As one of the most popular payment processing apps in in the United States and the UK, you’ve probably used Cash App before.

This free mobile payment app is an easy way to split a bill with friends or to transact with people in just a few taps. And it’s a popular alternative to solutions like PayPal and Venmo for sending and receiving money.

However, Cash App has also gotten into the crypto game over the last few years. Its millions of users can now buy, send, and receive Bitcoin with ease. Plus, the app has some other nifty crypto-flavored features to help you manage your BTC.

Here’s everything you need to know about buying and sending Bitcoin with Cash App and its cryptocurrency functionality.

How To Buy Bitcoin With Cash App

In 2018, Cash App added Bitcoin trading support to its platform, making it easy to buy, send, and sell BTC right from your account.

If you want to buy BTC with Cash App, the process is similar to using basic cryptocurrency exchanges and takes four simple steps:

- Tap on the Bitcoin screen in your Cash App account

- Tap on “ Buy BTC”

- Enter the amount of Bitcoin you’re buying

- Enter your PIN to confirm the trade

You need to have cash in your account to place BTC trades. Also note that Cash App lets you place different order types, including standard orders that execute automatically and custom orders that execute at a specific Bitcoin price.

Selling Bitcoin with Cash App works in the exact same way. You simply tap the “Sell” button in the Bitcoin tab and enter the amount you want to sell.

Cash App Bitcoin Transfers & The Lightning Network

In 2022, Cash App integrated with the Lightning Network, a layer-two solution for Bitcoin that helps increase transaction speeds while lowering fees. This system is useful for sending or receiving very small amounts of BTC without paying fees, and these transactions aren’t recorded on the blockchain.

You can now send and receive BTC using the Lightning Network, although if you’re receiving BTC, the sender needs to use a Bitcoin wallet that works with the Lightning Network. Cash App also limits Lightning Network transactions to $999 worth of BTC every seven days.

Other Cash App Crypto Features

Buying and sending Bitcoin is Cash App’s main foray into the crypto world. However, the platform continues to innovate, making crypto more accessible to its customers.

Get Paid In Bitcoin

One exciting Cash App feature is the ability to get paid in Bitcoin. If you have direct deposit enabled, you can choose a percentage of upcoming paychecks to deposit in Bitcoin instead of cash. This percent can range from 1% to 100% so you have full flexibility.

If you enable BTC paycheck payments, you can disable this in the future and return to pure cash payments.

Use Bitcoin Auto Invest

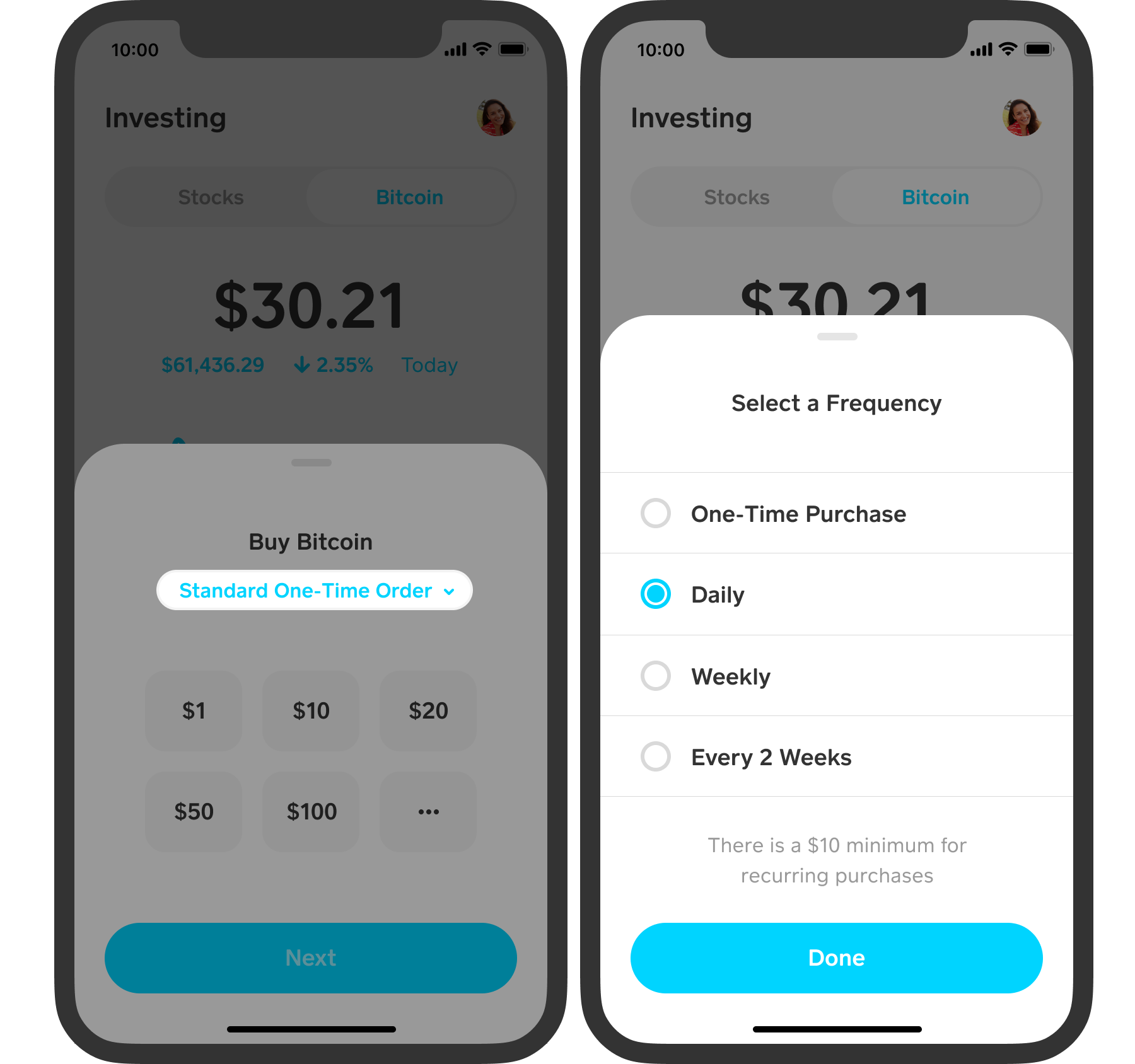

With Cash App’s Bitcoin auto investing feature, you create rules to automatically buy BTC at a regular interval.

Image courtesy of Cash App.

This idea is similar to micro-investing apps or using a robo-advisor. You can set up your Cash App account to automatically purchase a certain amount of Bitcoin daily, weekly, or every two weeks.

There’s a $10 minimum for purchases, so it’s an easy way to invest in cryptocurrency regularly without commiting a significant amount of money

What Are Cash App’s Bitcoin Fees?

Like other cryptocurrency exchanges or fiat on-ramps, Cash App charges some fees when you buy or sell Bitcoin. According to its website, fees are listed on the trade confirmation screen before you place a trade. Additionally, the price of Bitcoin is “derived from the quoted mid-market price, inclusive of a margin, or spread.”

In other words, when you buy or sell Bitcoin on Cash App, you’re paying slightly more than the average market price at the time of your trade, which is the spread fee. This fee varies depending on the network.

For serious crypto traders, you’re better off using a robust exchange like Binance or Kraken. But for sending small amounts of BTC once in a while, Cash App is an easy-to-use solution. Just know that you pay fees for the convenience.

Is Cash App Crypto Safe?

Yes, Bitcoin is safe on Cash App, and the company takes numerous steps to improving its cryptocurrency security, including:

- Not lending out your crypto to other institutions or traders to earn interest

- Keeping most crypto offline in cold storage

- Encrypting Bitcoin payment data

That said, at Cult of Money, we believe it’s important to take ownership over your digital assets. After all, if it’s not your keys, it’s not your crypto. If you’re holding significant amounts of Bitcoin on Cash App, you should consider using your own standalone cryptocurrency wallet instead or holding some BTC in cold storage.

It’s also worth noting that Cash App has been subject to data breaches in the past, so the platform isn’t perfect.

Frequently Asked Questions

Is Cash App FDIC Insured?

Cash App accounts can have up to $250,000 in FDIC insurance, but only if customers have a Cash Card, which is Cash App’s debit card. You can also gain FDIC insurance coverage on your account if you are a sponsor of an account with a Cash Card.

However, Bitcoin and any stock investment balances aren’t subject to FDIC coverage. Overall, we don’t suggest keeping large amounts of cash, crypto, or investments on your Cash App account.

Which Broker-Dealer Does Cash App Use For Crypto?

Block Inc facilitates Cash App’s Bitcoin trading service. Block Inc isn’t a member of the SIPC or FINra, and there’s no guarantee your crypto investments will grow. Always consider the risks of crypto trading and know that you can lose money.

What Is Cash App’s Bitcoin Limit?

Cash App customers can deposit up to $10,000 worth of BTC in a seven-day period.

How Do Crypto Taxes Work With Cash App?

If you sell Bitcoin on Cash App, the company issues you a 1099-B form. The company doesn’t report the cost basis of any sales to the IRS, and you’re responsible for accurately reporting any crypto gains and losses when filing your taxes.

If you need a helping hand, you can use leading cryptocurrency tax software like CoinLedger or CoinTracker to prepare your tax return.

Is Cash App Crypto Worth It?

If you’re trading high volumes of Bitcoin, Cash App isn’t worth using. The spread fees you pay are too high, and Cash App has limited trading functionality and a lack of data that you find with major cryptocurrency exchanges like Binance, Coinbase, or Kraken.

However, if you’re just sending small amounts of BTC to friends or want to dip your toes into the digital pool, Cash App is an effective solution. Just be mindful of spread fees and how much crypto or cash you hold in your account at one time.

The Bottom Line

With tens of millions of customers, Cash App’s cryptocurrency developments are nothing short of exciting. And as more major banks and payment processing apps embrace digital currencies, it stands to reason that adoption and opportunities should only increase.

That said, Cash App’s crypto functionality is still basic. If you want access to more cryptocurrencies, trading options, and data, it’s best to stick with an exchange. The same goes for earning passive income with your crypto through methods like staking and yield farming.

Tom Blake is a personal finance writer with a passion for making money online, cryptocurrency and NFTs, investing, and the gig economy.