If you’re looking for a gateway into the world of cryptocurrency or a new place to buy, store, and earn from your crypto holdings, you may want to know about Cake DeFi.

Cake DeFi is a decentralized finance (DeFi) company that can act as an important part of your crypto portfolio, particularly if you’re looking to earn interest from staking without going through the hassles of running your own digital wallet.

Here’s a closer look at how Cake DeFi works so you can decide if it’s a good fit for your unique crypto-investing needs.

What Is Cake DeFi?

Note: This DeFi platform is not open to users in the United States.

Cake DeFi is a cryptocurrency platform that specializes in crypto staking and other yield-generating products. The company began in 2019 and is based Singapore. It aims to be a one-stop platform for your cryptocurrency with strong levels of transparency to keep customer assets as safe as possible.

As of 2022, the company claimed over one million users from 190 countries. In 2021 alone, the company paid $230 million in cryptocurrency rewards from staking and other DeFi investment activities.

As the size of your account grows, you may qualify for the VIP program. VIP users pay lower fees and earn other benefits, like additional rewards and yield rates.

Cake DeFi Features

The main reason to use Cake DeFi is to put your crypto to work in some form to generate yield. Alternatively, you can also borrow against your crypto holdings to access more capital.

If you sign up for Cake DeFi, these are the main features that you have access to on the platform:

As with other DeFi products, Cake DeFi enables you to enter risky transactions with risky holdings.

While we love crypto and hope you earn enough to buy a Lamborghini, there’s a serious risk of losses. Never invest more than you can afford to lose in cryptocurrency.

Cake DeFi Pricing & Fees

Cake DeFi may help you earn a yield, but the company also has to make money somehow.

Here’s a look at pricing and fees at Cake DeFi so you know what to expect:

- Deposit Fees: CakeDeFi doesn’t charge any deposit fees. You can fund an account with any supported crypto and Cake DeFi won’t charge a fee on those deposits.

- Reward Fees: When you earn rewards through staking, you pay 10% of your earnings to Cake DeFi as a fee. For DFI, DASH, and MATIC, you pay 15% of the rewards you earn as a fee.

- Withdrawal Fees: As with many other crypto platforms, you have to pay a fee to liberate your currency to your external hardware or software cryptocurrency wallet. You pay a flat fee for each currency you withdraw in that currency. Withdrawal fees cover blockchain fees, plus a little more for Cake DeFi.

- Borrowing Fees: If you use cryptocurrency as collateral for a DUSD loan, you pay 5% APR plus a 0.5% origination fee.

Fees are also required for swaps. They’re not publicly listed, but you can see your specific fee before entering a transaction. VIP users save on swap fees among other costs.

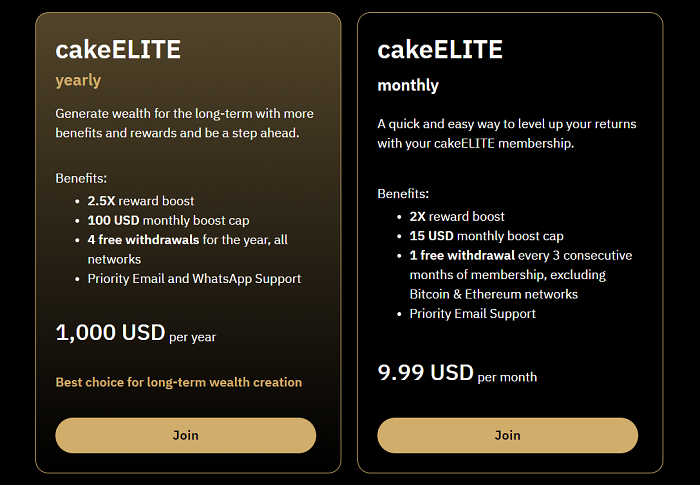

cakeELITE Program & Pricing

cakeELITE is a subscription membership program. Monthly members pay $9.99 per month and get a 2x rewards boost and priority email support. For $1,000 per year, Yearly plan members earn 2.5x rewards and have priority support through email or WhatsApp.

With large accounts, these add-ons could make sense. But for the typical crypto users who is speculating with a small portion of their assets, you can skip paying extra for cakeELITE.

Cake DeFi Alternatives

While Cake DeFi isn’t a traditional exchange, it offers competing features with several top exchanges and other DeFi companies.

However, the DeFi landscape changes quickly, so you’ll always want to keep close tabs on anyone holding your crypto outside of a wallet you control. Additionally, you can explore other Cake DeFi alternatives if you want to shop around for different staking providers and lending rates.

Here's a breakdown of some of our top CakeDeFi alternatives:

Cell | |||

Supported Coins | 40+ | 350+ | 250+ |

Staking Rewards? | Yes | Yes | Yes |

Best For | Easy staking and yield generation | Overall crypto exchange | Crypto rewards card and earning programs |

Cell |

You can also check out our list of the top cryptocurrency exchanges here. For other DeFi options where you can earn interest from cryptocurrency, here’s our list of the best crypto savings accounts.

Cake DeFi Account Opening

Opening an account is similar to doing so with many other cryptocurrency exchanges. You’ll need to set up a username and password and some personal information to open a fully functioning account.

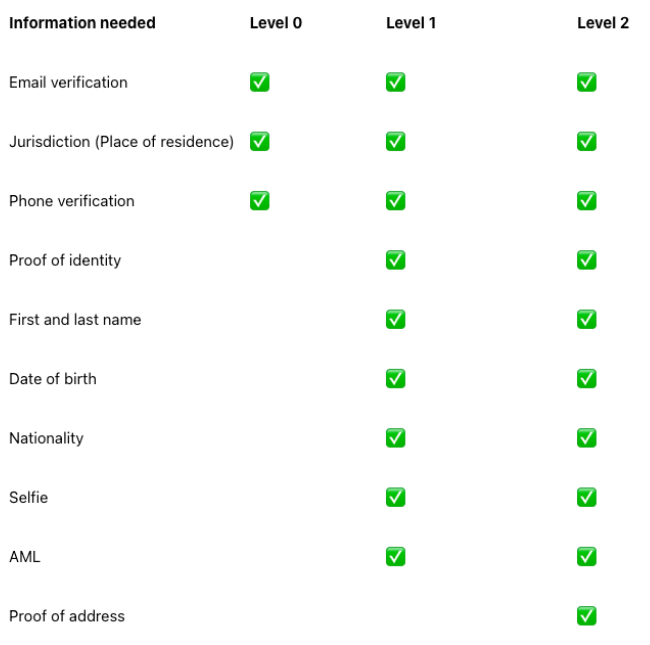

Once you verify your email, you must submit additional information to unlock all features. The site uses three Know Your Customer (KYC) verification levels. At Level 0, you can explore the platform but can’t transact. Level 1 verification opens up all features with a $10,000 monthly withdrawal limit. At Level 2, you can withdraw without limits.

A phone number, copy of your ID, picture of you holding your ID, birthday, and other personal information are required for Level 1 and Level 2 verification.

Safety & Security

Cake DeFi doesn’t have any history of hacking or major customer losses. As with all crypto platforms, there’s always some risk when you don’t hold the keys to your crypto.

If Cake DeFi runs into trouble, you may be unable to withdraw. Hopefully, however, they stay far away from what happened with FTX and other crypto scams.

To keep your account safe, follow online best practices for account security. That includes a unique password that’s not used on any other account. Two-factor authentication is required for many transactions, such as withdrawals.

And, of course, don't hold all of your digital crypto eggs in one basket. You want to diversify your portfolio with different tokens, but also hold them on your own wallet where you have control.

Cake DeFi Support & Customer Service

Past customers are happy with their Cake DeFi experience. On TrustPilot, the site holds an impressive 4.8-star rating with about 1,700 reviews. While most reviews are very good overall, the few complaints are serious, such as not being able to withdraw or access account funds.

The only way for most users to reach the company is through an email support form. Some VIP users with high account balances get faster responses. If you reach one of the top VIP tiers, you can get live chat support through WhatsApp.

Pros & Cons

Pros:

Cons:

The Bottom Line

In conclusion, Cake DeFi offers a comprehensive platform for cryptocurrency investors looking to diversify their holdings and generate yield through various DeFi strategies.

With its transparent approach, multiple yield-generating products, and a full cryptocurrency ecosystem, it is an attractive option for users in the 190 countries it serves. However, it's essential to consider the inherent risks involved in using any DeFi platform, including the possibility of not being able to withdraw or liquidate funds and the steep fees on rewards.

Despite these drawbacks, Cake DeFi has received positive feedback from its users and maintains a high rating on TrustPilot. Although it is not available to users in the United States, those who can access it may find it a valuable addition to their cryptocurrency investment toolkit.

As always, investors should carefully research and assess the risks involved before participating in any DeFi platform, including Cake DeFi, and only invest what they can afford to lose.

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment. His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, HuffPo, Investor Junkie, and other fine financial blogs and publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.