Figuring out how to file cryptocurrency taxes can be challenging, especially if you have a large portfolio and regularly trade. Plus, if you use different DeFi protocols to stake or lend your crypto, tracking income gets even trickier.

Crypto tax software like TokenTax largely takes the work of tracking your crypto gains off of your plate. If you want to file taxes faster and more accurately, using some sort of software is probably worthwhile.

However, crypto tax software isn’t necessary for every investor. Plus, many tax options still lack DeFi support and have some catching up to do. That’s why our TokenTax review is covering all of the features and pricing so you can decide if it’s worth it for you.

TokenTax Details | |

|---|---|

Product Name | TokenTax |

Product Type | Crypto Tax Software |

Pricing | $64 to $2,500/yr |

Supported Exchanges & Wallets | 80+ Native Integrations And Any Manual Integration Via CSV Upload |

Promotions | None |

Pros & Cons

About TokenTax

TokenTax began in 2017 and was created by Alex Miles and Zac McClure and is based in New York. The software originally focused on importing transaction data from Coinbase. But since then, TokenTax has grown into a leading crypto tax software that supports dozens of exchanges.

In 2019, TokenTax acquired cryptocurrency tax accounting firm Crypto CPAs. Today, TokenTax is a robust tax software that helps both beginner and serious cryptocurrency investors with staying on top of their taxes.

What TokenTax Offers

Keeping track of all your crypto transactions and gains is a nightmare if you trade frequently. But with TokenTax, you can track most of this activity automatically thanks to its variety of features.

Cryptocurrency Transaction Data

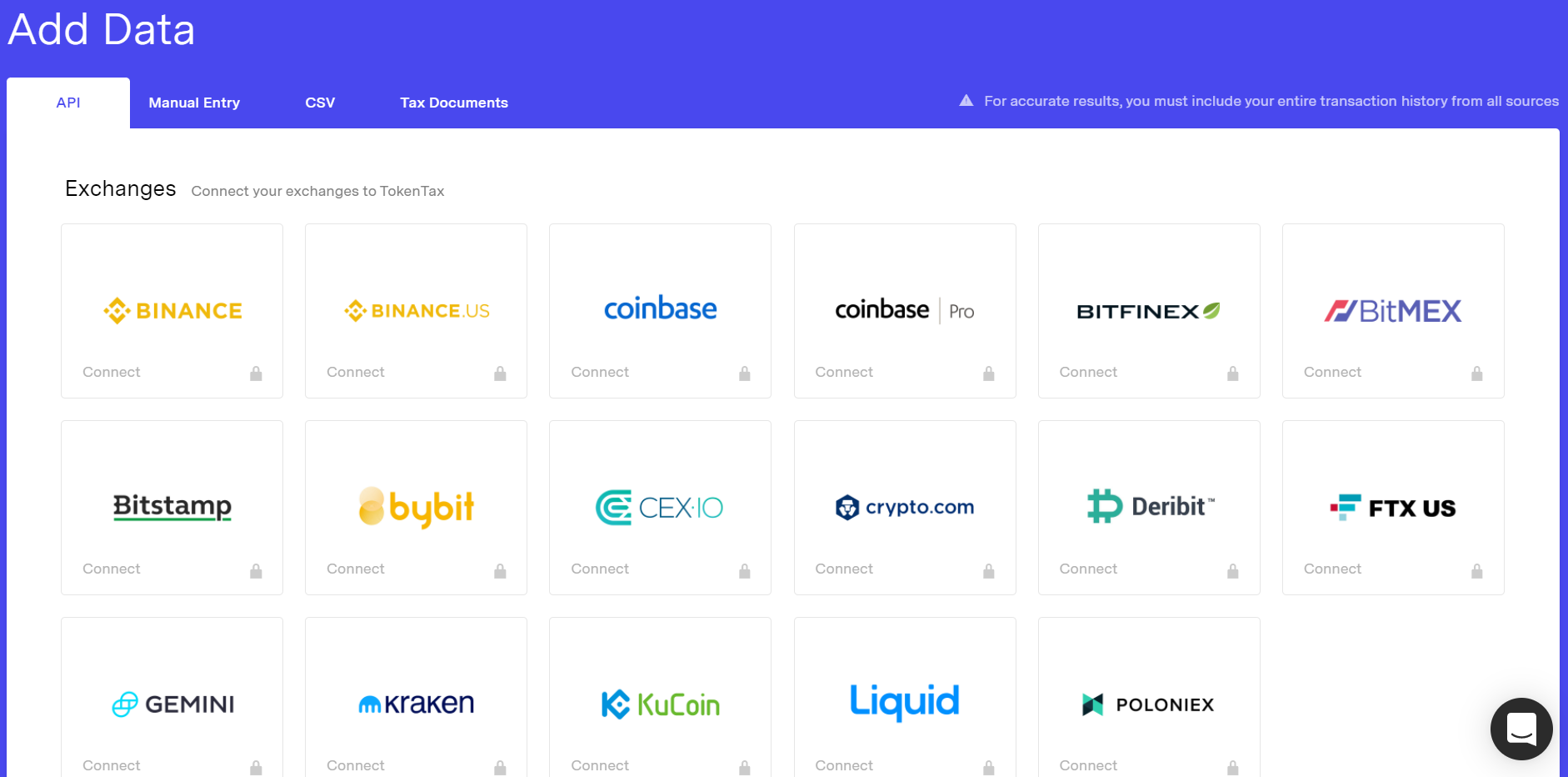

The main benefit of using TokenTax is its crypto tax reporting features. With TokenTax, you can import transaction data from any exchange to let the software calculate any capital gains and losses.

You can connect dozens of exchanges with its API automatically. Notable exchange integrations include:

TokenTax also lets you import data from any exchange by uploading a CSV file if it’s not a native integration option.

Once you import your transactions, your dashboard displays your estimated tax liability, capital gains, short versus long-term gains, and even income from staking, mining, and yield farming.

This isn’t a crypto portfolio tracker like Kubera. However, this dashboard provides a quick snapshot of your tax liabilities for a given year.

Automatic Crypto Tax Reports

TokenTak generates different tax forms after you import transaction data to speed up filing. You adjust different settings before creating your tax reports, such as your home country, currency, and short and long-term tax rate.

You also select your cost basis method. Options include First In First Out (FIFO), Last In First Out (LIFO), and Highest In First Out (HIFO). You can also use "minimization," which is a HIFO tax-rate adjusted algorithm TokenTax’s team created.

From there, different tax forms TokenTax creates include:

- IRS Form 8949: This form is for reporting sales and dispositions of capital assets which is something you must report if you buy and sell cryptocurrencies or other digital assets.

- Crypto Income Report: TokenTax calculates additional income from sources like mining, staking, lending, and airdrops.

- Audit Trail Report: This report provides a more granular view of all your taxable sales, right down to the exchange, date, time, and gains or losses from each sale.

- FBAR: This is the report of foreign bank and financial accounts that you must file if you’re a U.S. citizen, resident, or corporation with at least one financial account outside the U.S. exceeding $10,000 at any point during the year.

Automatically creating Form 8949 is the most useful tax reporting feature. Plus, you can export your tax reports to TurboTax to begin filing your taxes.

International Support

Most cryptocurrency tax software focuses on the U.S. market. And while this is the case for TokenTax as well, its software has more international support than most of the competition.

For starters, TokenTax lets you choose your home country and currency. Options for your home country include:

- Australia

- Canada

- India

- International

- New Zealand

- United Kingdom

- United States

Once you select your country and currency, TokenTax lets you download crypto gains and loss reports in any currency.

This isn’t as snappy as downloading an IRS Form 8949, but it’s still a way for international cryptocurrency investors to consolidate their transactions and performance to save time when filing.

Tax-Loss Harvesting

Tax-loss harvesting is a popular strategy investors use to offset capital gains in order to pay less in taxes. Essentially, this strategy involves selling securities to realize a loss and to then repurchase similar securities so your portfolio balance is the same.

Tax-loss harvesting is popular with stock investing. However, TokenTax has a tax-loss harvesting tool that’s useful if you have a significant crypto portfolio.

TokenTax’s tax-loss harvesting dashboard highlights all of your unrealized losses on different cryptocurrencies. It also outlines how much of a particular asset you should sell to maximize capital losses. If you use this tool near the end of the year, you can offset up to $3,000 of ordinary taxable income, and amounts over this can even be carried forward to help with future years.

This feature isn’t very useful for small portfolios because you likely can’t offset much taxable income. Additionally, repurchasing the crypto you sold off might cost more in exchange fees than the amount you save in taxes. But for large portfolios, tax-loss harvesting could potentially save a significant amount of money.

DeFi And NFT Reporting

Right now, the main weakness of most crypto tax software is DeFi support. If you only buy and sell crypto on popular exchanges like Crypto.com or Gemini, this isn’t really an issue. But if you stake, lend, and swap crypto with different DeFi platforms, most crypto tax software isn’t as useful.

Thankfully, TokenTax has some popular DeFi integrations like:

TokenTax also states it handles most basic DeFi protocols automatically. And if TokenTax doesn’t recognize a transaction, you can manually edit the transaction and select what type of income event it is.

This process can be a bit clunky. But, ultimately, this lets you track transactions from things like liquidity pool transfers or income from yield farming.

TokenTax is also expanding its support for NFTs. Right now, you can connect your ETH address to TokenTax and it can detect any OpenSea transactions automatically. Other NFT projects like CryptoPunks and CryptoKitties are also supported.

NFT support is still developing, but it’s promising that TokenTax is expanding its support for DeFi and a variety of digital assets.

TokenTax Plans & Pricing

TokenTax is one of the more expensive crypto tax software platforms out there. There isn’t a free plan or free trial either.

However, most crypto tax software on the market have cheap plans with unrealistically-low transaction limits, so you have to pay more anyway. When you look at what you get for your money with TokenTax, the pricing is actually quite reasonable.

Here’s how TokenTax’s pricing breaks down:

Free | Starter | Premium | Executive | |

Annual Cost | $64 | $199 | $799 | $2,500 |

Transaction Limit | 500 | 5,000 | 20,000 | 30,000 |

IRS Tax Form 8949 | Yes | Yes | Yes | Yes |

DeFi And | No | Yes | Yes | Yes |

Tax-Loss Harvesting | No | Yes | Yes | Yes |

TurboTax Integration | Yes | Yes | Yes | Yes |

Live Chat Support | Yes | Yes | Yes | Yes |

Tax Expert Support | No | No | No | Yes |

Investors need the Premium plan if you want tax-loss harvesting and DeFi support. If you mostly buy and hold cryptocurrency and sell occasionally, the Basic plan suffices.

The VIP Plan is quite expensive but has several notable features. For example, VIP users get two 30-minute calls with a TokenTax tax expert. You also get IRS audit assistance if you’re audited.

TokenTax Alternatives

TokenTax is one of the better crypto tax softwares out there. This is especially true if you need DeFi support or want international gain and loss reports because you live outside the United States. Furthermore, TokenTax’s VIP Plan caters to high net worth investors with large crypto portfolios who need a white glove service.

That said, TokenTax has fewer native integrations than many of its competitors. A lack of a free plan and higher annual pricing are also two small downsides.

Here’s how TokenTax compares versus ZenLedger and CoinLedger, two other popular tax options.

Header |  |  |  |

|---|---|---|---|

Rating | |||

Exchange & Wallet Integrations | 80+ native integrations and any manual integration | 400+ | 280+ |

Tax Software Pricing | $65 to $2,500/yr | $0 to $399/yr | $49 to $299/yr |

Tax Software Integrations | TurboTax | TurboTax | TurboTax, TaxAct |

Tax-Loss Harvesting | Included in some plans | Included in all paid plans | Included in all plans |

Cell |

ZenLedger and TokenTax are two of your best options if you use numerous DeFi protocols. If you don’t need VIP support and want more native exchange and crypto wallet integrations, ZenLedger or CoinLedger are more affordable options.

Account Opening Process

You sign up for TokenTax with your email or Gmail account. You don’t have to pay for a plan when you sign up, so you can still play around with TokenTax’s dashboard. However, you must pay for a plan to import transactions, download tax reports, and use any other tool.

TokenTax Security

TokenTax imports transactions by using APIs from different exchanges and wallets. This provides read-only data and doesn’t provide TokenTax with your private wallet keys.

This is the same process other crypto tax software use. Overall, this makes TokenTax safe to use because you’re not giving direct access to any of your funds.

TokenTax Customer Service

TokenTax customers can use live chat to get in touch with customer service for questions about their accounts. You can also reach TokenTax via email at [email protected] or by calling 1-845-663-1173.

Furthermore, you can use TokenTax’s Help Center to find answers for common questions people have about its software.

Bottom Line

Serious cryptocurrency investors should probably use some sort of tax software to help with bookkeeping. And this is even more true if you’re a frequent trader and use several exchanges and wallets.

TokenTax is an excellent choice if you need DeFi support or if you want VIP features like consulting calls. International gain and loss reports and continual improvements to the platform are also pluses.

It’s on the pricier side than the competition and there are fewer native integrations than competitors like ZenLedger. But if you have a large crypto portfolio, the support you get with TokenTax might be worth the extra cost.

TokenTax Features

Wallet & Exchange API Integrations | 80+ |

Pricing |

|

Tax Software Integrations | TurboTax |

Tax-Loss Harvesting | Available |

Tax Filing | Not included |

Cost Basis Methods | HIFO, FIFO, LIFO |

Downloadable Tax Reports | Yes |

Cost Basis Methods | HIFO, FIFO, LIFO |

Audit Reports | Yes |

Crypto As Income Support | Yes |

Mobile Apps | None |

Customer Support Options | TokenTax offers live chat, email, and phone customer support |

Customer Support Email | |

Customer Support Phone Number | 1-845-663-1173 |

Promotions | None |

Tom Blake is a personal finance writer with a passion for making money online, cryptocurrency and NFTs, investing, and the gig economy.