In the last year or so, the world of crypto lending and staking has been hit hard.

The fall of large industry players like BlockFi, Celsius, and FTX has rightfully made investors wary about locking up their digital assets to generate yield. And many investors have been turning to DeFi alternatives to reduce the risk of sticking with a centralized exchange.

YieldFlow is the perfect example. This decentralized platform lets members earn yield through its staking, lending, and liquidity pool features. And since everything is handled with smart contracts, you maintain control over your tokens.

But is YieldFlow safe and worth using? And how does it stack up versus some other yield farming favorites?

Our YieldFlow review is covering how this platform works, its pros and cons, and how to decide if you should use it.

Quick Summary

Pros

Cons

About YieldFlow

YieldFlow is a decentralized staking and lending platform that launched in 2023. Its goal is to let investors generate passive income with their tokens without having to give up control of their assets.

Considering how recent events have rocked a lot of trust in centralized lending platforms and exchanges, this is exciting news. And YieldFlow’s own whitepaper describes how its mission is to “generate an easy-to-use, sustainable, profitable, and anonymous cash flow by providing smart contracts-based, automated, and preselected investment opportunities” to its members.

In other words, YieldFlow wants crypto holders to benefit from their participation in the market. But it wants to create this benefit in a secure, anonymous way by using smart contracts and staying more true to the goals of DeFi.

YieldFlow Features

YieldFlow offers three main ways to generate yield: staking, lending, and using various liquidity pools. It also has its own native token you can use to earn with as well.

Here's a breakdown of how each feature works and the types of returns you can expect.

Staking

One of YieldFlow’s main products is its staking feature. This lets you use various tokens to join node pools and act as validators to earn rewards.

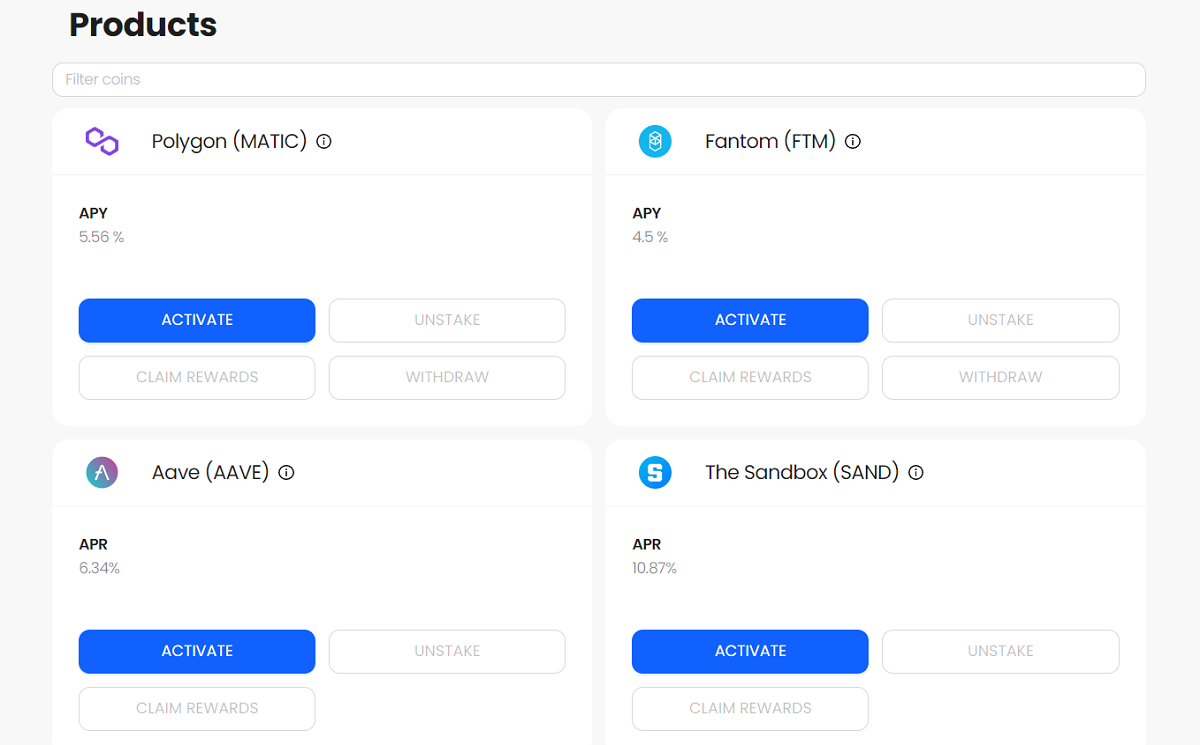

At the time of writing, YieldFlow supports four different tokens for staking and pays up to 10.87% APR:

- AAVE: 6.35%

- Fantom: 4.5%

- Polygon: 5.56%

- The Sandbox: 10.87%

This isn’t a diverse range of tokens. But YieldFlow makes it easy to stake your tokens without having to know the tech behind the scenes or having to run nodes yourself. And these yields are still superior to your average high-yield savings account.

2. Lending

Another method to generate yield through YieldFlow is to lend out your tokens. Specifically, YieldFlow offers this for USDC and SNX lending, paying out 2.61% APY and 2.5% APY respectively.

You earn yields in a minimum of seven days as well. And borrowers must post collateral to cover their loans, which helps reduce risk for the lender.

3. Liquidity Pools

One final way you can earn yield with YieldFlow is to use its liquidity pool feature. This involves depositing different cryptocurrencies into shared mining pools to earn rewards.

YieldFlow requires you to deposit certain trading pairs, meaning you deposit two types of cryptos to begin earning. At the time of writing, it supports 11 different trading pairs and pays up to 26.61% APY. Available trading pairs include:

- LINK-ETH

- MATIC-ETH

- USDT-ETH

- MANA-ETH

- SAND-ETH

- HEX-ETH

- OCEAN-ETH

- SHIB-ETH

- WBTC-ETH

- PEPE-ETH

I like that YieldFlow supports major coins like Ethereum and stablecoins like USDT while also offering altcoin support. And you can withdraw assets anytime from liquidity pools, so there’s no lock-in requirement.

4. YFlow Tokens

In true DeFi spirit, YieldFlow has its own native token, aptly named YFLOW, that lets token holders earn rewards and participate in the future of the platform.

For starters, YieldFlow is integrating a governance program to let YFLOW holders vote on upcoming changes to the platform. The company outlines this plan, as well as other developmental goals, in its whitepaper.

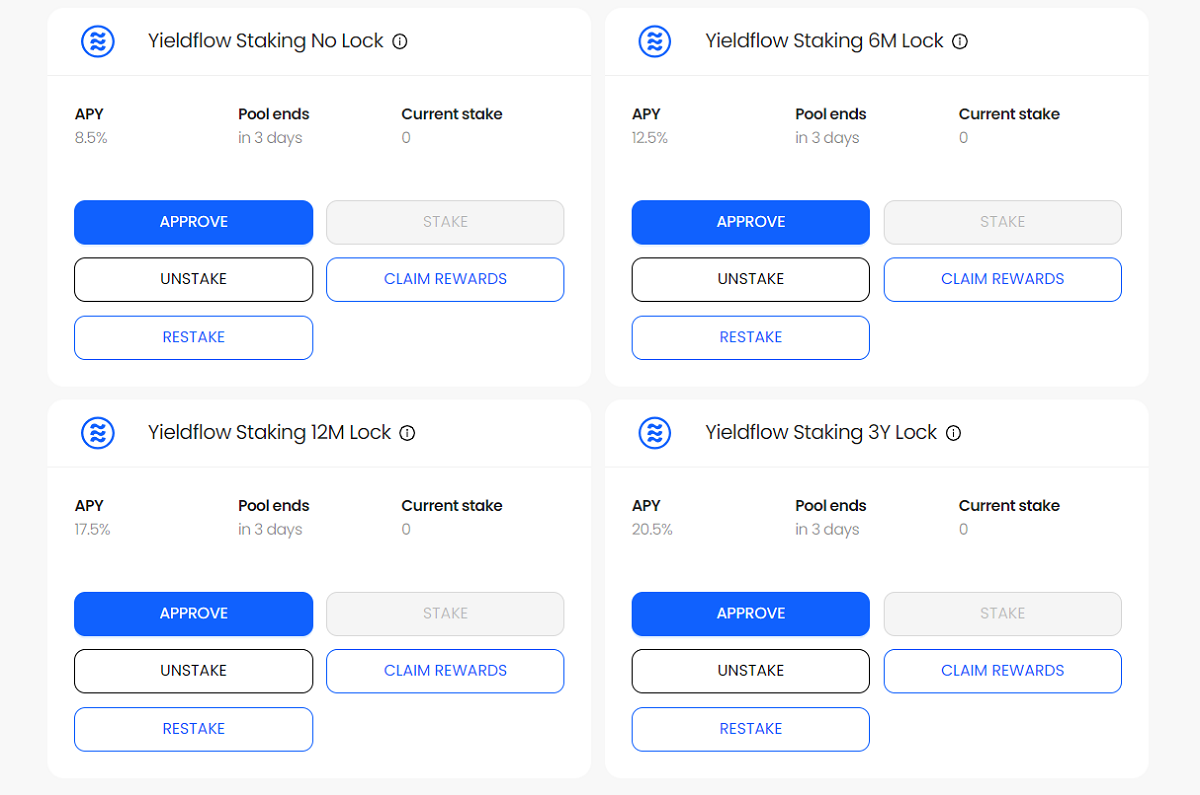

You can also stake YFLOW to earn rewards and lower platform management fees. At the time of writing, there are four different YFLOW staking options, ranging from no lock-up period to 12-month periods:

The fact that you can earn up to 20.5% is a selling point. And you can easily buy YFLOW by using the platform’s integration with Uniswap to buy or swap different assets.

YieldFlow Pricing & Fees

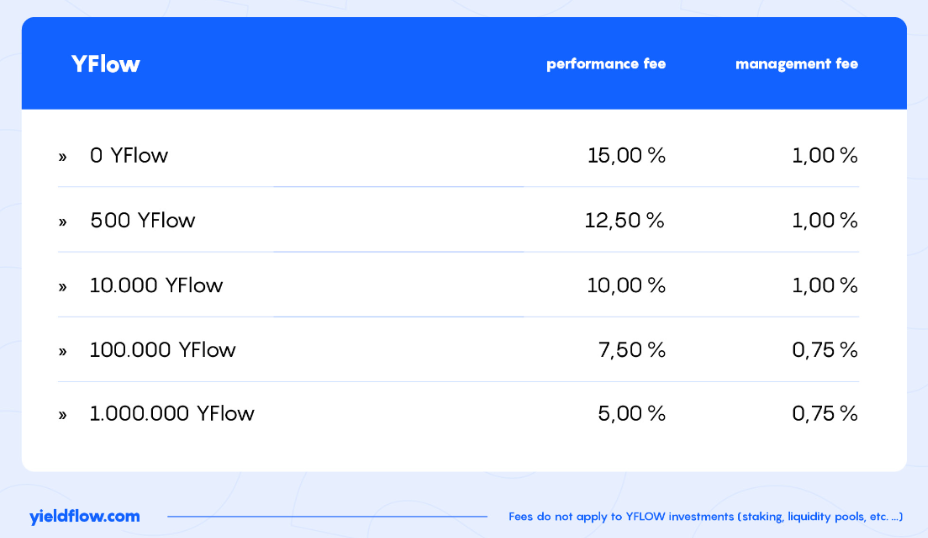

If you don’t hold any YFLOW, you pay a starting 15% performance fee and 1% management fee on the yield you generate. You can then receive discounts for holding YFLOW:

At the time of writing, one YFLOW costs approximately $9.07. This means it costs just over $4,500 to buy enough YFLOW to reach the first discount tier.

YieldFlow Alternatives

If you want a DeFi staking and lending platform to generate yield, YieldFlow is one of the top options out there. And it’s certainly less risky than using centralized platforms as the last year or two have proven anything.

That said, other staking platforms might be better depending on the assets you want to stake and other features you’re looking for.

- Binance: As the largest exchange in the world, Binance is a centralized option for staking, crypto trading, and lending.

- Bake: Formerly known as Cake DeFi, bake also lets you earn by staking, lending, and depositing crypto into liquidity pools. It has similar tokens to YieldFlow and similar yields, so compare both platforms to find the current highest yield.

- Allnodes: One of the most popular DeFi staking options that supports over 70 protocols.

Account Opening Process

Since YieldFlow wants to remain anonymous and decentralized, you don’t have to create an account or verify your identity to use the service.

Instead, all you have to do is connect your Coinbase wallet or WalletConnect wallet to YieldFlow to use the platform. WalletConnect is particularly useful since it means YieldFlow can work with leading crypto wallets like Ledger and CoinWallet.

Safety & Security

As a decentralized platform, YieldFlow relies on smart contracts to maintain anonymity and to help users earn rewards without involving a centralized body. From this standpoint, YieldFlow is safe because it relies on blockchain-powered contracts and lets you maintain control over your own tokens rather than acting as a custodian.

Furthermore, many earning options don’t require locking-up your assets. This means you can generate yield but withdraw your tokens anytime if you need to.

The fact you can remain anonymous is also a selling point for some. However, you’re still always responsible for protecting your crypto wallet and private keys, especially if you’re going the DeFi route.

Customer Service

YieldFlow doesn’t have a dedicated customer support hotline or phone number you can call. However, you can communicate with the team on its Discord server or via Twitter. Its website also has a useful help center with answers to common questions members have.

The Bottom Line

Centralized staking platforms often have more supported assets and features than some DeFi counterparts. But at the end of the day, if you want to generate yield while maintaining custody of your crypto, the DeFi route is the only way forward.

YieldFlow, while a newer player in the space, offers competitive rates and numerous ways to earn. And it will be interesting to see how its governance program and native token work out in the future.

For now, DeFi advocates can consider staking or lending some of their crypto with YieldFlow. Just ensure you research some alternatives and diversify your portfolio so you’re not holding too much of your assets with just one platform.

Tom Blake is a personal finance writer with a passion for making money online, cryptocurrency and NFTs, investing, and the gig economy.