Founded in 2017 by MIT professor and cryptologist Silvio Micali, Algorand (ALGO) is a layer one, decentralized blockchain that aims to improve upon the blockchain trilemma of speed, security, and decentralization.

This blockchain network and token has its own unique staking mechanism, Pure Proof of Stake (PPoS). It’s also completely open-source, and is one of the cryptocurrencies supporting decentralization alongside Ethereum.

However, with the price of ALGO hovering at all-time lows and SEC lawsuits muddying the waters, the future of this innovative blockchain is far from clear.

But what is Algorand? And does ALGO have a place in your portfolio?

Let’s dive into how Algorand works and what the future of this blockchain and token might be.

What Is Algorand?

As mentioned, Algorand is an open-source, decentralized blockchain that wants to solve the blockchain trilemma of speed, security, and decentralization.

To help accomplish this goal, Algorand is a payment-focused network first and foremost to assist with speed. At the time of writing, it supports up to 6,000 transactions per second (TPS), making it significantly faster than proof-of-work (PoW) cryptocurrencies like Bitcoin, which has a TPS of about 7.

Algorand also has its own unique proof of stake consensus mechanism, PPoS. And it supports decentralized applications (dApps) on its network, making it an alternative blockchain to Ethereum.

The Algorand Foundation, which helps manage the Algorand blockchain, explains that its goal is to empower a “dynamic, inclusive, and borderless global ecosystem - at scale - based on the Algorand blockchain technology. The project is also carbon zero, having low base energy consumption and using smart contracts to buy carbon offsets to reduce its footprint.

Overall, Algorand and its corresponding token ALGO seem quite revolutionary. And there are certainly some unique elements to this protocol that are worth highlighting.

How Does Algorand & PPoS Work?

To understand how Algorand works, it’s important to understand how its unique consensus mechanism, pure-proof-of-stake (PPoS), works.

With PPoS, validators are randomly selected depending on the weight of ALGO tokens they’re staking. The token holder that is chosen to be the validator then proposes the next block in Algorand’s blockchain. Then, in phase two, 1,000 tokens are randomly chosen, and the token holders must confirm that the block from phase one is correct.

With this PPoS system, everyone staking ALGO has a chance to become a validator and earn governance rewards. And, as with other proof-of-stake protocols, it reduces the chance a majority holder can hurt the network or act in bad faith, since doing so would likely reduce the value of the tokens they hold.This video from Binance Academy provides a breakdown of what Algorand is and how its unique PPoS consensus mechanism works. But the two main takeaways are that PPoS helps improve transaction speed while reducing the chance of attacks on the network.

Advantages & Unique Features of Algorand

Since Algorand is built with speed and scalability in mind, there are several unique features and even more advantages to this blockchain:

Algorand & The SEC-Bittrex Lawsuit

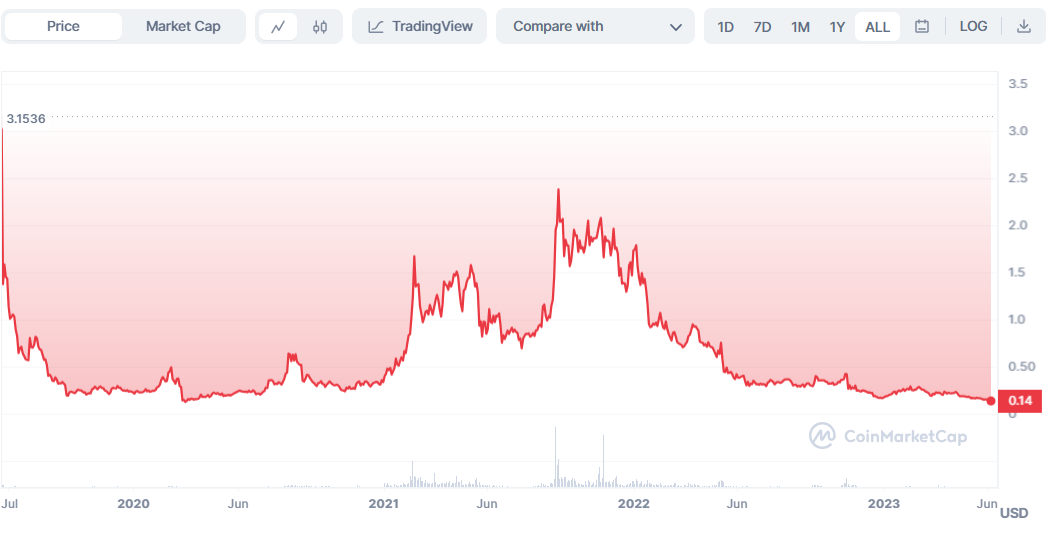

At the time of writing, the price of ALGO is hovering around $0.15 per token according to CoinMarketCap, down about 90% from the all-time high price.

So, what’s happened to Algorand?

Well, one main factor contributing to ALGO’s recent dropping prices is the Security and Exchange Commission’s (SEC) lawsuit against Bittrex, a popular cryptocurrency exchange.

In its filing, the SEC claims that Bittrex has been operating as an unregistered securities exchange. It also claims that ALGO and five other tokens are securities.

The SEC needs to classify something as a security for its claims against Bittrex to hold true. So, while the Algorand Foundation disputes the claim, ALGO and five other tokens are now in the crossfire; not what you want for a token with decentralization as one of its main goals.Where Can You Buy ALGO?

At the time of writing, ALGO is a top 50 cryptocurrency at the number 42 spot, with a total market cap of almost $1.1 billion. And there are numerous cryptocurrency exchanges where you can purchase ALGO, including:

As for storing your ALGO, numerous cryptocurrency wallets suffice. Some of our favorites include Atomic, Exodus, and Ledger for holding ALGO.

Frequently Asked Questions

Is Algorand A Good Investment?

At the time of writing, ALGO is down by over 90% from its highest price point. The token also shows little sign of improving in the near future following the SEC-Bittrex lawsuit, in which the SEC stated ALGO and five other tokens constitute securities.

Image courtesy of CoinMarketCap.

For investors, ALGO’s dropping price reflects regulatory risks and uncertainty. This means it’s a riskier token to invest in at this time. You should always do your own due diligence and also consider your portfolio’s overall diversification before investing in any cryptocurrency.

Can You Stake Algorand?

Yes, you can stake ALGO if you become a member of its governance program, and this is how the PPoS consensus mechanism works.

However, many leading cryptocurrency exchanges, such as Coinbase and Kraken, have removed ALGO staking from their platforms.

Is Algorand Better Than Ethereum?

Algorand has some advantages over Ethereum, namely its faster transaction times and far lower transaction fees.

However, ETH has a much larger market cap and far more liquidity. Ethereum is also the most popular blockchain for developing dApps, so it’s arguably a more useful blockchain in this day and age.

Is Algorand Better Than Cardano?

Both Algorand and Cardano (ADA) are fast, low-transaction-fee blockchains that utilize Proof of Stake. Additionally, both of these blockchains seek to solve some of the issues facing Ethereum, such as speed and scalability.

However, Cardano’s main goal is to solve blockchain scalability issues, whereas Algorand is tackling the blockchain trilemma.

It’s also worth noting that at the time of writing, Cardano is the 7th most popular cryptocurrency with a market cap of approximately $13 billion.

How Much ALGO Is In Circulation?

At the time of writing, ALGO has a circulating supply of approximately 7.24 billion tokens, which is roughly 72% of the total tokens that can be in circulation.

The Bottom Line

Whenever there’s a new blockchain or token taking on issues like decentralization, speed, and security, there’s cause for excitement. After all, any token or project looking to improve the world of dApps and what’s possible with a decentralized blockchain is great news for crypto enthusiasts.

That said, Algorand’s future is still unclear. Ethereum remains the most popular platform for dApps, and recent issues with the SEC are a potential cause for concern for investors.

Ultimately, you have to do your own due diligence and decide if ALGO belongs in your portfolio. Hopefully, potential regulatory concerns settle in the near future so Algorand can continue its goal of tackling the blockchain trilemma.

Tom Blake is a personal finance writer with a passion for making money online, cryptocurrency and NFTs, investing, and the gig economy.