Investing in cryptocurrency is an effective way to diversify your portfolio and take advantage of an emerging asset class. But, figuring out how to manage cryptocurrency taxes and gains can be a nightmare.

Software like CoinTracker helps you monitor your portfolio and taxable events so you’re ready to file. If you have capital gains or income from crypto staking or mining, this type of software can be handy for tax season.

Our CoinTracker review is covering all of the features, pricing, and how to decide if this crypto tax software is right for you.

Quick Summary

CoinTracker Details | |

|---|---|

Product Name | CoinTracker |

Product Type | Crypto Tax Software Crypto Portfolio Assistant |

Tax Software Pricing | $0 to $199/yr |

Integrations | 300+ |

Promotions | None |

Pros & Cons

What Is CoinTracker?

Figuring out how to file taxes on cryptocurrency has been a gray area for some time. As of 2014, the IRS treats virtual currencies like property for income tax purposes. This means you can incur short-term and long-term capital gains on your cryptocurrency. It also means expenses like gas fees or mining fees are potentially deductible.

Despite this complexity, there’s been an unfortunate lack of tax software that’s robust enough to handle this asset class. The need for robust crypto tax software is why Chandan Lodha and Jon Lerner founded CoinTracker in 2017. Since then, the company has grown to over 500,000 users who track over $20 billion in crypto assets

What Does It Offer?

There are numerous ways to create taxable gains on crypto. For starters, capital gains are possible when you buy and sell various cryptocurrencies like Bitcoin and Ethereum. You can also create ordinary income through cryptocurrency staking, mining, or by using lending companies like BlockFi and Celsius.

CoinTracker helps you manage your cryptocurrency gains and there are numerous features for portfolio management and tax preparation as well.

Crypto Portfolio Assistant

CoinTracker supports over 300 cryptocurrency wallets and exchanges, letting you sync your holdings with your CoinTracker account.

Integrations include popular exchanges like Coinbase, Binance, and KuCoin. As for wallets, you can connect hardware wallets like Trezor and Ledger or software wallets like MetaMask.

Once you sync your wallets and exchanges, CoinTracker consolidates this data in a performance dashboard. This dashboard outlines:

- Net deposits

- Net proceeds from selling cryptocurrency

- Total return

- The previous day of performance

- Coin diversity

Screenshot of the CoinTracker dashboard

CoinTracker also breaks out performance by each asset, so you can quickly view how a particular cryptocurrency is performing. Overall, it’s a sleek, easy-to-use crypto portfolio tracker that you can set up in under a minute.

Just note that you need to pay for CoinTracker to see all of the performance-by-crypto data. You also need to pay to adjust the time frame on your portfolio dashboard.

Capital Gains Tracking

While a portfolio assistant is a nice feature, CoinTracker isn’t as robust as software like Kubera that specializes in portfolio tracking.

Really, the main reason to use CoinTracker is for its tax features. CoinTracker organizes most of this data under its Tax Center tab. This tab includes a list of transactions and total capital gains.

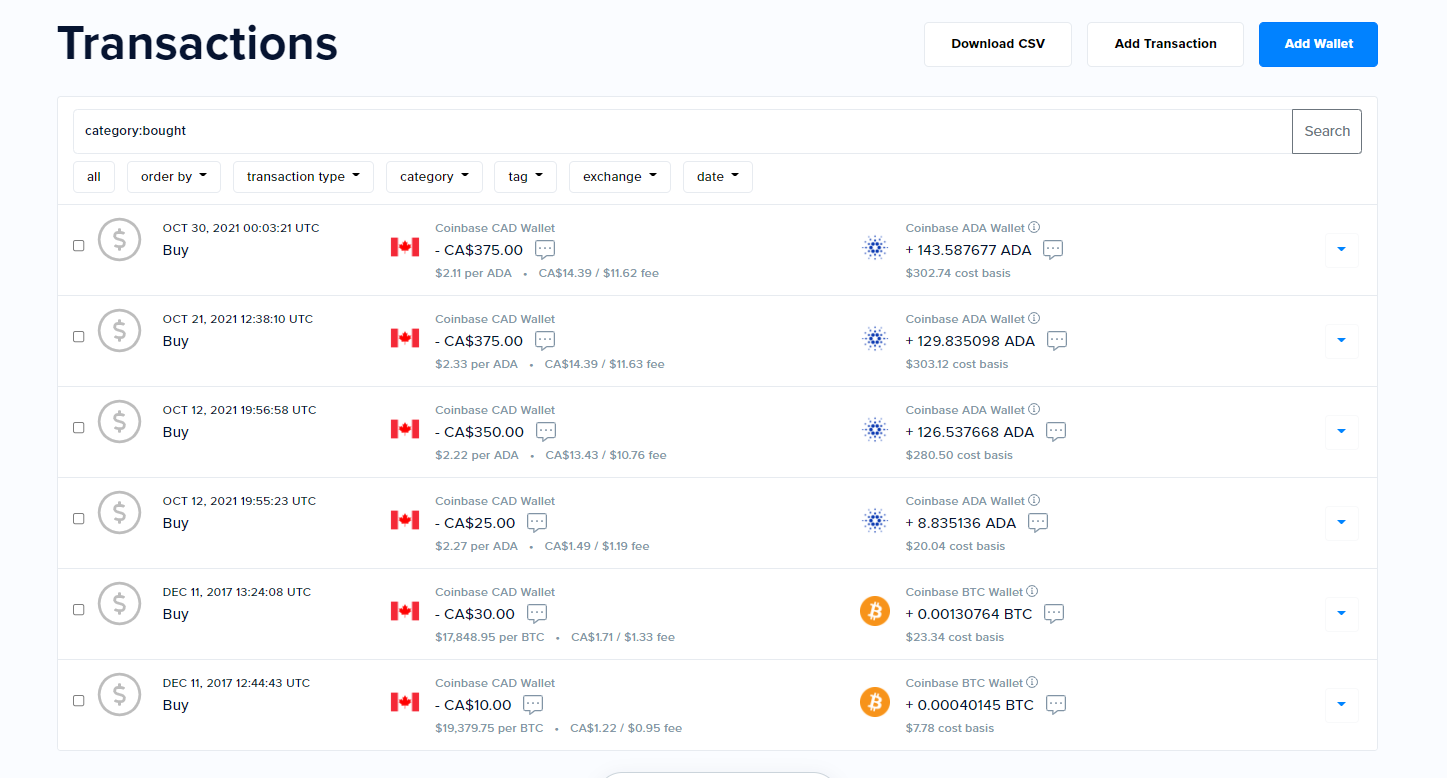

The transaction history tab is useful because you can also track how much you’re paying in exchange fees and the total value of your trades.

Screenshot of CoinTracker's transaction history tab

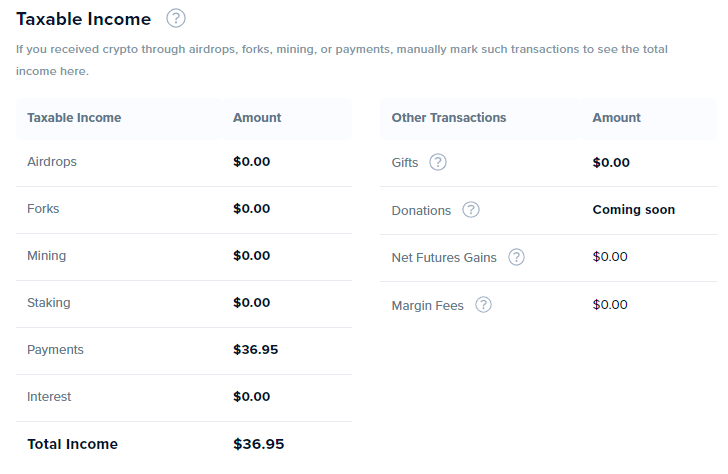

CoinTracker also tracks possible taxable income sources like:

- Airdrops

- Forks

- Gifts

- Interest

- Margin fees

- Mining

- Payments

- Staking

Screenshot of CoinTracker's taxable income tracker

Crypto Tax Forms And Reports

When you pay for CoinTracker, you unlock downloadable tax reports that you can send to an accountant or use to file taxes yourself.

CoinTracker offers four useful downloads and tax reports:

- Capital gains download (CSV)

- Transaction history (CSV)

- IRS Form 8949 report

- IRS Schedule D (Form 1040) report

You can export this information to TurboTax or TaxAct. However, exporting your crypto gains to TaxAct requires having a Plus or higher-level account.

The bottom line is downloadable capital gains, transaction history, and tax reports help you file taxes more quickly and accurately with CoinTracker. This feature also helps you send the appropriate information to your accountant.

Tax-Loss Harvesting

Tax-loss harvesting involves selling securities at a loss to lower the amount of capital gains tax you pay. The idea is to sell off losses and to then replace those assets with similar assets so your portfolio has a similar composition. By doing so, you offset some capital gains and pay less in taxes.

This strategy is popular with robo-advisors and traditional investing. And with CoinTracker, you can also consider leveraging tax-loss harvesting to pay less in capital gain taxes.

The tax-loss harvesting tab tracks how much you can claim in losses and how much this can reduce your overall tax bill. You have to upgrade to a paid plan to use this feature. But depending on your portfolio’s performance and capital gains tax rate, it might be worth paying for.

Tax Impact Tool

A newer CoinTracker feature is its Tax Impact tool. While it’s currently in Beta, this tool lets you manually enter transactions you’re considering. After you enter your potential trades, CoinTracker recalculates the cost basis for your portfolio and highlights new capital gains or losses.

This feature isn’t too useful for small trades. But if you’re considering a sizable investment or sell-off for a particular crypto, knowing the potential impact on your taxes is useful.

NFT Center

CoinTracker lets you sync your NFT holdings to your account alongside cryptocurrencies. You connect your wallet just like connecting a crypto wallet. This lets you track potential NFT income or expenses so you can include this information when filing taxes.

One drawback here is that this feature made us re-sync our wallet with our NFTs everytime we accessed the NFT center. Once this feature gets worked out, it will be very helpful to NFT investors.

CoinTracker Plans & Pricing

Crypto Portfolio Assistant

CoinTracker’s portfolio tracker free plan is quite sparse on features. Free users get a basic portfolio tacker and can connect up to five wallets. However, you can’t view performance by crypto or performance overtime.

If you want tax-loss harvesting information and more portfolio data, you have to pay. CoinTracker has two monthly subscriptions for its portfolio tracker:

- Enthusiast ($14 per month): Includes crypto performance over time and performance by crypto. You can connect up to 30 wallets.

- Pro ($99 per month): Includes everything in enthusiast plus performance by date and tax-loss harvesting. You can connect up to 100 wallets.

Both plans have a seven-day free trial. But if you’re not using tax-loss harvesting and have a smaller crypto portfolio, paying this much for a portfolio tracker isn’t very reasonable.

Crypto Taxes

The main reason to use CoinTracker is for its tax tools. There are four tax plans, and CoinTracker charges you annually for these plans:

Free | Hobbyist | Premium | Unlimited | |

Cost | $0 | $59 | $199 | Individual Pricing |

Transactions | 25 | 100 | 1,000 | Unlimited |

Cost Basis & Capital Gains | Yes | Yes | Yes | Yes |

Tax Summary by Wallet | Yes | Yes | Yes | Yes |

Tax Form Downloads & Exports | Yes | Yes | Yes | Yes |

Margin Trading | Yes | Yes | Yes | Yes |

DeFi Functionality | Yes | Yes | Yes | Yes |

Forum Support | Yes | Yes | Yes | Yes |

Email Support | Yes | Yes | Yes | Yes |

Custom Features & Concierge Support | No | No | No | Yes |

Transaction limits are one of the main reasons to upgrade to a paid CoinTracker tax plan. If you frequently trade on an exchange like Binance, Gemini, or another popular exchange, you’re probably going to pay for CoinTracker.

DeFi support is the other main reason to pay for a plan. If you stake crypto anywhere or trade with peer-to-peer exchanges, you need tax software that can track your gains and losses.

Currently, DeFi is a bit of a weak point for CoinTracker. According to its website, CoinTracker currently supports four DeFi platforms: Compound, IDEX, Maker, and Uniswap.

These are popular DeFi platforms, and CoinTracker states it’s expanding overall DeFi support. But for now, many other platforms don’t integrate with CoinTracker.

CoinTracker Alternatives

Cryptocurrency tax software is a relatively new industry. This means many of the options on the market still have improvements to make. CoinTracker’s DeFi weakness is one prime example.

That said, there are numerous CoinTracker alternatives you can also shop around for. Here's how it compares to two of its most popular competitors: ZenLedger and CryptoTrader.Tax.

Header | |||

|---|---|---|---|

Tier #1 | Free $0 | Free $0 | Hobbyist $49 |

Tier #2 | Hobbyist $59 | Starter $49 | Day Trader $99 |

Tier #3 | Premium $199 | Premium $149 | High Volume $199 |

Tier #4 | Unlimited | Executive $399 | Unlimited $299 |

Tax Software Integrations | TurboTax, TaxAct | TurboTax | TurboTax, TaxAct |

Cell | Cell |

At this stage, it’s hard to pick a leading crypto tax software. CryptoTrader.Tax has the most reasonable price if you want tax reporting and tax-loss harvesting. It also supports 12+ DeFi applications, so it’s more robust in this department than CoinTracker.

Picking the right company largely depends on what tax software you normally use and how much you want to spend.

Account Opening Process

You create a CoinTracker account with your email address or by connecting through Gmail.

Once you create an account, the next step is to connect your cryptocurrency exchanges and wallets to your CoinTracker account. This lets CoinTracker consolidate your holdings and portfolio performance so it can track taxable events.

CoinTracker Security

CoinTracker has several features and practices in place to increase security. Most importantly, CoinTracker doesn’t have access to your private keys. This means you can connect exchanges like Coinbase to your account without giving up private key access.

CoinTracker also states it encrypts all API keys and also never sells your private information. There’s also a bug bounty program to help improve the platform’s overall security.

Ultimately, CoinTracker is safe to use because you don’t give up your private keys. However, you should still use a strong password and guard your account details. Furthermore, if you keep most of your crypto on an exchange, consider moving it to a hardware wallet like Ledger or Trezor where you have full control.

CoinTracker Customer Service

CoinTracker's customer support options are limited. If you don't have an active account, your only option is to browse the posts in its Help Center. And even if after logging into your account, the best you can do is send an email.

Given its lack of options, it's unsurprising that CoinTracker has received mixed customer service reviews online. On Trustpilot, its rating is 2.9/5 from just over 100 reviews.

Is CoinTracker Right For You?

If you’re a serious cryptocurrency investor and need help with tax preparation, CoinTracker could be worth using. Granted, you have to pay to get real value from its software. But if you can save hundreds or thousands of dollars when filing taxes because of tax-loss harvesting and get an accurate picture of your capital gains, the price is worth it.

CoinTracker’s portfolio tool isn’t as impressive. But you can always pay for the Pro version near the end of the year to use its tax-loss harvesting tool.

If you’re on the fence, you can always consult an accountant or financial professional to find a solution that’s best for you. This is especially true if you invest in numerous DeFi projects or quite heavily into crypto and have a complicated return to file.

CoinTracker Features

Exchange Integrations | 300+ |

Supported Crypto Assets | 8,000+ |

DeFi Protocol Integrations | Compound IDEX Maker Uniswap |

Tax Software Integrations | TurboTax TaxAct |

Tax Software Pricing |

|

Portfolio Tracker Pricing |

|

Tax Filing | Not included |

Cost Basis Methods | HIFO FIFO LIFO Adjusted Cost Base ACB Share Pooling |

Audit Reports | Yes |

Downloadable Tax Reports | Yes |

Margin Trading | Yes, on the Premium and Unlimited plans |

Mobile Apps | None |

Customer Service Options | CoinTracker has a public support knowledgebase and a customer support email for active users |

Promotions | None |

Tom Blake is a personal finance writer with a passion for making money online, cryptocurrency and NFTs, investing, and the gig economy.