Many people like the idea of decentralized finance (DeFi). And one of the main reasons is that it allows just about anyone to participate in ways that, in the past, were reserved to a select few.

Among the ways that it’s possible to participate in DeFi is by becoming a market maker on a decentralized exchange. You can contribute to a liquidity pool, providing others the ability to complete exchanges while earning money from the fees they pay.

However, impermanent loss is one of the concepts (and risks) that you have to be aware of when you decide to provide liquidity to others on a decentralized exchange. Let’s take a look at impermanent loss and how it affects your swaps.

Liquidity Pools And Automated Market Makers

First, it’s important to understand that many decentralized exchanges, like Uniswap, make use of liquidity pools and automated market makers to provide the needed volume of tokens to allow for the smooth operation of an exchange.

A liquidity pool functions as a place for an exchange. A common example is Ethereum (ETH) and DAI. With a liquidity pool, a set ratio is maintained using an algorithm. It’s important to note that the ratio is more important than the outside price of the assets in the pool. We’re going to use a simple example of how it works, with simple numbers, that might not reflect current market prices.

When you deposit into the ETH/DAI liquidity pool, the idea is that you have to deposit an equivalent value of ETH and DAI. Perhaps 1 ETH is the same in value as 100 DAI, according to the algorithm. When you contribute to the pool, you put in 2 ETH and 200 DAI. Because DAI is pegged to the dollar, that means that you’ve put a total fiat value of $400.

The other part of the equation is total liquidity. Others are funding the pool with ETH and DAI, with totals of 10 ETH and 1,000 DAI. The total liquidity in the pool is 10,000. Now, because you have 2 ETH and 200 DAI in the pool, you have a 20% share in the total liquidity.

Next, traders on the exchange will come to the pool to complete transactions. Every time they complete a transaction, you will get a share of the fees. Impermanent loss is the result of transactions that change the ratio in the pool, reflecting market prices. Let’s take a look at how that works next.

What Is Impermanent Loss In A Liquidity Pool?

Impermanent loss is the idea that you could have made more money by simply holding an asset, rather than adding it to a liquidity pool.

Let's say that while you have your ETH and DAI in the liquidity pool, the price of ETH increases. Instead of being worth 100 DAI, it’s now worth 400 DAI. Traders on the exchange are going to use your liquidity pool to make money on arbitrage. In order to do this, traders add DAI to the pool and remove ETH. Throughout the whole process, the liquidity must remain at 10,000. However, the ratio of ETH to DAI in the pool — maintaining that liquidity — will change.

At the end of the day, the pool now has 5 ETH and 2,000 DAI. The liquidity pool remains at 10,000 total, but now there are different numbers of ETH and DAI tokens. Because you are entitled to 20% of the pool, you could potentially withdraw 1 ETH and 400 DAI. Your new fiat value would be $800. You’ve doubled your money since you put in $400 originally — and that doesn’t even include the additional money made from transactions fees you earned.

However, if you’d just held onto those tokens instead of putting them in the liquidity pool, their fiat value would be $1,000 — a difference of $200. The difference between what you could have made by simply holding your tokens and putting them in the liquidity pool is your impermanent loss.

The idea here is that you “lost” $200 worth of value because your tokens were in the liquidity pool instead of just earning at the market rate.

Larger Positions = Larger Potential Impermanent Losses

When estimating impermanent loss, it’s important to realize that bigger positions and bigger changes in prices can lead to larger perceived losses.

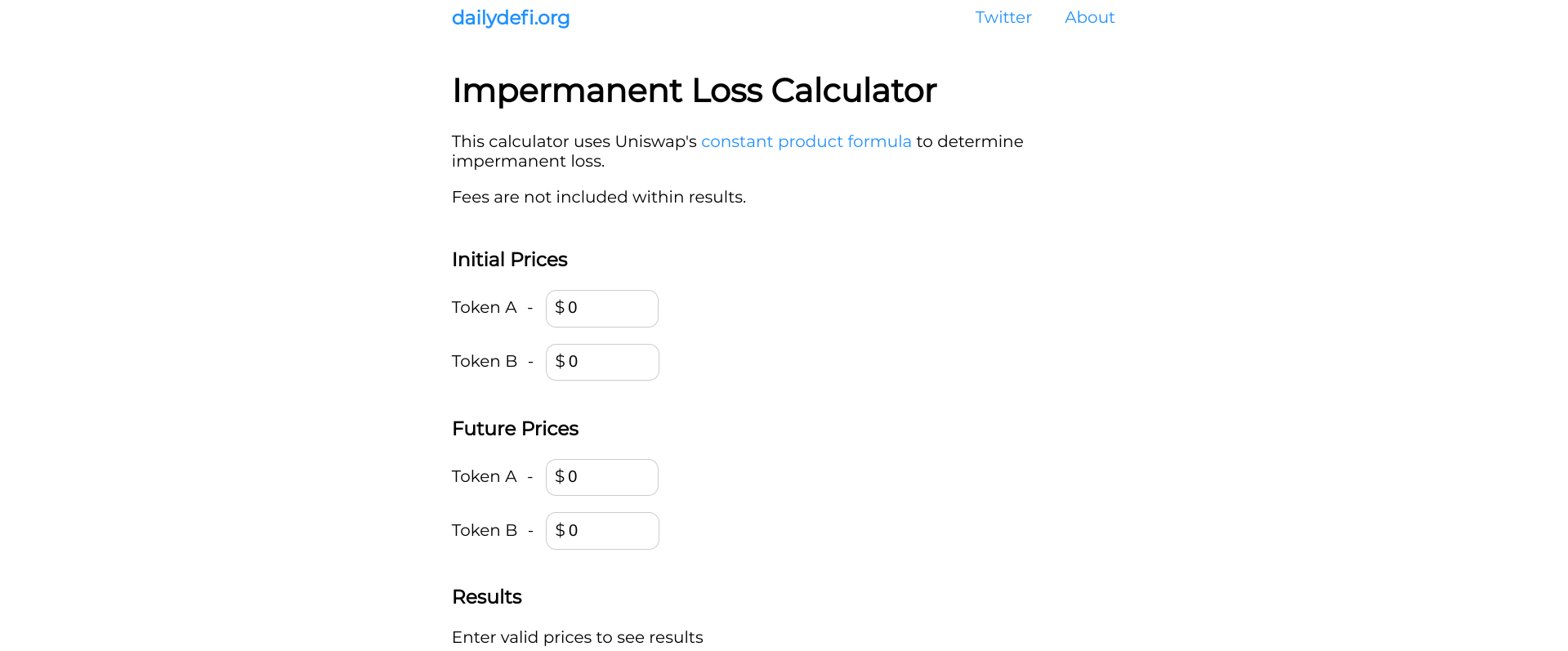

You should also understand that the direction of the price change doesn’t matter. Impermanent loss is about the fiat value of your assets when you deposit them into the liquidity pool and the price ratio you end up with later. There are a number of online calculators, like this one from dailydefi.org, that can help you estimate your impermanent losses and figure out what you could have made if you had kept your money out of the liquidity pool.

It's important to note that your impermanent loss calculation won't initially take into account any of the money you earned from transactions. When you contribute to a liquidity pool, you're entitled to your portion of the transaction fees charged by the decentralized exchange. So you'll want to determine whether some of your impermanent loss has been offset by what you earned in fees.

Another consideration is the potential for actual loss if the cryptocurrency tokens you have all lost in value. Impermanent loss is more like the idea that you could have earned more elsewhere, and not a true loss. In our example above, you still made a tidy profit, even if the profit wasn’t as big as it could have been if you’d done something else with your tokens.

However, DeFi (and cryptocurrency as whole) is still a new asset class. As a result, it’s hard to say what the future value of a token will be relative to fiat currency. If ETH and DAI both fall significantly without recovering, you could end up losing money, regardless of impermanent loss. Understanding this before you invest in cryptocurrency or become involved in DeFi is important. There are a lot of opportunities, but there are also several risks.

Understanding The Purpose Of Your Assets

When deciding how to use any assets, it’s important to understand how they fit in your overall financial planning and in your portfolio.

For some, the idea of putting tokens in a liquidity pool is to generate ongoing income. For these investors, impermanent loss is less important than harvesting a share of the transaction fees.

Perhaps you decide to put 20% of your crypto assets to work in a liquidity pool. You still have the remaining 80% available to generate capital returns based on the market. However, the 20% you put into the liquidity pool is providing you with additional tokens as you earn from the transaction fees.

This is similar to lending some of your tokens to others inside a crypto savings account. When you lend your crypto assets to others, the interest you earn provides you with income beyond waiting for capital gains.

When deciding if you want to participate in a liquidity pool, think about the purpose of your assets. Putting crypto assets into a liquidity pool may not necessarily magnify your profits. However, it can provide ongoing income and allow you to increase the assets you own over time.

Bottom Line

Don’t assume that participating in a liquidity pool is going to increase your capital gains. It certainly could. But if your impermanent losses end up being high, you may end up with less than if you had just held the asset separately.

Miranda Marquit, MBA, has been covering personal finance, investing and business topics for more than 15 years, and covering crypto topics for more than 10 years. She has contributed to numerous outlets, including NPR, Marketwatch, U.S. News & World Report and HuffPost. She is an avid podcaster, co-hosting the podcast at Money Talks News. Miranda lives in Idaho, where she enjoys spending time with her son playing board games, travel and the outdoors.