One reason cryptocurrencies have seen a surge in popularity is that they are seen as distinct from the traditional financial markets.

In fact, many crypto investors tout how digital value is uncorrelated to the stock market and point to it as a way to add asset diversity to an investment portfolio.

But are cryptocurrencies really uncorrelated to the stock market? In the last few weeks, drops in the stock market have been accompanied by losses in cryptocurrency prices. And according to some sources, crypto prices and the stock market might be more attached at the hip than previously believed.

Let’s take a look at cryptocurrencies and consider how they might be correlated to the stock market.

Crypto Market Cap vs The Stock Market

As of March 28, 2022, the global crypto market is valued at about $2.14 trillion. And compare crypto's market cap today to the IMF's estimate of $620 billion in 2017, and you see just how far this asset class has grown in recent years.

However, the total crypto market cap is still in retreat from its approximate $3 billion cap back in November 2021.

Part of this drop in crypto's overall market cap has come as stock market prices have also struggled. Year-to-date, the S&P 500 is still down almost 5%, and this is after a period of market recovery in March.

So, what does this all of this crypto and stock market movement mean for crypto investors?

Well, with crypto assets accounting for such a huge amount of financial value in the markets, it’s no surprise that people are increasingly interested in assets like Bitcoin and Ethereum.

But when adding crypto to your portfolio, it's important to understand how correlated this digital asset class is to the overal stock market itself.

Cryptocurrencies Correlating With Stock Market Movements

In recent months, questions about whether cryptocurrencies can really be used to diversify risk and hedge against stock market losses have arisen. Part of this has to do with the way that cryptocurrencies have dropped when stocks have dropped in value recently.

While the correlation hasn’t always been exact, when comparing stock market drops, they are often accompanied by cryptocurrency drops.

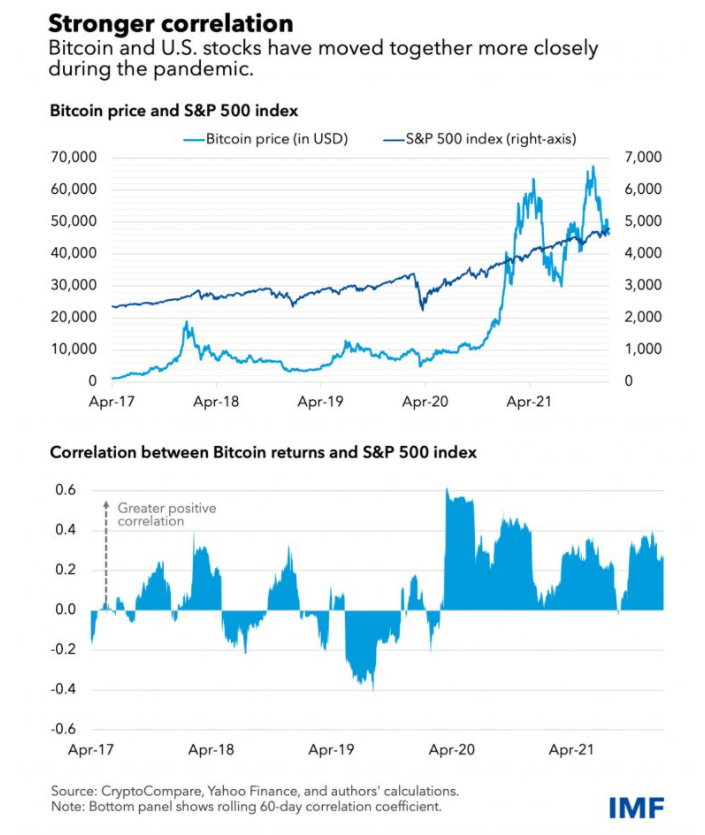

This seems, however, to be a relatively new development. The IMF report points out that back in 2017, there wasn’t much of a correlation between the stock market and cryptocurrencies. And while there were periods of correlation between Bitcoin returns and the S&P 500 between 2017 and early 2020, they weren’t very pronounced.

Starting in April 2020, though, Bitcoin (and other cryptocurrencies) started showing more correlation to the stock market.

This is also the period when cryptocurrencies started gaining more traction in the wider population and values started rising. The IMF report indicates that a greater level of correlation between Bitcoin and the S&P 500 has been in place since the Covid-19 pandemic.

Image courtesy of the IMF.

While there have been periods of lesser correlation, there has only been one point since the pandemic that there has been a negative correlation between Bitcoin and the stock market, as represented by the S&P 500.

There has also been an explosion of available cryptocurrency tokens since then. In 2017, there were 1,335 cryptocurrencies, according to Statista. By November 2019, there were 2,817. However since that time, during 2020 and 2021, the number of coins has ramped up even more. As of February 2022, there are 10,397 cryptocurrencies.

This surge in new cryptos has created a scenario where main cryptos like Bitcoin and Ethereum seem highly correlated to the stock market. But we even see popular altcoins like Cardano and many others often mirroring price movements of main cryptos and the stock market.

So overall, there's wider adoption of cryptocurrencies and more interest in this asset class as an investment vehicle. And as the IMF report points out, there's been an increased correlation between cryptocurrencies and the stock market.

As a result, it seems as though the promise of an uncorrelated asset class hasn’t been borne out — at least not yet.

Why Are Cryptocurrencies Correlated To The Stock Market?

Now that we’re seeing some correlation between cryptocurrencies and the stock market, this begs another question: why is this correlation happening?

For starters, the IMF report points out that spillovers between volatility in the asset classes increased from 2020 to 2021 as compared to 2017 to 2019.

Here’s what the IMF has to say about Bitcoin specifically and its correlation to the S&P 500 in the last couple of years:

“Bitcoin volatility explains about one-sixth of S&P 500 volatility during the pandemic, and about one-tenth of the variation in S&P 500 returns. As such, a sharp decline in Bitcoin prices can increase investor risk aversion and lead to a fall in investment in stock markets. Spillovers in the reverse direction—that is, from the S&P 500 to Bitcoin—are on average of a similar magnitude, suggesting that sentiment in one market is transmitted to the other in a nontrivial way.”

It appears that cryptocurrencies have been seen as similar to stocks in terms of risk as far as many “regular” investors are concerned.

In other words, investors who are worried about Bitcoin volatility during periods of poor performance might become more risk averse, which also impacts their investing in the stock market. In contrast, if markets are doing well, this positive sentiment can spillover to crypto markets.

At scale, this means positive or negative movements in either the crypto or stock market can significantly impact the other.

However, this is an interesting correlation, especially in terms of how the spillover from crypto assets impacts volatility in the stock market.

For example, as of February 2022, the companies listed on the New York Stock Exchange boasted a total capitalization of $27.69 trillion. When looked at in that light, the fact that cryptocurrencies, with their total capitalization only reaching close to $3 trillion at one point, seems to have an outsized influence on stock market volatility.

In any case, at this point, it does appear that there is some level of correlation between cryptocurrencies and stocks right now, and it remains to be seen whether this correlation continues.

The Future Of Cryptocurrencies And Stock Market Correlation

The IMF report expresses concern that continued interconnectedness between the stock market and cryptocurrencies could actually cause destabilization in the financial markets.

One of the goals of decentralized finance (DeFi) is to disrupt the current traditional markets. This is because with blockchain technology, you can operate decentralized financial systems that are transparent, efficient, and provide fairer access to wealth creation.

However, it’s far from certain whether blockchain technology will emerge as a true alternative to the current monetary system.

The volatility of cryptocurrencies is one of the reasons that it might be difficult to use them as mediums of exchange.

We don’t use stocks as currency because the prices can be volatile on a day-to-day basis. The same is true of most cryptocurrencies. After all, the prices of Bitcoin, Ethereum, Solana, and other cryptocurrencies can swing widely, making it difficult to settle on a common exchange of value.

For an example of this price volatility, just take a look at the price of Bitcoin from the start of 2020 to March 2022:

Image courtesy of CoinMarketCap.

Additionally, unless cryptocurrencies are widely adopted for mundane financial transactions, it’s unlikely that they will achieve the critical mass needed to stabilize their values and see practical use as mediums of exchange.

Plus, unless cryptocurrencies are more widely adopted for transactions, it’s unlikely that they will be able to overcome the limitation that, for many people to benefit from them, they still need to convert them into fiat currency for everyday use.

So far, the IRS treats cryptocurrency taxes similarly to stocks, especially when crypto assets are bought and sold on crypto exchanges like Coinbase or Gemini.

As long as cryptocurrencies are treated as stocks for regulatory purposes, there’s a good chance that they will continue to be correlated to the stock market, since they are seen more as speculative investments or stores of value than they are mediums of exchange.

On the other hand, the cryptos most correlated to the stock market are the major currencies like Bitcoin and Ethereum.

Smaller cryptocurrencies might not be as correlated in the future. Additionally, coins that have strong underlying use cases might be used as hedges later on, even if that don’t truly disrupt the financial system and instead co-exist with the current system.

The Bottom Line

Ever since the Covid-19 pandemic, cryptocurrency returns, particularly Bitcoin, have seen an increased correlation to the stock market.

This correlation has only increased as cryptocurrencies are seen more as investments along the lines of other asset classes like stocks and have become a more popular alternative asset class overall.

While there’s no way to predict the future, it’s not too far-fetched to consider that, unless cryptocurrencies can truly replace the current financial system, they are unlikely to become completely uncorrelated from the stock market. Instead, cryptocurrencies could potentially co-exist as an additional, if correlated, asset class.

Miranda Marquit, MBA, has been covering personal finance, investing and business topics for more than 15 years, and covering crypto topics for more than 10 years. She has contributed to numerous outlets, including NPR, Marketwatch, U.S. News & World Report and HuffPost. She is an avid podcaster, co-hosting the podcast at Money Talks News. Miranda lives in Idaho, where she enjoys spending time with her son playing board games, travel and the outdoors.