USD Coin (USDC) and Tether (USDT) are among the most popular cryptocurrencies in the world, both ranking in the top five by total market value.

USDC and USDT are also stablecoins, meaning that the value of each coin is always worth exactly one dollar.

However, each works differently and has a different history, so it’s important to understand what you’re buying and holding before buying either coin. That's why our USDC vs USDT breakdown is covering the similarities and differences investors must know.

USDC Vs USDT - At A Glance

What Is USDC?

USD Coin, often referred to by the cryptocurrency ticker symbol USDC, is a cryptocurrency token created and managed through a partnership with Coinbase.

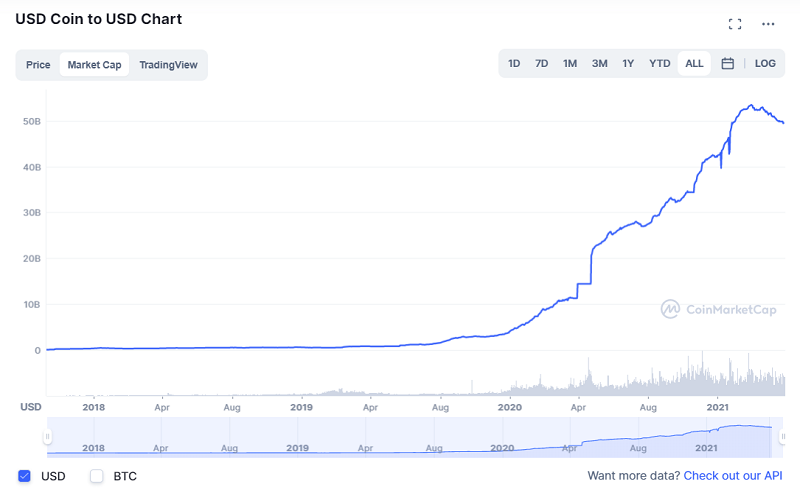

USDC is always worth one U.S. dollar and ranks as the second-largest stablecoin and fifth-largest cryptocurrency overall by market capitalization, according to CoinMarketCap. As of this writing, nearly $50 billion USDC are in circulation.

Image courtesy of CoinMarketCap.

USDC is officially run by the Centre, a joint project that includes Circle and Coinbase, one of the largest cryptocurrency exchanges in the world. USDC is backed by funds held in segregated accounts. Centre publishes monthly audit reports from reputable public accounting firm Grant Thornton attesting to these reserves.

A recent report stated that on February 28, 2022, the total 53.5 billion USDC circulation was supported by at least $53.5 billion in “US Dollar denominated assets held on behalf of USDC holders.”

USDC is also a multi-chain currency that works natively with the several blockchains, including:

You can also buy, sell, and send directly to other Coinbase users without any fees using a Coinbase account. Several other prominent exchanges offer fee-free or low-fee transactions with USDC and other stablecoins.

What Is USDT?

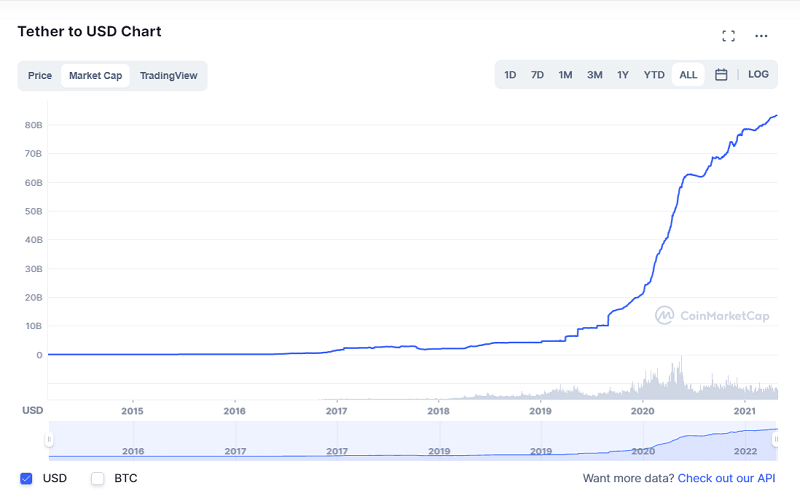

Tether, often called USDT, is the third-largest cryptocurrency by market capitalization and the largest stablecoin, with over 85 billion in circulation.

This makes Tether nearly twice as large as USD Coin, the most significant competitor. Like USDC, Tether is also pegged to the United States dollar on a 1-to-1 basis.

Image courtesy of CoinMarketCap.

However, Tether isn’t just for dollars, though that’s the version we’re focused on here.

The same company also supports stablecoins tied to the Euro, Chinese Yuan, and physical gold. USDT is closely related to the Bitfinex exchange, and the relationship has led to allegations of wrongdoing (more on that below).

Tether publishes reports explaining how reserves are held and invested, more than 80% cash and cash equivalents. For 2021, reserves were audited and reported by Moore Cayman and MHA Cayman, Cayman Islands-based branches of the Moore Global accounting firm.

As of April 20, 2022, the Q1 2022 report is unavailable. The latest version from December 31, 2022, indicates a total of 78 billion USDT backed by assets exceeding liabilities related to the USDT token.

Like USDC, USDT is a cross-blockchain token that works with popular blockchains like:

- Algorand

- Bitoin Cash

- Ethereum

- EOS

- Liquid Network

- Omni

- Simple Ledger Protocol

- Tron

USDT transactions often get discounts on significant crypto exchanges, similar to USDC and several other top stablecoins.

UDSC Vs. USDT - The Similarities

Aside from the companies that run them behind the scenes, USDT and USDC are almost identical cryptocurrency products.

For the typical user, there’s no practical difference between them. If it works in your cryptocurrency account or with the blockchain you’re using, a dollar of USDT is more or less equal to a USDC.

These are some of the most significant similarities between USDC and USDT:

- Always Worth $1: USDC and USDT are pegged to the dollar. If you have 100 USDC, 100 USDT, or $100 USD, the value is practically the same.

- Audited Reserves: The companies behind USDC and USDT employ outside auditors to verify and report on reserves and assets backing the currency.

- Cross-Chain Compatibility: USDC and USDT work across numerous blockchains. Both work on Ethereum, Algorand, Solana, and Tron. Each also works on a few different networks not supported by the other.

- Discounted Trading Fees: Depending on the exchange, you could find lower trading fees when buying or swapping with stablecoins than traditional cryptocurrencies.

- Interest & Staking Rewards: As these currencies are always worth $1, there are in demand by decentralized finance (DeFi) applications. Various crypto savings accounts even let users stake either stablecoin (the cryptocurrency version of making a bank deposit or opening a CD) to earn interest or other rewards.

There are so few differences between USDC and USDT that we don’t need to do a differences section. There wouldn’t be enough to include!

However, the one main difference between USDC and USDT are the controversies surrounding the trustworthiness of each currency, notably Tether.

Controversies & Security Concerrns

You don’t have to search hard to find past government actions regarding Tether.

For starters, the Commodity Futures Trading Commission (CFTC) fined Tether and Bitfinex over misleading holders that Tether was fully backed by United States dollars and processing illegal trades. In New York State, Bitfinex was banned from operating and fined for overstating reserves and hiding $850 million in global losses. This isn’t a good track record.

Some have gone so far as to accuse Tether of creating a new currency without reserves to enrich the founders and managers of the Tether and Bitfinex operations. Whatever is going on leaves a lot of questions about trust.

Personally, I would rather hold USDC audited by Grant Thornton and backed by Coinbase than hold Tethers that may be part of a giant fraud. Tether poses a severe risk to the entire cryptocurrency ecosystem if it turns out to be doing anything shady.

And I trust those Cayman Island accountants about as much as I trust Arthur Anderson. In short, keep trust and verified reserves in mind when making your investment and stablecoin decisions.

Should You Buy USDC Or USDT?

Stablecoins have a lot of utility, and USDC and USDT are the two largest stablecoins out there. This naturally begs the question: should you invest in either coin?

Since USDC and USDT are pegged to the dollar, there's no point in buying them in hopes of appreciation. Rather, you have to consider the world of decentralized finance (DeFi) and what opportunities these coins present.

For many holders, USDC and USDT are an easy, predictable way to generate staking rewards. You can buy either token, stake them on an exchange like Binance, and earn passive income. Similarly, crypto interest products from companies like BlockFi and Celsius also let you deposit either coin to earn interest.

Even online FinTech companies and banks are getting in on the action. For example, you can deposit USDC with OnJuno, a mobile crypto and banking platform, and earn 6% APY.

And, as mentioned, using stablecoins like USDC or USDT to trade on exchanges can sometimes lead to lower trading fees.

So, before deciding to buy either coin, think about the utility they have and if you're actually going to benefit from either one.

And never put all of your eggs in a single basket. USDC seems more trustworthy than USDT. But you should still diversify your crypto holdings and consider your overall crypto asset allocation versus your entire portfolio as well.

The Bottom Line

Stablecoins offer many valuable benefits, including keeping your funds in the cryptocurrency sphere without the volatility and risk associated with currencies like Bitcoin and Ethereum.

Stablecoins are also useful for sending payments to others, holding funds in a cryptocurrency exchange, or earning interest through staking. As long as you understand the risks and benefits, stablecoins can be a helpful part of your crypto investment strategy.

And, hopefully, our USDT vs USDC breakdown helps you understand the key similarities and differences between these stablecoins so you can make the right investing decision.

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment. His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, HuffPo, Investor Junkie, and other fine financial blogs and publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.