There are thousands of cryptocurrencies out there, and new projects spring up all the time.

However, not all cryptocurrencies operate on the same blockchain. In fact, there are many popular networks, like the Binance Smart Chain or Ethereum network, that these different coins are built on.

But what if you want to spend your Bitcoin like Ethereum, or move some USDC from the Ethereum network to the Polygon network?

This is where blockchain bridges come in handy. But before you invest across multiple chains, it’s important to understand exactly how blockchain bridges work and why this technology is critical for crypto’s success.

What Is A Blockchain Bridge?

A blockchain bridge connects two blockchains and lets users transfer data and tokens between chains. By connecting two chains, blockchain bridges provide interoperability, letting two different blockchains exchange information where it would normally be impossible.

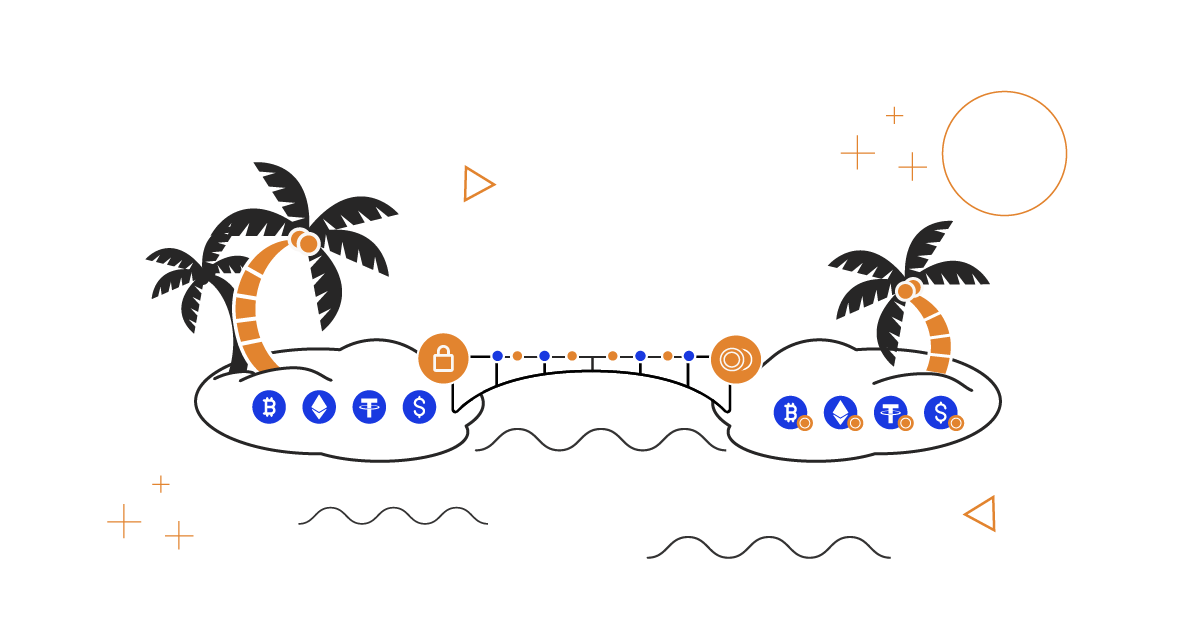

The simplest analogy for a blockchain bridge is to picture it as a bridge between two isolated islands.

Imagine you have Solana island, where tokens on the Solana blockchain like Solana and Serum operate. Then, you also have Ethereum island, where ERC-20 tokens like ETH and Chainlink exist.

Normally, these islands are isolated from one another and can’t exchange information. In other words, you can’t take your ETH tokens and use them on Solana island, or vice versa.

This lack of interoperability wouldn’t be an issue, but different blockchains have certain advantages over others.

For example, Solana is addressing some of the scaling issues of Ethereum and allows for much faster and cheaper transactions. Plus, what if there’s a lucrative staking opportunity on one blockchain, but all your crypto is tied up on another chain?

This is where blockchain bridges become incredibly useful and help provide cross-chain interoperability.

How Do Blockchain Bridges Work?

A blockchain bridge lets you move tokens between different chains. So, if you want to move your Chainlink to Polygon’s network to stake it or spend it, you can by using a blockchain bridge.

However, it’s important to note that your crypto isn’t technically “moving” when you use a blockchain bridge.

Rather, blockchain bridges typically use a mint-and-burn approach with smart contracts or centralized pools to give you an equivalent token representation on different chains.

In other words, you don’t really move your Bitcoin to the Ethereum network, but you can get a 1:1 ERC-20 token equivalent that represents that value of your Bitcoin.

The end result is generally the same with each bridge type, but it’s important to know the difference between each bridge type before using one.

Decentralized Blockchain Bridges

Decentralized blockchain bridges, also known as trustless bridges, rely on smart contracts to transfer tokens between blockchains. This means there’s no central entity like a crypto exchange or bank that helps move tokens around.

Let’s say you want to move some Dogecoin onto the Ethereum network to spend it more easily or lend it out using various decentralized applications (dApps) to earn interest.

Here’s how that process would unfold with a decentralized blockchain bridge:

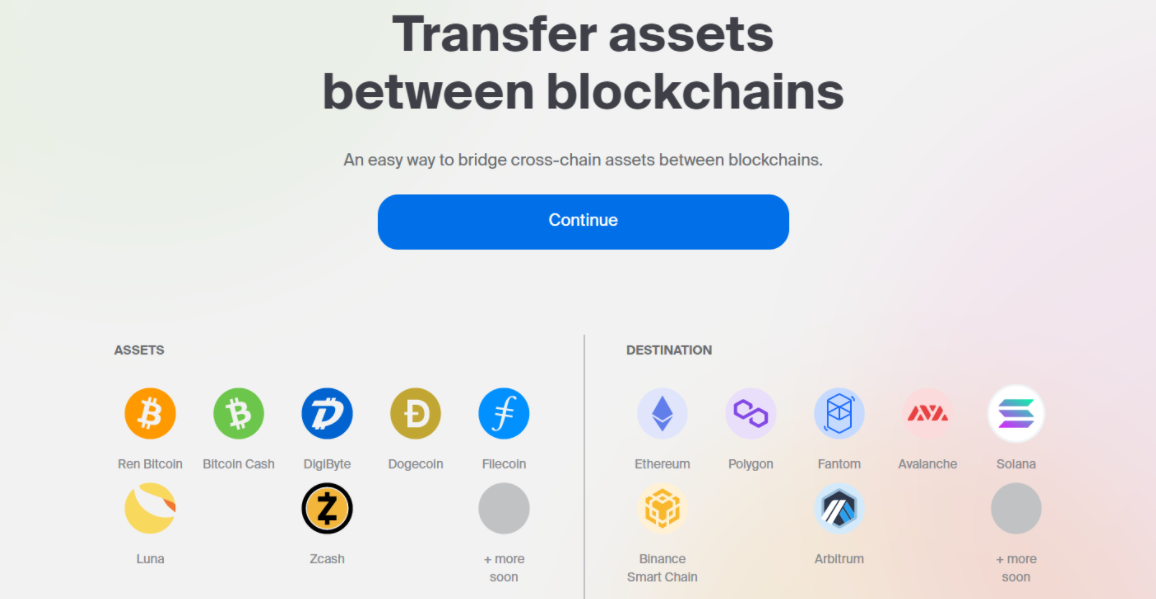

- You use a decentralized blockchain bridge like RenBridge to send your DOGE to the Ethereum network.

- RenBridge converts your DOGE into 1:1 ERC-20 tokens that are compatible with the Ethereum network. In this case, you get renDOGE.

- RenBridge freezes your original DOGE so you can’t double-spend your crypto on two different chains.

- You use your renDOGE, which is a ERC-20 token, with the Ethereum dApps you’re interested in.

- When you’re ready to get your DOGE back, RenBridge burns (releases) your renDOGE and gives you back your original DOGE.

RenBridge is decentralized, and all of this minting and burning happens by using smart contracts.

You still pay various fees, like a 0.15% fee per mint and 0.15% per burn, dynamic network fees, and ETH gas fees.

But in exchange, you can move cryptocurrencies like Bitcoin and Doge around, convert them into 1:1 ERC-20 tokens, and get way more flexibility for how you spend and leverage your crypto.

And this is just one example since RenBridge works with seven different blockchains:

- Avalanche

- Arbitrum

- Binance Smart Chain

- Ethereum

- Fantom

- Polygon

- Solana

Centralized Blockchain Bridges

Centralized blockchain bridges are similar to decentralized bridges except a central organization facilitates moving tokens around.

In this sense, centralized bridges are similar to cryptocurrency exchanges like Coinbase and Binance. You essentially deposit your cryptocurrency, request a token equivalent of a crypto on another chain, pay some fees, and you’re off to the races.

An example of this is the OKX Bridge, a system from centralized exchange OKX that lets you transfer crypto across different blockchains.

Advantages And Disadvantages Of Blockchain Bridges

Blockchain bridges help different blockchains communicate with one another. Considering that different blockchains have advantages over others, like security or speed, having more interoperability is good for crypto.

But blockchain bridges still have certain advantages and disadvantages investors should be aware of:

Advantages:

Disadvantages:

Examples Of Blockchain Bridges

It can be a bit confusing to research blockchain bridges since there are lots of centralized and decentralized options out there.

It’s always important to do your due diligence when using a blockchain bridge. This means reading reviews and forum posts about the bridge. It also means reading any whitepapers or information on the blockchain bridge that you can find.

With this responsibility in mind, some popular blockchain bridges you can research include:

- Binance Bridge: Convert crypto to and from the Binance Chain and Binance Smart Chain wrapped tokens.

- RenBridge: A trustless blockchain bridge that supports seven chains, including Ethereum and Solana.

- Multichain (AnySwap): Another trustless bridge that operates on the Fusion network that allows for cross-chain swapping.

- Polygon Bridge: Provides a way to transfer ERC-20 tokens and NFTs to the Polygon chain.

Are Blockchain Bridges Safe?

Blockchain bridges provide important interoperability for different chains. But crypto is still an emerging space, and there have been cases of bridge hacks in the past.

For example, crypto bridge Wormhole got hacked for around $320 million of Ethereum in early 2022. The hack was a result of an exploit in Wormhole’s validation process, so the hacker was able to mint 120,000 wrapped-Ethereum without having to back it with an equivalent amount of ETH.

Wormhole restored funds the following day, but this is just one example of how a leading crypto bridge can suffer a massive exploit.

Qubit Finance, an Ethereum-to-BSC bridge, had a similar experience and lost $80 million in January 2022. The hacker used the same minting exploit to generate qXETH without depositing any collateral.

These are extreme cases, but it goes to show that leading crypto bridges can lose tens or hundreds of millions in assets overnight.

This is the reality of cryptocurrency, and there are plenty of crypto and NFT scams out there as well as the threat of hackers. However, this doesn’t mean you shouldn’t use blockchain bridges. After all, the flexibility this technology provides is extremely useful for avid investors.

But, you need to do your due diligence when using any exchange or crypto bridge. You should also take charge of your own private keys by using your own cryptocurrency wallet.

Hardware wallets like Ledger or Trezor are two reliable wallets you can use. And, at the very least, look into software wallets like Exodus and MetaMask rather than parking large amounts of crypto on an exchange where you don’t control your private keys.

The Bottom Line

Cryptocurrency investing can get complex when you get into the technology behind the scenes. But it’s important to understand concepts like blockchain bridges if you want to be an informed investor.

Overall, blockchain bridges are increasing interoperability between different blockchains, which is great news for crypto’s long-term adoption.

And if you plan on investing across multiple digital assets on different chains, you might even need a blockchain bridge in the near future.

Tom Blake is a personal finance writer with a passion for making money online, cryptocurrency and NFTs, investing, and the gig economy.