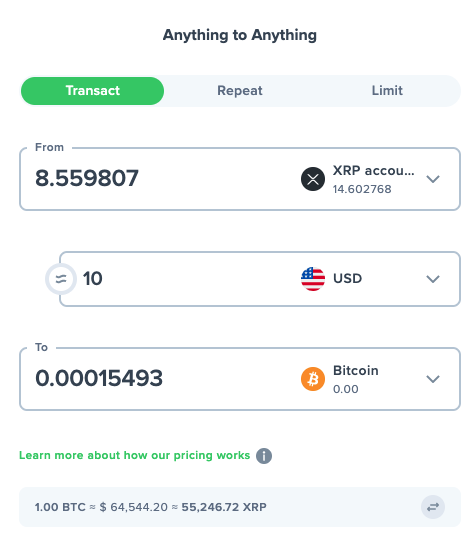

Uphold is a financial trading company supporting cryptocurrencies, precious metals, and fiat currencies. They claim to let you exchange “anything to anything,” swapping quickly between a wide range of assets.

It offers a quick and straightforward way to exchange and buy crypto assets. But is it the right cryptocurrency exchange for your needs?

Keep reading to learn more about Uphold, its features, and if it could be a good fit for your crypto trading goals.

Uphold Details | |

|---|---|

Product Name | Uphold |

Product Type | Multi-Asset Digital Money Platform |

Minimum Deposit | $10 |

Supported Cryptocurrenceies | 60+ |

Promotions | None |

Pros And Cons

Pros

Cons

What Is Uphold?

Uphold is a cryptocurrency, precious metals, foreign currency exchange that enables users to buy, sell, and swap between a long list of supported assets. We’re going to focus on the crypto side of Uphold, though it’s good to know about the other features if you’re interested in trading other assets.

Uphold supports 60+ cryptocurrencies and utility tokens for trading. Uphold is a rare exchange that offers the ability to trade Ripple (XRP) for users in the United States. It’s also noteworthy as a partner of the Brave browser where users can receive BAT token rewards.

Uphold Main Features

Uphold relies on a simple trading platform that’s easy enough for anyone with basic web and computer skills to use. It’s not super fancy but does an excellent job of making cryptocurrency investing accessible.

Plus, they make it a point to call out that they never lend your assets.

You can change between any supported currency using a simple form

It doesn’t offer much for advanced active trading. Instead, it sticks to doing one thing very well -- making it easy to change anything to anything among supported financial markets.

Uphold Pricing And Fees

Uphold doesn’t charge any commissions on trades or fees for ACH transfers. However, Uphold does have to make money somehow.

Trades

Uphold primarily creates revenue through adding a spread between purchase and sale prices on Uphold’s exchange. While fees are not hidden, spread fees make it feel like you’re trading for free, even if you’re paying a significant fee through spreads.

For crypto traders in the U.S. and Europe, spreads are typically around 0.8% to 1.20% on high liquidity cryptos like Bitcoin and Ethereum. Rates can be much higher for lower-liquidity coins and tokens.

Outside of crypto, Uphold charges a 3% spread on precious metals plus their supplier’s fee. For major fiat currencies, it charges a more modest 0.20%. If U.S. equities are available where you live, you’ll pay 1%, plus a small spread outside of regular market hours.

Deposits And Withdrawals

Cryptocurrency deposits to Uphold are free. But it's unclear how withdrawals are handled. On this FAQ page, Uphold says that it charges "0%" withdrawal fees. But the very next sentence says, "However, you'll pay for certain activities such a withdrawing funds to private wallets on crypto networks."

And then there's this page that lists a variety of fees that vary by where the funds are withdrawn to. Needless to say, this is all confusing and we'd love to see Uphold do a better job of providing a consistent message regarding withdrawal fees across its site.

If you want to send any asset to another Uphold user, transfers are completely free. This is a huge perk for international families who want to get around the costs of services like Western Union and Money Gram.

Assets Available At Uphold

Here's a quick look at what you can buy, sell, or trade on the Uphold platform.

Cryptocurrency Assets

- BTC

- BTC0

- AAVE

- BCH

- BAL

- BTG

- CSPR

- COMP

- CRV

- DASH

- DCR

- DGB

- DOGE

- DOT

- EGLD

- ENJ

- EOS

- FIL

- FLOW

- GRT

- HBAR

- XRP

- ETH

- FTM

- BAT

- HNT

- MIOTA

- LINK

- LTC

- LUNA

- MATIC

- MKR

- NANO

- NEO

- OMG

- OXT

- REN

- RUNE

- SAND

- SHIB

- SNX

- SOL

- SRM

- ADA

- ALGO

- ATOM

- AXS

- AVAX

- SUSHI

- THETA

- TRX

- VET

- WBTC

- UMA

- UNI

- UPBTC

- UPCO2

- UPT

- XCH

- NEM

- XLM

- XTZ

- ZIL

- ZRX

Note that you can trade XRP on Uphold even if you’re in the United States. XRP is not supported for those in the U.S. at many major exchanges.

Uphold is also a partner of Brave, an alternative browser based on the same software as Chrome, but with custom changes for added privacy and using cryptocurrency wallets. If you use Brave and opt-in to an advertising rewards program, you’ll get paid in Basic Attention Token (BAT) through an account at Uphold.

Other Assets

In addition to changing your local currency into cryptocurrency and swapping between any supported cryptocurrency, you can buy several other financial products. Uphold works with 27 national currencies (fiat currencies), including USD, EUR, GBP, and others.

For precious metals, you can buy gold, silver, platinum, and palladium.

How Does Uphold Compare?

If you're looking to trade between multiple asset types, Uphold is a strong option. It could also be a great choice if you often travel overseas.

However, if you're only looking to trade crypto and you rarely travel outside your country of residence, you might want to look for a platform that has a more transparent fee structure or can provide advanced trading tools.

Here's a quick look at how Uphold compares:

Header |  |  |  |

|---|---|---|---|

Rating | |||

Transfer Fees | Free Between Users | Free Between Users | Free Between Users |

Trade Fees | Vary by token | Vary by token | Up to 1.49% |

Supported Assets | Crypto, fiat currencies, precious metals, and more | Crypto and fiat currencies | Crypto |

Supported Currencies | 60+ | 20+ | 100+ |

Interest Accounts | |||

Cell |

Signup And KYC Requirements

Signing up for an account is relatively quick and painless. If you’ve opened multiple cryptocurrency accounts in the past, you’ll be familiar with the steps and required questions.

Plan to submit your contact information and a photo of your driver’s license or passport to activate your account fully.

Is Uphold A Good Choice For You?

Uphold is suitable for those who want an extremely simple trading experience that includes foreign exchange, cryptocurrencies, and precious metals. It’s a unique platform with a fun combination of assets.

Fees seem deceivingly low when using any exchange that only charges through spreads, so stay aware of what you’re paying. While it’s not ideal for expert or advanced traders, many beginners and casual crypto holders will find Uphold does the job well.

Uphold Features

Product Type | Multi-asset digital money platform |

Min Deposit | $10 |

Asset Types | Crypto Fiat currencies Precious metals And more |

Supported Coins | 60+ |

Supported Countries | 180+ |

Crypto Lending/Borrowing | No |

Staking | No |

Other Rewards Options | Get paid rewards in Basic Attention Token (BAT) for using the Brave browser |

Spread On Crypto Trades | Varies by coin. Typical spread in the U.S. for BTC or ETH ranges from 0.80% to 1.20% |

Maintenance Fees | No |

Deposit Fees | No |

Withdrawal Fees | Unclear |

Crypto Transfers | Free |

Supported Payment Types | Debit Card Wire Transfer |

Insurance | None for U.S. residents Crypto insurance policy for customers in Europe that protects against loss or theft due to a security breach |

Security | Aside from your password, account security enhancements include: - 2-step account verification - PCI/DSS certified |

Mobile App Availability | Android and iOS |

Web/Desktop Account Access | Yes |

Customer Support Options | Contact form and a helpdesk FAQ |

Promotions | None |

Uphold Disclaimer: Cryptocurrency investing within the EU/UK (by Uphold Europe Limited) and (USA by Uphold HQ Inc).

You should be aware that the risk of loss in trading or holding cryptoassets can be very high. As with any asset, the value of cryptoassets can go up or down and there can be a substantial risk that you lose all your money buying, selling, holding or investing in cryptoassets. Your cryptoassets are not subject to protection. You should carefully consider whether trading or holding cryptoassets is suitable for you in light of your financial condition. Uphold makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about Uphold.

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment. His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, HuffPo, Investor Junkie, and other fine financial blogs and publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.