writer with a passion for making money online, cryptocurrency and NFTs, investing, and the gig economy.