Ethereum gas, or ETH gas for short, is the term for transactions fees on the Ethereum network.

Anyone who enters a transaction on the Ethereum network pays fees to the miners who track transactions in the form of Ethereum gas.

Keep reading to learn how Ethereum gas works, why fees get so high, and how you can keep costs under control while using cryptocurrency.

What Is Ethereum (ETH) Gas?

Simply put, Ethereum gas is a fee charged for transacting on the Ethereum network. If you send or receive Ethereum or any related asset, Ethereum gas is involved. Ethereum is sometimes abbreviated ETH, so you may see Ethereum gas referred to as ETH gas.

The Ethereum blockchain operates around the clock, supporting transactions for the Ether currency, NFTs, and many other cryptocurrency tokens. Behind the scenes, the Ethereum blockchain is a network of computers, called miners, competing to verify the next block of transactions. These computers get paid for their work in the form of Ethereum gas fees.

Basically, think of gas as a transaction fee - just like a credit card may have a transaction fee.

On the Ethereum blockchain, gas fees are paid using Ether, the native Ethereum currency. If you’re trading a currency or NFT on the Ethereum blockchain, you’ll need Ether in your wallet to cover the gas costs.

How ETH Gas Fees Are Determined

Ethereum gas fees vary based on network congestion. If there’s excess mining capacity and fewer transactions, gas fees go down. If there’s less capacity and more demand for transactions, fees go up.

Every block has a base fee and a priority fee. Depending on the transaction, you may have an option to pay a little more for a faster transaction or pay a little less for a slower transaction. Smart contracts are more calculation-intensive than simple currency transactions, so you may see higher fees when trading NFTs and other smart contract tokens.

Your wallet should show you estimated fees before entering a transaction, so there should never be any surprises once you enter a transaction. Make sure to pay attention to fees when setting up your transaction before hitting the submit button.

Why ETH Gas Costs Can Get So High

Ethereum transactions are verified in groups at a time called "blocks." A new block is committed to the blockchain roughly every 15 seconds.

Each block can only handle a certain number of transactions. So when the Ethereum network gets busy, transactions can get backed up and put on a virtual waiting list for an upcoming block. When the network is busy and the value of ETH goes up, the cost of gas goes up in dollar terms.

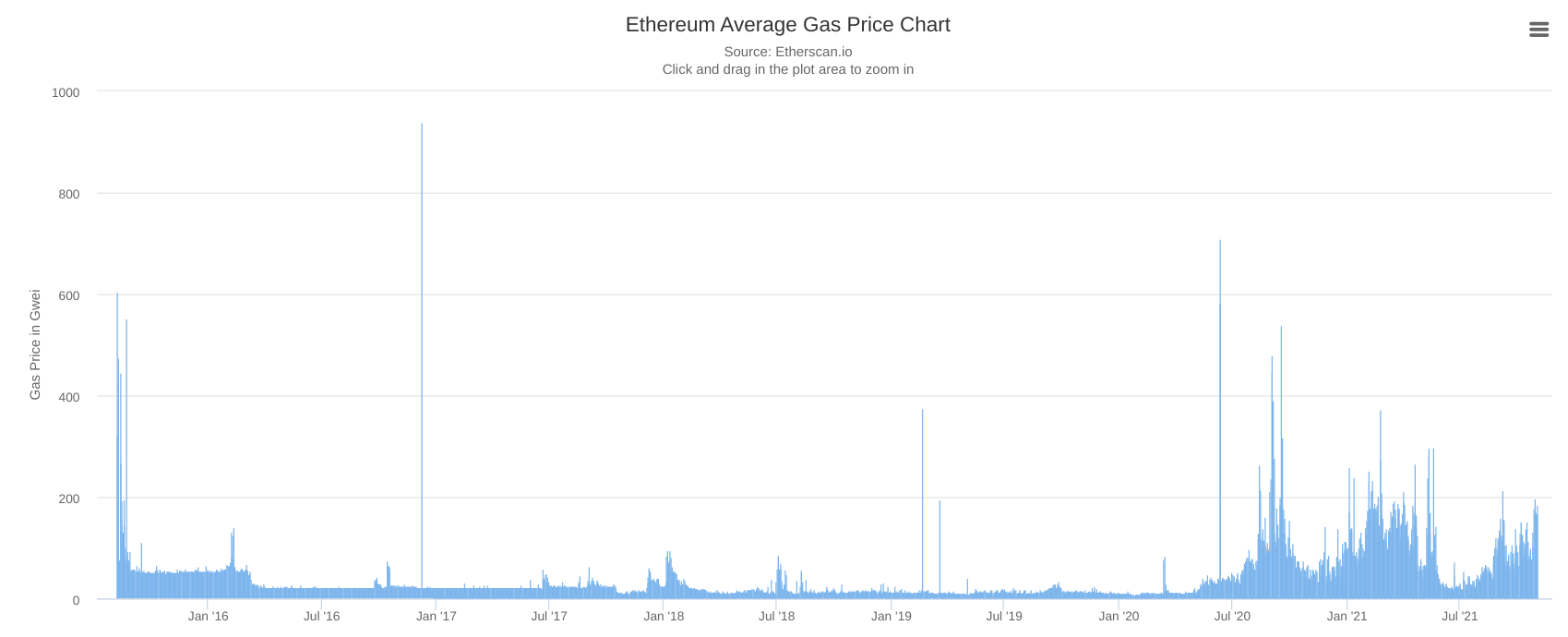

As the chart below from Etherscan.io shows, ETH gas costs stayed fairly steady from mid-2016 to mid-2020. But since then increased traffic has caused average prices to rise overall and has led to numerous spikes.

For regular Ether transactions, recent fees ranged from around $12 to $50. For an NFT, as of this writing, you may spend anywhere from around $60 to $400 of dollars to buy and receive an asset or around $300 to $500 when selling an asset.

Fees Should Go Down With Ethereum 2.0

The consensus mechanism (cryptocurrency jargon for an algorithm) behind Ethereum is based on a system called proof-of-work (PoW). With PoW, miners compete against each other to verify the next block of transactions. The big problem with this system is that, while it’s very secure, it’s also very inefficient.

Ethereum and older rival Bitcoin both rely on proof-of-work. Bitcoin recently earned headlines for using more electricity than many countries. Ethereum’s similar system is also energy-intensive.

The volunteer developer community behind Ethereum is upgrading the entire system to a consensus mechanism called proof-of-stake (POS). With PoS, miners work together to validate blocks, and those with the largest holdings in the network are given preference to validate the next block.

Proof-of-stake is much less energy-intensive and should lead to a much lower average gas fee. Cardano, Solana, and Algorand are popular cryptocurrencies already using PoS.

Lower-Cost Ethereum Alternatives

While Ethereum is the second most popular cryptocurrency, there’s no rule saying you have to use Ethereum and pay its high gas fees. Consider one of these other currencies for lower fees:

- Binance Smart Chain

- Cardano

- Solana

- Polkadot

ETH Gas Is A Cost Of Doing Business

Ethereum is part of a cryptocurrency ecosystem that’s could revolutionize how the world sends money and does business. In the meantime, high ETH gas fees are a growing pain paid for by Ethereum’s growing base of users.

If you want to use Ethereum, gas costs are simply the price of doing business. Planning ahead, being patient, and understanding how your favorite cryptocurrency exchange and wallet work can help you keep those costs under control.

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment. His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, HuffPo, Investor Junkie, and other fine financial blogs and publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.