When you sell or use cryptocurrency, it’s a taxable event, just like selling stock. But unlike your stock brokerage account, your cryptocurrency exchange or wallet provider isn’t likely to provide you with a nice, easy-to-use 1099 form to file your taxes.

Most active cryptocurrency users will need outside tax software that’s capable of handling crypto purchases, trades, staking rewards, interest payments, transfers, NFTs, and other transactions.

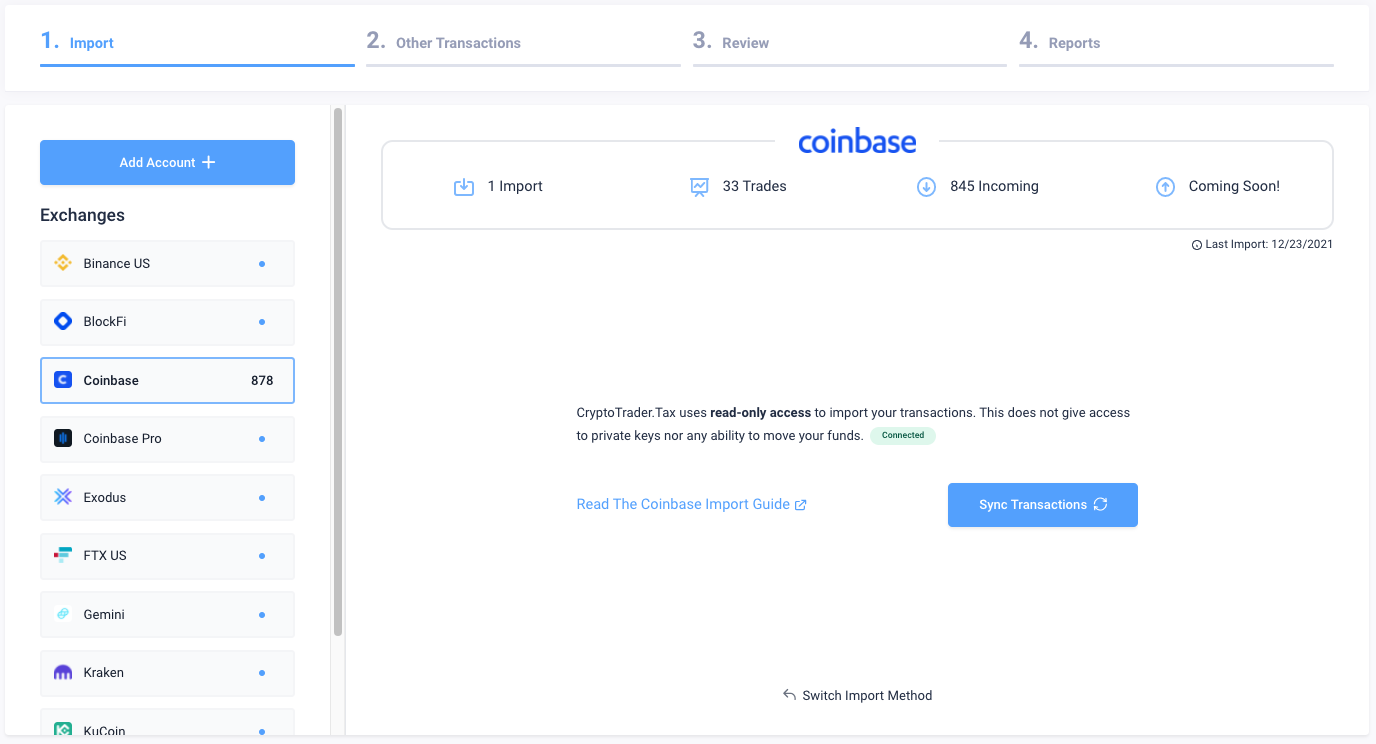

CoinLedger (formerly CryptoTrader.Tax) is a crypto tax software that's noteworthy for its intuitive process for connecting and importing transactions from multiple crypto accounts, wallets, and DeFi services. Here’s a closer look at how CoinLedger works and if it makes sense for your cryptocurrency tax season needs.

Quick Summary

CoinLedger Details | |

|---|---|

Product Name | CoinLedger |

Product Type | Crypto Tax Software |

Pricing | $49 to $299/yr |

Exchange Integrations | 45+ |

Promotions | None |

Pros & Cons

What Is CoinLedger?

CoinLedger is a cryptocurrency tax and analysis software package. It was one of the original crypto tax software options, and previously went under the name CryptoTrader.Tax.

Once you’ve connected or uploaded all of your account data using a guided process, the software does the math to calculate your cryptocurrency income and taxes, suggest tax-loss harvesting opportunities, and generate your tax forms. It works for users in the United States as well as international tax jurisdictions.

CoinLedger includes native support for dozens of cryptocurrency exchanges, wallets, and other services. Anyone with one or two crypto accounts could very quickly get connected and generate tax reports. Those with more exchanges will appreciate how the app tracks your accounts and helps you list them before connecting one at a time.

While you can access some analysis features and get started for free, getting your tax reports requires a fee of $49 to $299 per year, depending on the number of transactions you had for that tax year. All paid accounts can access all site features with no limitations.

Overall, it’s a useful tool for getting a full view of your cryptocurrency portfolio in addition to generating accurate tax reports.

CoinLedger Features

Here’s a deep dive looking at the most important features you’ll want to use at CoinLedger.

Transaction Import Process

Going from exchange to exchange creating API keys for your taxes isn’t much fun. But CoinLedger makes the process more organized than competitors. It gives you a list of wallets and exchanges to choose from at signup before guiding you through the connection and import process for each supported exchange.

Cyptocurrency import process

Not all exchanges work via API. For example, BlockFi users have to download a transaction report and upload it to CoinLedger. But for many exchanges, you can connect with an API and the site handles the downloads for you.

Tax Forms & Reports

The key feature is accurate tax form generation. Once you pay for your specific tax year, you can generate or regenerate your tax forms in a click. After a near-instant process, your forms are ready for download.

Supported forms and reports include:

- IRS Form 8949 – Short-term and long-term gains

- Income Report – This report breaks down your income from mining, staking, and gifts for easy input into your tax return.

- Audit Trail Report – This download takes you step-by-step through every calculation so you can prove what went into it if you’re ever audited by the IRS.

- Tax-Loss Harvesting – A tax-loss harvesting tool helps you find places to enter trades that offset capital gains for tax purposes. This can help you save on taxes.

The reports you get from CoinLedger can be handed off to an accountant. Or you can export your crypto gains and losses directly into TurboTax or TaxAct.

When you pay for a tax year, the site also gives you an end-of-year positions report so you know where you stand going into the following tax year.

CoinLedger Plans & Pricing

CoinLedger is available at four pricing tiers. All versions include the same reports and information. The version you need depends on your total transaction count for the year. All plans come with a 14-day money back guarantee.

Hobbyist | Day Trader | High Volume | Unlimited | |

Cost | $49 | $99 | $199 | $299 |

Transaction Limit | 100 | 1,500 | 5,000 | Unlimited |

CoinLedger Alternatives

CoinLedger's Unlimited tier is a great value; but it's one of the few companies that doesn't have a Free tier. So if you only make a few trades per year, you'll likely be better off choosing an alternative software provider. Here's how CoinLedger compares to ZenLedger and CoinTracker:

Header |  |  | |

|---|---|---|---|

Tier #1 | Hobbyist $49 | Free $0 | Free $0 |

Tier #2 | Day Trader $99 | Starter $49 | Hobbyist $59 |

Tier #3 | High Volume $199 | Premium $149 | Premium $199 |

Tier #4 | Unlimited $299 | Executive $399 | Unlimited |

Tax Software Integrations | TurboTax, TaxAct | TurboTax | TurboTax, TaxAct |

CoinLedger Security

CoinLedger uses read-only APIs so it won't ever have access to your crypto. It also uses 256-bit encryption to protect the private information of its account holders. Still, it should be mentioned that hackers were able to breach CoinLedger's servers in 2020 and 1,000 customers had their email addresses stolen.

Customer Service At CoinLedger

Based on our testing, customer service at CoinLedger isn’t quick to respond to inquiries. But if you’re comfortable with computers and can manage your account with the available self-service tools, you should be in good shape.

If you sign up and don’t like it, there’s a 14-day money-back guarantee. But you should see enough from the free account and import process to know if it’s right for you before you pay.

Based on past customer reviews at Trustpilot, people are generally very happy with their purchases. The few complaints say that the reports didn’t match their trading accounts or failed to import, though customer service left timely responses in those cases.

Is CoinLedger Right For You?

CoinLedger is one of a growing number of competing cryptocurrency tax products. While it isn’t the most robust, it offers one of the best import and upload processes, which is helpful when you’re working with multiple accounts.

If you need to do your crypto taxes, you'll likely need crypto tax software. CoinLedger does an overall good job of helping users calculate what they need for their annual tax return.

CoinLedger Features

Exchange Integrations | 45+ |

DeFi Protocol Integrations | Uniswap |

Tax Software Integrations | TurboTax, TaxAct |

Pricing |

|

Tax Filing | Not included |

Cost Basis Methods | HIFO, FIFO, LIFO |

Audit Reports | Yes |

Crypto As Income Support | Yes |

Tax-Loss Harvesting | Yes |

Margin Trading | Unclear |

Free Trial | Free report previews |

Refunds | Yes, for up to 14 days |

Mobile Apps | None |

Customer Support Options | Email or chat |

Customer Support Email Address | |

Promotions | None |

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment. His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, HuffPo, Investor Junkie, and other fine financial blogs and publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.