When you sell or exchange cryptocurrency, whether you make money or lose money, it’s essential to keep track of your gains and losses for taxes.

However, once you consider multiple wallets or exchange accounts, daily staking rewards for several currencies, and an occasional NFT purchase, those tax calculations can become quite complex. That’s where ZenLedger comes in.

ZenLedger is a cryptocurrency tax software that takes all of your cryptocurrency data and turns it into required tax forms for reporting investment gains and losses. Today, we’re going to dive in and take a close look at ZenLedger’s features, pricing, and if it could be suitable for your crypto tax prep needs.

ZenLedger Details | |

|---|---|

Product Name | ZenLedger |

Product Type | Crypto Tax Software |

DIY Plan Pricing | $0 to $399/yr |

Integrations | 400+ |

Promotions | None |

Pros & Cons

What Is ZenLedger?

ZenLedger is a cryptocurrency tax and tracking software. It’s useful for tracking your cryptocurrency balances and gains (or losses) across all of your exchange and wallet accounts with a single, unified view. It’s kind of like a combination of Mint.com and TurboTax for your cryptocurrency.

When you want to track your crypto or do your taxes, a ZenLedger account works with more than 400 exchange and wallet providers, including major exchanges such as:

Wallets include:

On the off chance your wallet or exchange isn’t supported, they have an easy process to upload your data or request support.

It works with 98 exchange APIs, 52 more exchanges using CVS uploads, 42 blockchains, 12 hardware wallets, 13 mobile wallets, ten desktop wallets, 31 DeFi apps, and NFTs. That gives you a “grand unified accounting” of your cryptocurrency for your knowledge and tax reporting.

The screen displayed while your transactions import to ZenLedger

You can use ZenLedger for DIY tax form preparation for most tax forms you would need for cryptocurrency reporting. ZenLedger also offers a premium service where a tax pro prepares your crypto tax forms if you’d rather hand it off to someone else.

What ZenLedger Offers

Here’s a look at the key features of ZenLedger and how they work:

Tax Forms And Reports

The main reason most people will sign up with ZenLedger is for help with taxes. ZenLedger can help you tame thousands of annual transactions and turn them into a single set of data for tax reporting.

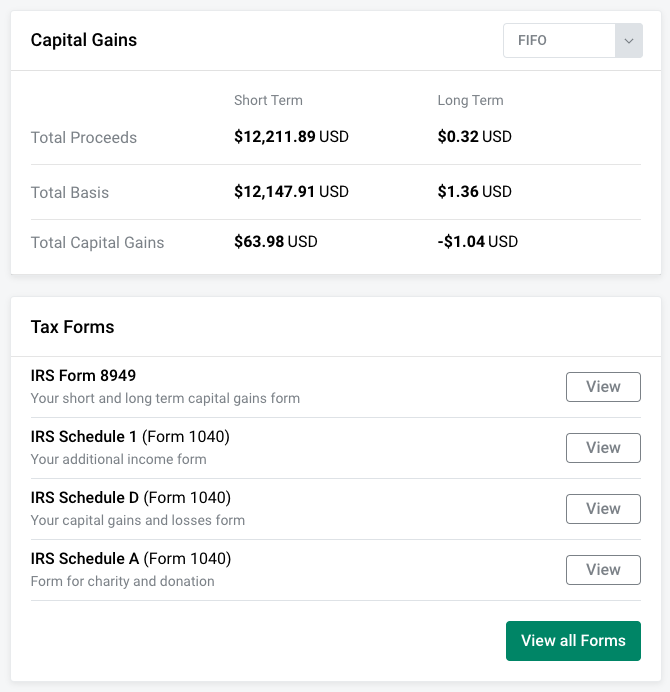

The ZenLedger dashboard includes a capital gains summary and access to your IRS tax forms

Not only does ZenLedger do the calculations, but it also completes your tax forms automatically. Tax forms supported by ZenLedger include:

- Schedule D: Capital Gains and Losses

- Schedule 1: Additional Income and Adjustments to Income

- Form 8949: ales and Other Dispositions of Capital Assets

- Form FBAR: Report of Foreign Bank and Financial Accounts

When I was testing things out, ZenLedger noticed that I transferred out from one exchange to a wallet that I hadn’t added, so something was likely missing. That’s a great feature I have not run into anywhere else.

You can download the forms to use with other tax software, notably TurboTax and TaxAct. However you’re doing your taxes, you can use the outputs from ZenLedger for any cryptocurrency-related inputs.

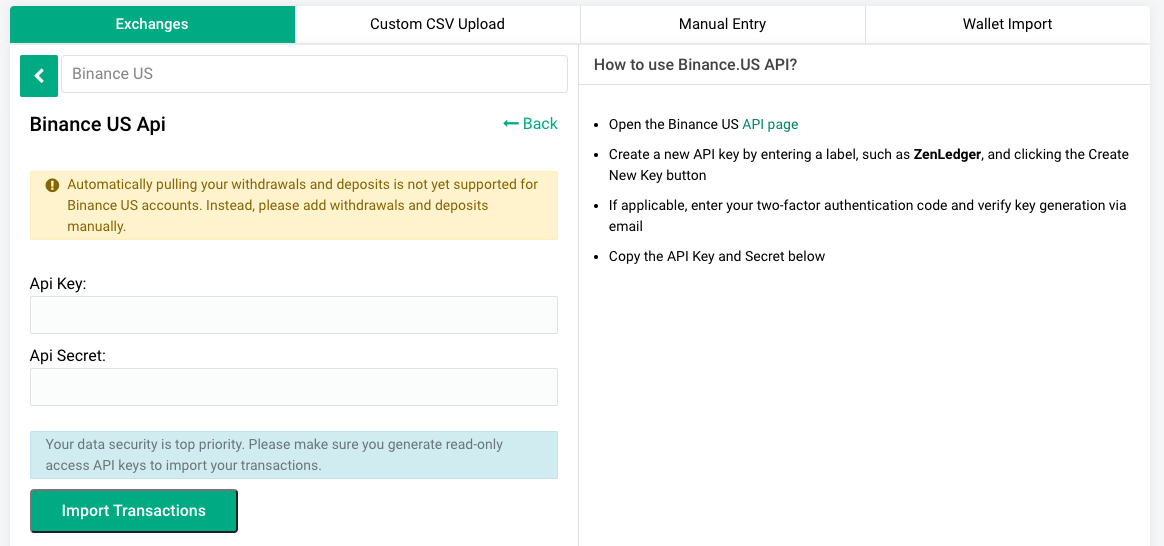

The screen used to add an API key and import your cryptocurrency data

Cryptocurrency Analysis & Tax Loss Harvesting Guidance

Even outside of tax season, you may want to use ZenLedger as your unified source of cryptocurrency data. If you’ve used portfolio trackers like Mint, Personal Capital, or Lunch Money in the past, ZenLedger has similar features but is exclusively designed for cryptocurrency.

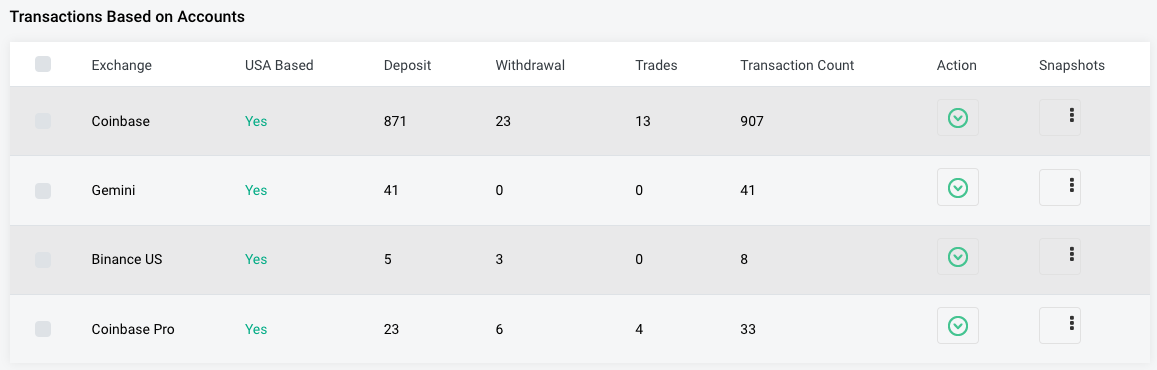

The transaction import summary helps you keep track of which accounts you’ve connected

The site includes summaries of your holding by currency or exchange and in aggregate across your entire cryptocurrency portfolio. Helpful graphs and charts break down your holdings by percentage and your total cryptocurrency portfolio history over flexible time periods.

Knowing where you stand at any given time is beneficial. If you’re planning future cryptocurrency trades, it’s essential.

For tax-loss harvesting, ZenLedger generates a Google Sheet unique for your account that can help you make tax-loss harvesting trades to lower what you owe to the IRS.

Professional Tax Preparation

If you want your taxes done for you, ZenLedger works with a network of cryptocurrency tax professionals who can take over instead of importing all of your data yourself.

Of course, this is a more expensive service than the DIY plan. A 30-minute consultation costs $195. And prepared plans start at $2,500 for a single-year tax report.

Most people comfortable with crypto should be able to handle things on their own. But this option is a nice alternative if you’re less confident or would rather just pay someone else.

ZenLedger Plans & Pricing

There are four plans at ZenLedger, including a free plan to log in and test things out. However, there’s a limit on the number of transactions it can handle at each pricing tier for taxes.

Free | Starter | Premium | Executive | |

Cost | $0 | $49 | $149 | $399 |

Transaction Limit | 25 | 100 | 5,000 | Unlimited |

DeFi/Staking/ | No | No | Yes | Yes |

For one-on-one help, you can consult with ZenLedger staff for $150 per hour. For professional tax prep, you can get a 30-minute consult for $195, single-year tax preparation for $2,500, and multi-year starting at $4,500 for two years.

ZenLedger Alternatives

While ZenLedger does an excellent job of tracking and summarizing your cryptocurrency taxes, it might not be right for everyone. Here's how it compares to some popular alternatives:

Header |  |  | |

|---|---|---|---|

Tier #1 | Free $0 | Hobbyist $49 | Free $0 |

Tier #2 | Starter $49 | Day Trader $99 | Hobbyist $59 |

Tier #3 | Premium $149 | High Volume $199 | Premium $199 |

Tier #4 | Executive $399 | Unlimited $299 | Unlimited |

Tax Software Integrations | TurboTax | TurboTax, TaxAct | TurboTax, TaxAct |

Cell |

ZenLedger Security

It's important to exercise caution whenever a company is asking for access to your financial information. The good news for ZenLedger users is that the company only gets read-only access to your wallet and exchange data and it never asks for your crypto private keys.

The ZenLedger website is also encrypted and offers two-factor authentication if you want to further protect your account. You can learn more about the company's privacy and security policies here.

ZenLedger Customer Service

ZenLedger users can access customer support by live chat, phone, or email. The company's customer service phone number is (877) ZEN-TAXS and its email address is [email protected].

The operating hours for ZenLedger's customer support staff is Monday through Friday, 9 AM to 9 PM (EST). The company currently has a 3.8/5 rating on Trustpilot (out of 18 reviews) and an A- rating on the Better Business Bureau (BBB).

Is ZenLedger Right For You?

While it’s not cheap at the upper tiers, ZenLedger does a great job importing and summarizing your cryptocurrency data for taxes and investment planning. Whether you’re looking to lower your tax bill through tax-loss harvesting or just want a simple platform to get your crypto-related tax forms, ZenLedger has you covered.

ZenLedger Features

Exchange Integrations | 400+ |

Blockchain Integrations | 40+ |

DeFi Protocol Integrations | 20+ |

Tax Software Integrations | TurboTax |

DIY Pricing |

|

Pro Support Pricing |

|

Tax Filing | Not included |

Cost Basis Methods | HIFO, FIFO, LIFO |

Audit Reports | Yes |

Crypto As Income Support | Yes |

Mobile Apps | None |

Customer Service Number | (877) ZEN-TAXS |

Customer Service Email | |

Customer Service Hours | Mon through Fri, 9 AM to 9 PM (EST) |

Promotions | None |

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment. His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, HuffPo, Investor Junkie, and other fine financial blogs and publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.

ZenLedger is some hot garbarge. They have what looks like a useful service, but there are so many bugs and misleading claims that I would recommend people choose another service for doing crypto taxes if your taxes involve anything more than a few exchanges. I have found ZenLedger a waste of money that gives me inconsistent results and lacking in user resources. Will absolutley not be using ZenLedger for my 2022 crypto taxes.