In the crypto world, there are plenty of options to generate passive income by holding digital assets.

Staking and yield farming are two prime examples. However, over the last few years, we’ve seen the unfortunate rise and fall of many crypto lending platforms that promised massive returns for investors but took on too much risk to remain solvent.

Thankfully, there are still companies in the lending space that take a more conservative approach to balancing risks and rewards for investors.

One of these companies is PennyWorks. This U.S. company lets investors earn up to 7.5% APY by converting their fiat into stablecoins which it lends out in collateralized loans. And with no management fees or lock-in fees, it’s an appealing option for more risk-averse investors.

That said, it’s still important to understand how this platform works and what the risks are before signing up. That’s why our PennyWorks review is covering everything you need to know about this passive income opportunity.

Quick Summary

Pros

Cons

About PennyWorks

PennyWorks is a U.S. financial platform that began in 2021. The company offers a high-yield, decentralized finance (DeFi) product that lets investors deposit $USD to earn daily interest. And PennyWorks’ main attraction is that it lends out investor’s capital with stablecoins in collateralized loans to help mitigate risk.

Considering that we’ve seen major collapses and bankruptcy filings from crypto lending platforms like BlockFi and Celsius, risk mitigation certainly seems like a warranted mission statement.

PennyWorks’ reliance on stablecoins is also reassuring since stablecoins like USDC and DAI are pegged to the $USD. So at the very least, it’s lending out digital assets that tend to have more stable prices versus obscure altcoins.

How Does PennyWorks Work?

PennyWorks is available to accredited investors in the United States and is free to sign up for. It’s also available in all 50 U.S. states, which isn’t the case for many staking and lending platforms that are often prohibited in several states.

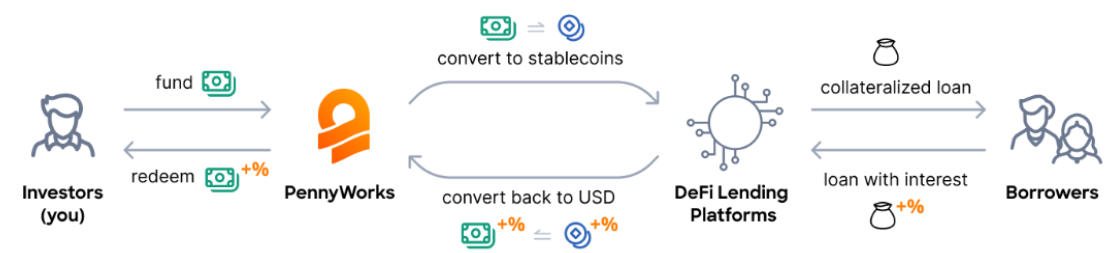

If you decide to make a deposit, here’s how PennyWorks begins generating returns with your investment:

- You deposit $USD into your PennyWorks account to purchase Notes

- PennyWorks converts your fiat into stablecoins that are pegged to the $USD, such as USDC and USDT

- PennyWorks lends out stablecoins via collateralized loans to generate interest

- Interest accrues daily and you can cash out anytime since there’s no lock-in period

Image courtesy of PennyWorks.

There’s no minimum deposit requirement either. However, deposits under $500 don’t generate any yield. How much you generate depends on the total value of $USD you deposit, and PennyWorks has three different tiers:

$500 - $99,999 | $100,000 - $299,999 | $300,000+ |

|---|---|---|

5.5% APY | 6.5% APY | 7.5% APY |

Earning at least 5.5% APY should be possible for most investors. This is higher than most high-yield savings accounts on the market, and PennyWorks can even pay up to 7.5% APY for large account balances.

And again: two main selling points are the use of stablecoins to reduce risk and the ability to withdraw funds instantly. Interest also accrues daily so you begin generating returns quickly.

PennyWorks Pricing & Fees

PennyWorks doesn’t charge any account fees or active management fees for investors. In fact, investors don’t pay any platform fees at all. I assume PennyWorks takes a cut of the yield it generates and passes on the rest to investors.

Deposits and withdrawals are also fee-free, although you can pay bank fees depending on your bank. There’s also a $15 wire transfer fee for outgoing wire transfers that occur more than once a month.

PennyWorks Alternatives

In the last year or two, numerous crypto lending and staking platforms have gone out of business. Many platforms have also had liquidity issues and paused withdrawals for certain periods of time, especially following FTX’s collapse.

That said, there are still reputable crypto exchanges and lending platforms you can use to generate yield. Some of our favorite PennyWorks alternatives include:

- Binance: The largest cryptocurrency exchange in the world that also offers staking with 15 different cryptocurrencies, including Bitcoin, Ethereum, and USDT.

- Crypto.com: Another crypto exchange that lets you generate yield with 20+ stablecoins and crypto.

- Nexo: One of the leading lending platforms on the market that supports over 60 cryptocurrencies.

PennyWorks Account Opening

You have to be an accredited investor to open an account with PennyWorks. This means you must meet at least one of the following requirements:

- Have an annual income of $200,000 or more for the last two years

- Have a joint household income of at least $300,000 for the last two years

- Have an individual or joint net worth of at least $1 million, excluding the value of your primary residence

If you meet these requirements, you can get started. At this time, PennyWorks offers individual taxable accounts, business entity accounts, and IRA accounts. To sign up, you choose your account type and create your account with your email and phone number.

PennyWorks takes approximately 24 to 48 hours to verify your account and follows Know Your Customer (KYC) requirements. After verification, you can fund your account to purchase Notes with ACH or wire transfer payments.

Safety & Security

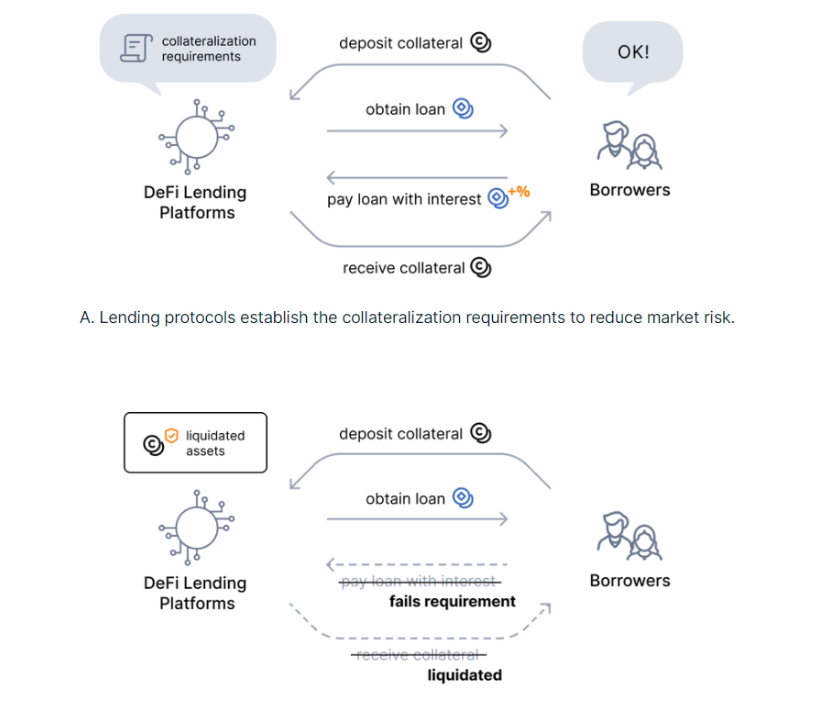

PennyWorks’ mission is to provide easy access to DeFi lending and income opportunities while lowering risk. The use of stablecoins and no lock-up periods certainly helps the company in achieving this goal. But PennyWorks’ main security feature is the fact it collateralizes loans.

A collateralized loan means that borrowers have to put up collateral to back their loan. In the event the borrower becomes insolvent or becomes too risky for the lender, their funds are automatically liquidated to help cover the loan.

Image courtesy of PennyWorks.

Traditional lenders use this system as well. And PennyWorks only works with specific DeFi protocols to improve safety. According to its website, “Extensive risk management procedures have been set up in order to vet various protocols in the decentralized web ecosystem (web3) and help ensure that funds are only placed in responsible protocols with proven track records.”

The result is that PennyWorks only deals with reputable blockchains, like Ethereum and Polygon, and more trusted DeFi protocols like AAVE, Compound, and Uniswap.

However, PennyWorks Notes aren’t FDIC-insured. If the platform goes under because of poor risk management or other factors, investors are going to be left holding the bag.

The fact you don’t have to lock-in money to get decent rates is quite reassuring. However, never deposit more money than you can afford to lose when it comes to DeFi lending.

PennyWorks Support & Customer Service

You can reach PennyWorks’ customer support by calling 848-420-8350.

At this time, PennyWorks doesn’t have a Trustpilot rating and isn’t an accredited Better Business Bureau business. It seems the company is fairly new and there aren't many online reviews yet from customers, so keep this in mind.

The Bottom Line

Despite the turbulence the DeFi world has experienced in the last year, there are still exciting opportunities in the space. And companies like PennyWorks offer a refreshing, much-needed change in business model with its focus on risk-mitigation and stablecoin usage.

That said, DeFi investments and crypto savings accounts aren’t without risks. Your money isn’t FDIC-insured with PennyWorks, and there’s no promise of returns. A lack of lock-up times and daily interest payments are reassuring, but you should never deposit more money than you can afford to lose.

Tom Blake is a personal finance writer with a passion for making money online, cryptocurrency and NFTs, investing, and the gig economy.